- United States

- /

- Real Estate

- /

- NYSE:RFL

The Rafael Holdings (NYSE:RFL) Share Price Has Gained 29% And Shareholders Are Hoping For More

Passive investing in index funds can generate returns that roughly match the overall market. But you can significantly boost your returns by picking above-average stocks. For example, the Rafael Holdings, Inc. (NYSE:RFL) share price is up 29% in the last year, clearly besting the market return of around 21% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! We'll need to follow Rafael Holdings for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

See our latest analysis for Rafael Holdings

Because Rafael Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Rafael Holdings saw its revenue shrink by 0.4%. Despite the lack of revenue growth, the stock has returned a solid 29% the last twelve months. To us that means that there isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

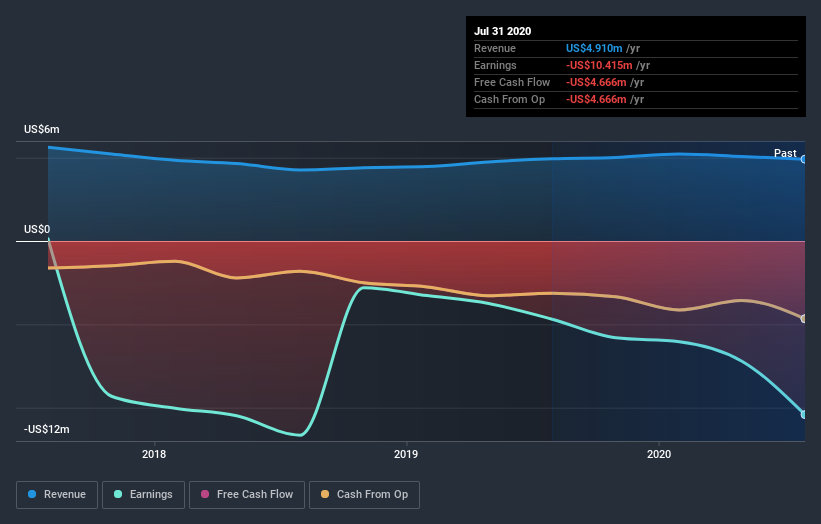

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on Rafael Holdings' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Rafael Holdings boasts a total shareholder return of 29% for the last year. And the share price momentum remains respectable, with a gain of 27% in the last three months. This suggests the company is continuing to win over new investors. It's always interesting to track share price performance over the longer term. But to understand Rafael Holdings better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Rafael Holdings (of which 1 is a bit unpleasant!) you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Rafael Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSE:RFL

Rafael Holdings

Primarily engages in holding interests in clinical and early-stage pharmaceutical companies, and commercial real estate assets in the United States and Israel.

Excellent balance sheet low.

Market Insights

Community Narratives