- United States

- /

- Industrial REITs

- /

- NYSE:REXR

What Do Rexford’s Recent Stock Moves and Industrial Demand Shifts Mean for Investors in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with your Rexford Industrial Realty shares or considering whether now is the time to buy in? You are not alone. With many investors searching for reliable real estate opportunities, Rexford’s recent stock moves have caught some attention and raised questions about how the company is really valued.

Let’s get the lay of the land. Over the past week, Rexford’s stock rose by 0.3%, but it is still down 2.9% for the last month. The longer-term numbers present a mixed picture: the stock is up 8.4% year-to-date, yet it remains negative over the past one, three, and five years. Swings like these can signal shifting market sentiment or changing risk appetites, which may not always reflect the actual business. Some of this is connected to broader movements across commercial real estate, particularly as investors react to news about interest rates and changing demand for industrial space. While there has not been a major headline catalyst recently, this gradual change in market perception is noteworthy on its own.

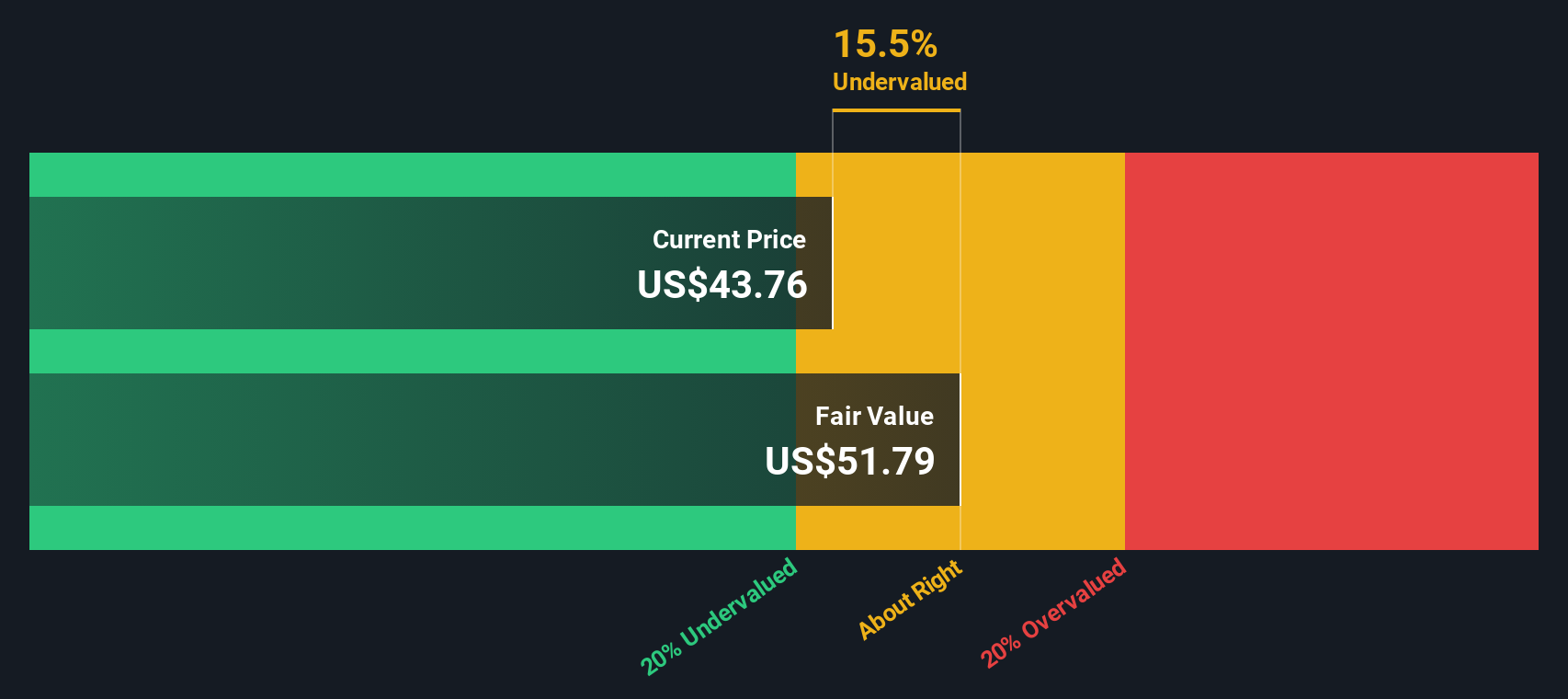

So, is Rexford trading at a bargain right now, or is this a value trap? Our initial look at the company gives it a valuation score of 3 out of 6, which means it appears undervalued in half the ways we typically check. But what does that really tell us? In the next section, we will break down these valuation approaches in detail. Before we wrap up, a smarter framework will be shared to help you go beyond the numbers and gain a clearer view of what real value looks like in this market.

Why Rexford Industrial Realty is lagging behind its peers

Approach 1: Rexford Industrial Realty Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's worth by extrapolating its future adjusted funds from operations and discounting those cash flows back to today’s value. This approach helps investors understand what Rexford Industrial Realty might be worth based on its expected ability to generate cash over the long term.

Looking at the data, Rexford’s latest twelve-month Free Cash Flow stands at $543.2 million. Analysts have projected steady increases in cash flows over the next several years, with forecasts rising to $692.7 million by 2029. Projections beyond 2029 are extrapolated but still reflect ongoing growth, with 2035’s discounted cash flow estimate at $424.1 million.

