- United States

- /

- Hotel and Resort REITs

- /

- NYSE:RLJ

Assessing RLJ Lodging Trust (RLJ) Valuation After a Recent Short-Term Share Price Rebound

Reviewed by Simply Wall St

RLJ Lodging Trust (RLJ) has quietly climbed about 6% over the past month even as its year to date return sits deep in the red, setting up an interesting rebound compared with its longer term slump.

See our latest analysis for RLJ Lodging Trust.

That recent 6% one month share price return is a welcome change of pace for RLJ, but it comes against a still weak year to date share price return and negative multi year total shareholder returns, suggesting momentum is only cautiously rebuilding.

If RLJ's rebound has you scanning the broader market for ideas, this could be a good moment to explore fast growing stocks with high insider ownership for other potential standouts.

With shares still down sharply this year despite improving profitability and a modest discount to analyst targets, the key question now is whether RLJ Lodging Trust offers genuine value or if the market is already pricing in any recovery.

Price-to-Sales of 0.9x: Is it justified?

RLJ Lodging Trust trades on a price-to-sales ratio of 0.9 times, which looks inexpensive against its last close at $7.75 and its beaten-down long-term share price performance.

The price-to-sales multiple compares the company’s market value with the revenue it generates, a useful lens for hotel REITs where earnings can be volatile and heavily influenced by property cycles and financing costs.

In RLJ’s case, the current 0.9 times price-to-sales ratio sits far below the global Hotel and Resort REITs industry average of 3.7 times and below the peer average of 1.4 times. Regression-based analysis suggests a fair price-to-sales ratio closer to 1.4 times, which implies the market may be underpricing the company’s revenue base and potential earnings recovery.

Compared with those benchmarks, RLJ’s discount is notable. Its 0.9 times price-to-sales ratio trades at a substantial markdown to both industry norms and the level our fair ratio analysis indicates the market could eventually move toward if sentiment improves.

Explore the SWS fair ratio for RLJ Lodging Trust

Result: Price-to-Sales of 0.9x (UNDERVALUED)

However, lingering risks remain, including RLJ’s thin net margin and weak multi year returns. These factors could limit re rating potential if hotel demand softens.

Find out about the key risks to this RLJ Lodging Trust narrative.

Another View: What Our DCF Says

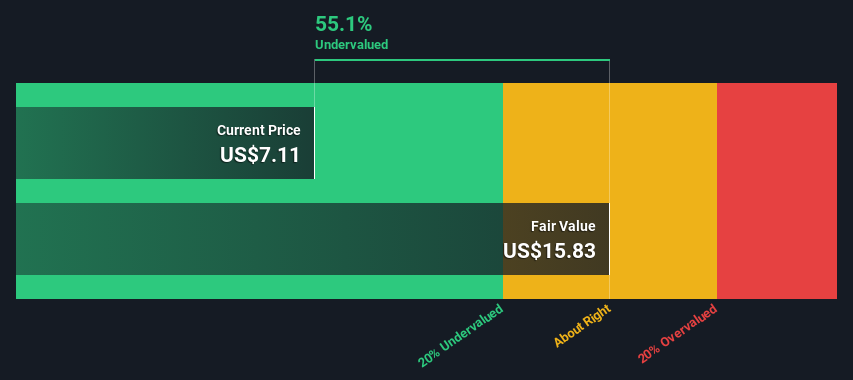

Our DCF model paints an even more optimistic picture, suggesting RLJ’s fair value is around $12 per share, roughly 35% above the current $7.75 price. This reinforces the idea that the stock may be undervalued. However, it raises the question of whether the market is missing something or pricing in risks that are not yet visible.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out RLJ Lodging Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 912 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own RLJ Lodging Trust Narrative

If you would rather dig into the numbers yourself and reach your own conclusions, you can build a complete view in just minutes. Do it your way.

A great starting point for your RLJ Lodging Trust research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, give yourself an edge by scanning fresh opportunities across themes that could complement or outperform RLJ in your portfolio.

- Target reliable income streams by reviewing these 13 dividend stocks with yields > 3% that balance yield potential with underlying business stability.

- Capitalize on long term innovation by assessing these 26 AI penny stocks positioned to benefit from the rapid adoption of artificial intelligence.

- Strengthen your value hunting approach by focusing on these 912 undervalued stocks based on cash flows that trade at meaningful discounts to their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RLJ

RLJ Lodging Trust

RLJ Lodging Trust ("RLJ") is a self-advised, publicly traded real estate investment trust that owns 94 premium-branded, rooms-oriented, high-margin, urban-centric hotels located within the heart of demand locations.

Undervalued average dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)