- United States

- /

- Hotel and Resort REITs

- /

- NYSE:RLJ

RLJ Lodging Trust (RLJ): Assessing Valuation After Recent Share Recovery

Reviewed by Simply Wall St

RLJ Lodging Trust (RLJ) has been on investors’ watch lists lately, with the stock showing mixed performance across recent months. The company’s shares have edged higher in the past month, which has sparked interest among market watchers.

See our latest analysis for RLJ Lodging Trust.

RLJ Lodging Trust’s shares have regained some ground over the past month, but zooming out reveals momentum has faded. The 1-month share price return is nearly 8%, while the 1-year total shareholder return sits deep in negative territory at -19%. Longer-term performance has shown ongoing pressure, reminding investors to consider both near-term optimism and the broader valuation picture.

If you’re weighing your next move, this could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership.

With shares trading below analyst targets and recent gains contrasted by longer-term underperformance, the key question arises: Is RLJ Lodging Trust undervalued and ready for a rebound, or is future growth already reflected in its price?

Price-to-Sales Ratio of 0.8x: Is it justified?

RLJ Lodging Trust’s current price-to-sales ratio stands at 0.8x, positioning the stock as significantly cheaper than industry peers and suggesting the market may be overlooking its potential value following recent underperformance.

The price-to-sales ratio compares the market’s valuation of the company to its actual revenue, making it a useful tool for real estate investment trusts (REITs) where earnings can be volatile. For RLJ, this ratio highlights how much investors are willing to pay for every dollar of sales generated by the company.

RLJ’s 0.8x price-to-sales ratio is much lower than the global Hotel and Resort REITs industry average of 3.7x. This reflects a steep discount. Compared to the estimated fair price-to-sales ratio of 1.4x, there could be meaningful upside potential if market sentiment shifts back toward the company’s fundamentals.

Explore the SWS fair ratio for RLJ Lodging Trust

Result: Price-to-Sales Ratio of 0.8x (UNDERVALUED)

However, persistent long-term underperformance and modest revenue growth continue to pose risks. These factors could potentially limit short-term gains if market sentiment remains cautious.

Find out about the key risks to this RLJ Lodging Trust narrative.

Another View: Discounted Cash Flow Perspective

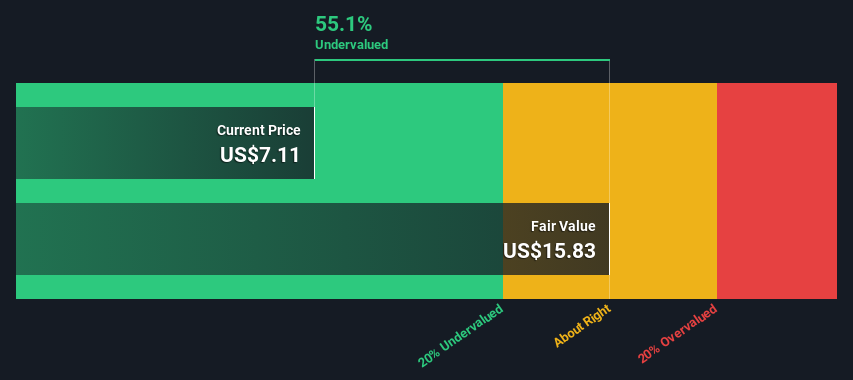

To challenge the price-to-sales view, our DCF model provides a different angle. This method estimates RLJ Lodging Trust’s value by projecting future cash flows and discounting them to today's value. The result is that RLJ appears to be trading below our estimate of fair value, suggesting underappreciated potential.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out RLJ Lodging Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 932 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own RLJ Lodging Trust Narrative

If you want to dive deeper and have your own perspective, you can explore the data and craft your own analysis in just a few minutes. Do it your way.

A great starting point for your RLJ Lodging Trust research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always stay one step ahead by seeking fresh opportunities. Surf beyond RLJ Lodging Trust and unlock even more potential using these powerful screens:

- Charge ahead with steady passive income and tap into attractive yields through these 15 dividend stocks with yields > 3% with robust fundamentals and consistent payouts.

- Ride the tech revolution and catch the momentum behind market-defining innovation using these 25 AI penny stocks making headlines in artificial intelligence.

- Capitalize on market inefficiencies by exploring these 932 undervalued stocks based on cash flows to spot companies priced below their intrinsic worth before the rest of the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RLJ

RLJ Lodging Trust

RLJ Lodging Trust ("RLJ") is a self-advised, publicly traded real estate investment trust that owns 94 premium-branded, rooms-oriented, high-margin, urban-centric hotels located within the heart of demand locations.

Undervalued average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.