Based on these forecasts and the DCF analysis, the estimated intrinsic value for Rexford shares is $53.30. This value is about 21.8% higher than where the stock trades today. This suggests the market is currently undervaluing the company by a sizable margin.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Rexford Industrial Realty is undervalued by 21.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Rexford Industrial Realty Price vs Earnings

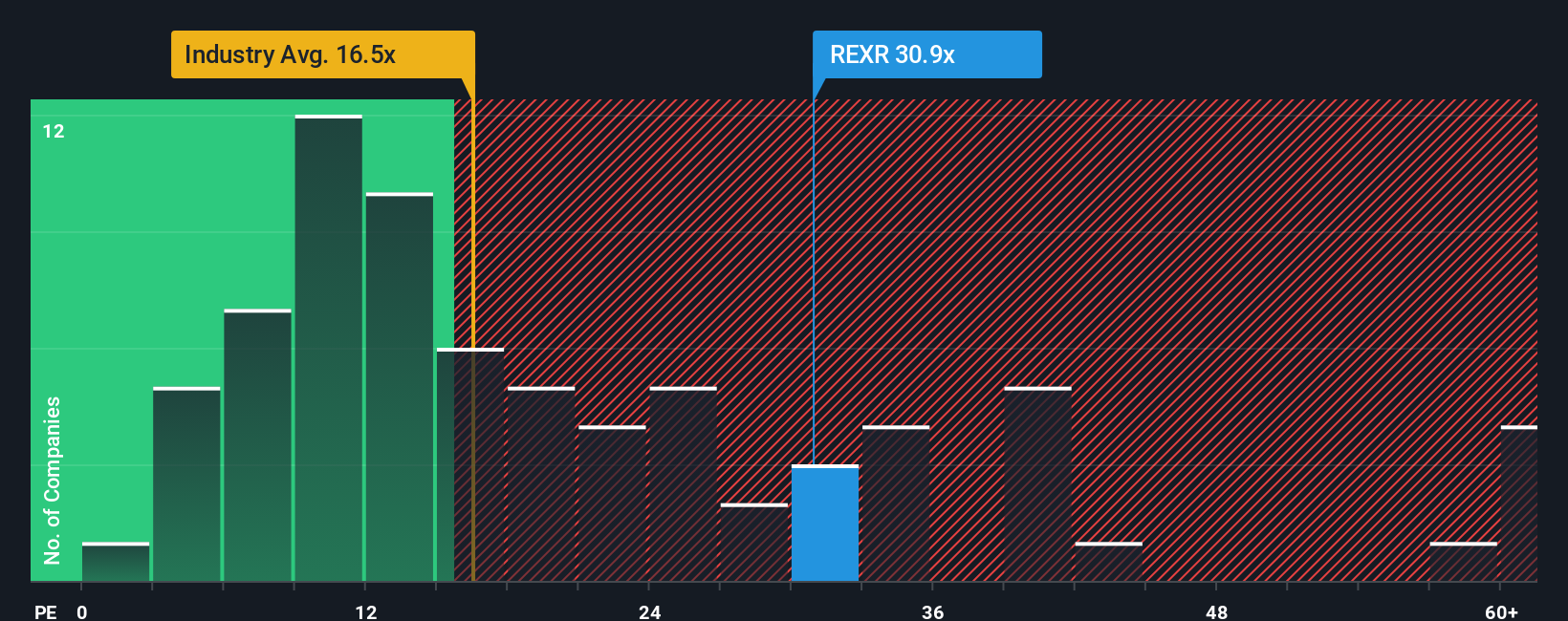

The price-to-earnings (PE) ratio is a preferred valuation metric for profitable companies because it offers a quick snapshot of how much investors are willing to pay for each dollar of earnings. When a company is generating steady profits, as Rexford Industrial Realty is, the PE ratio becomes especially useful in comparing value relative to peers and the broader industry.

Interpreting what counts as a "fair" PE ratio is not always straightforward, since higher growth prospects or lower risk often justify higher multiples. Conversely, companies facing sluggish growth or heightened risk should trade at a discount. For Rexford, the current PE ratio stands at 32.1x. This is notably above the Industry REITs average of 16.4x and the peer average of 29.2x, suggesting that investors expect more growth or less risk from Rexford than its competitors.

Rather than relying solely on these averages, Simply Wall St’s proprietary “Fair Ratio” takes the analysis a step further. The Fair Ratio methodology considers company-specific variables such as growth rates, profit margins, risks, market capitalization, and how it stacks up within its industry. For Rexford, the Fair PE Ratio is 33.4x. This signals that, despite trading at a higher multiple than its peers and the industry, the stock is valued almost exactly where it should be considering its specific fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Rexford Industrial Realty Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a straightforward story you create around your expectations for a company. It brings together your view of what drives future revenue, earnings, and margins, and how all that adds up to a fair value. Narratives connect the business’s story to your financial forecast and then directly to what you believe a share should be worth, making investing less about guesswork and more about well-grounded conviction.

On Simply Wall St, Narratives are available right on the Community page, where millions of investors share their perspectives and see theirs evolve automatically as news, results, or forecasts change. Narratives make it easy to compare Fair Value to Price, helping you spot clear buy or sell signals, especially when the numbers move with new developments. For example, some investors think Rexford’s Southern California properties will keep unlocking growth, setting their fair value up at $44.0. Others, worried about risks like rent declines or redevelopment delays, set their number as low as $35.0. That is the power of Narratives, revealing the reasoning behind the forecasts so you can invest with insight rather than just data.

Do you think there's more to the story for Rexford Industrial Realty? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:REXR

Rexford Industrial Realty

Rexford Industrial creates value by investing in, operating and redeveloping industrial properties throughout infill Southern California, the world's fourth largest industrial market and consistently the highest-demand with lowest-supply major market in the nation over the long term.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives