- United States

- /

- Media

- /

- NasdaqGS:ADV

Insider Buying Highlights 3 Undervalued Small Caps Across Regions

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, although it is up 10% over the past year with earnings forecast to grow by 15% annually. In this environment, identifying stocks that are potentially undervalued can be particularly appealing to investors seeking opportunities for growth and value.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Lindblad Expeditions Holdings | NA | 0.9x | 34.10% | ★★★★★★ |

| Myomo | NA | 2.5x | 37.12% | ★★★★★☆ |

| Columbus McKinnon | NA | 0.4x | 41.33% | ★★★★★☆ |

| S&T Bancorp | 10.3x | 3.6x | 45.47% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 29.22% | ★★★★☆☆ |

| MVB Financial | 13.9x | 1.8x | 34.71% | ★★★☆☆☆ |

| Standard Motor Products | 11.7x | 0.4x | -2212.47% | ★★★☆☆☆ |

| Farmland Partners | 9.1x | 9.2x | -17.19% | ★★★☆☆☆ |

| BlueLinx Holdings | 13.8x | 0.2x | -73.36% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.2x | -352.07% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

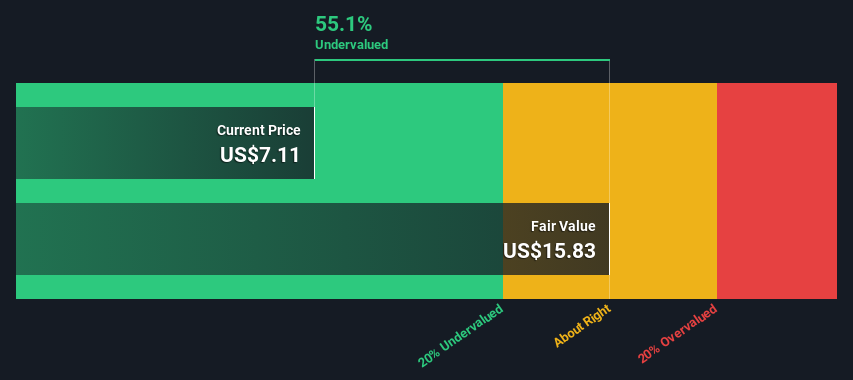

Advantage Solutions (ADV)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Advantage Solutions operates as a provider of outsourced sales and marketing services, with a market cap of approximately $1.33 billion.

Operations: Branded, Retailer, and Experiential Services contribute significantly to the company's revenue streams. The gross profit margin has shown variability over time, with a recent value of 14.09%. Operating expenses include notable allocations for general and administrative costs, which were $181.02 million in the latest period analyzed.

PE: -1.3x

Advantage Solutions, a smaller company in the U.S. market, has seen insider confidence with David Peacock acquiring 75,000 shares for US$86,123. Despite recent volatility and a net loss of US$56 million in Q1 2025, the company completed a share buyback program totaling US$53.97 million since November 2021. Leadership changes include Andrea Young transitioning out as COO by June 30, 2025. While currently unprofitable with reliance on external borrowing for funding, these strategic moves may position Advantage Solutions for potential future growth opportunities.

- Dive into the specifics of Advantage Solutions here with our thorough valuation report.

Evaluate Advantage Solutions' historical performance by accessing our past performance report.

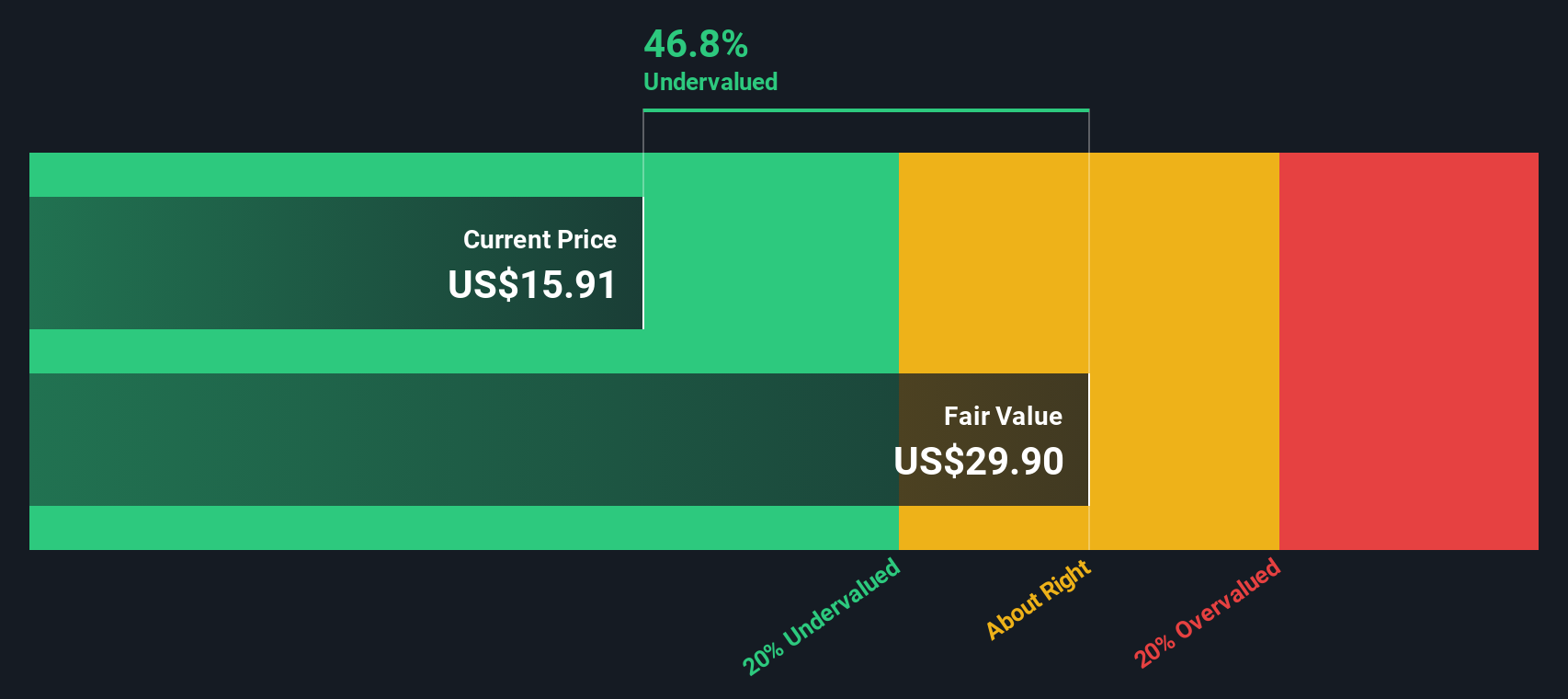

RLJ Lodging Trust (RLJ)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: RLJ Lodging Trust is a real estate investment trust that focuses on acquiring premium-branded, focused-service and compact full-service hotels, with a market capitalization of approximately $2.27 billion.

Operations: RLJ Lodging Trust generates its revenue predominantly from its hotel operations, with the latest reported revenue at $1.37 billion. The company's cost of goods sold (COGS) is significant, amounting to $988.29 million, contributing to a gross profit margin of 28.05%. Operating expenses are also notable, including general and administrative expenses totaling $52.35 million in the most recent period.

PE: 26.7x

RLJ Lodging Trust, a player in the hospitality sector, is navigating challenges with its earnings expected to decline by 27.1% annually over the next three years. Despite this, insider confidence is evident from recent share repurchases totaling US$44.54 million through May 2025. The company declared dividends of US$0.15 per common share and US$0.4875 on preferred shares for Q2 2025, signaling stability amid financial pressures from high-risk external borrowing sources and insufficient interest coverage by earnings.

TXO Partners (TXO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: TXO Partners is engaged in the exploration and production of oil, natural gas, and natural gas liquids with a market capitalization of $1.23 billion.

Operations: The company's primary revenue stream is from the exploration and production of oil, natural gas, and natural gas liquids. Over recent periods, it has experienced fluctuations in net income margin, with a notable peak at 34.21% in early 2023 before declining to negative values later. Operating expenses have consistently been a significant portion of costs, impacting overall profitability.

PE: 55.6x

TXO Partners, a smaller company in the U.S. market, has recently drawn attention with significant insider confidence as their Director purchased 878,000 shares for US$17.56 million, boosting their stake by 28%. Despite a recent follow-on equity offering raising US$175 million at a slight discount per share, the company's earnings have faced pressure with net income dropping to US$2.42 million from US$10.27 million year-over-year for Q1 2025. Their strategic focus on growth is underscored by projected earnings expansion of over 50% annually and new board member Lawrence Massaro bringing extensive industry expertise to guide future endeavors amidst higher-risk funding challenges without customer deposits.

- Click here and access our complete valuation analysis report to understand the dynamics of TXO Partners.

Understand TXO Partners' track record by examining our Past report.

Taking Advantage

- Gain an insight into the universe of 85 Undervalued US Small Caps With Insider Buying by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADV

Advantage Solutions

Provides business solutions to consumer packaged goods companies and retailers in North America, Asia Pacific, and Europe.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives