- United States

- /

- Industrial REITs

- /

- NYSE:PLD

Will Prologis' (PLD) Energy Focus and $1.17B Notes Offering Redefine Its Logistics Edge?

Reviewed by Sasha Jovanovic

- In September and October 2025, Prologis, Inc. completed a US$1.17 billion dual-tranche notes offering, hosted its annual GROUNDBREAKERS forum in Los Angeles, and published new research on energy reliability in warehouses.

- The company's survey revealed that 90% of supply chain managers are willing to pay a premium for dependable power, underscoring the growing importance of energy infrastructure in logistics real estate.

- We'll explore how Prologis' emphasis on energy resilience may influence its investment outlook and long-term industry positioning.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Prologis Investment Narrative Recap

To buy into Prologis, Inc., you need to believe in the enduring demand for logistics real estate, anchored by e-commerce, supply chain modernization, and energy resilience trends. The latest dual-tranche notes offering and GROUNDBREAKERS forum underscore Prologis's commitment to energy infrastructure, but these moves do not materially change the immediate outlook: momentum remains driven by pent-up leasing demand, while the greatest risk is lingering tenant caution and slower new leasing due to macro uncertainty.

Among recent announcements, Prologis’s partnership with EV Realty to develop EV charging infrastructure directly aligns with the company's energy reliability focus highlighted at the GROUNDBREAKERS forum. This initiative reflects customer priorities from Prologis’s own global survey, connecting longer-term catalysts like value-added services with the critical short-term goal of supporting warehouse operational continuity.

Yet, against this backdrop, investors should be mindful that delayed tenant decision-making amid economic uncertainty remains a central risk that could...

Read the full narrative on Prologis (it's free!)

Prologis' narrative projects $9.7 billion revenue and $3.6 billion earnings by 2028. This requires 3.0% yearly revenue growth and a $0.2 billion earnings increase from $3.4 billion today.

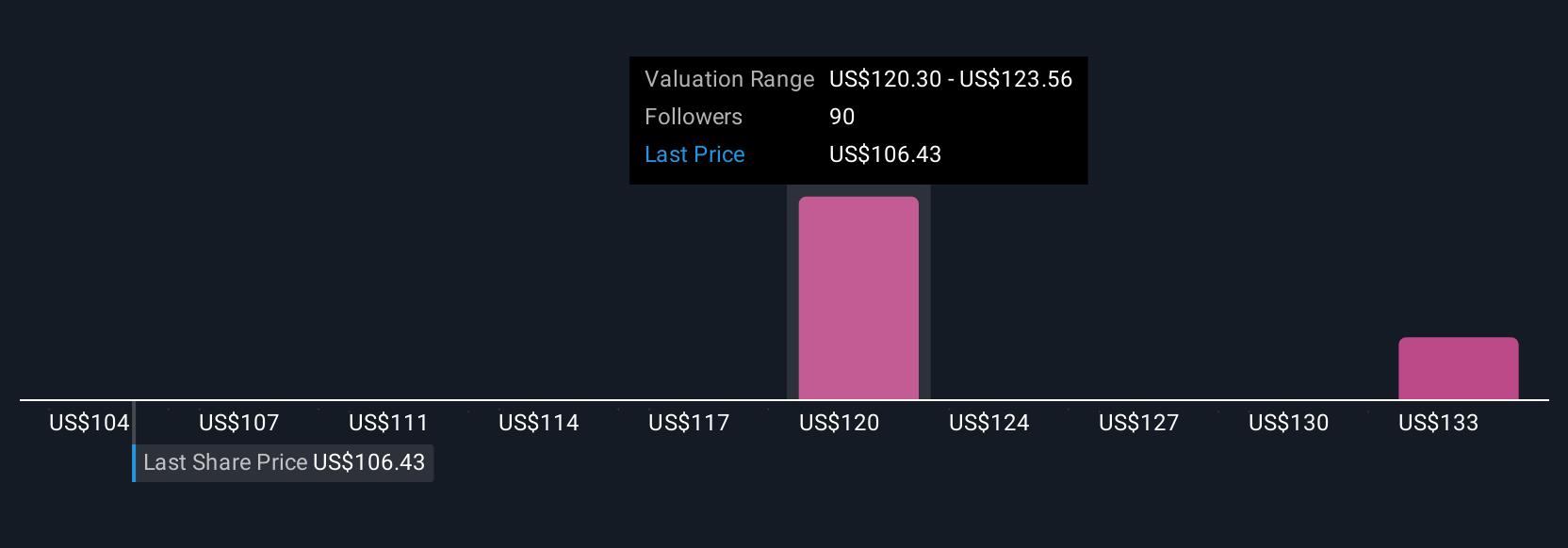

Uncover how Prologis' forecasts yield a $120.00 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Seven independent fair value estimates from the Simply Wall St Community fall between US$103 and US$124.82 per share. As many anticipate pent-up leasing demand to drive revenue growth, it is clear opinions on the path ahead can differ widely.

Explore 7 other fair value estimates on Prologis - why the stock might be worth as much as 7% more than the current price!

Build Your Own Prologis Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Prologis research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Prologis research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Prologis' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PLD

Prologis

Prologis, Inc., is the global leader in logistics real estate with a focus on high-barrier, high-growth markets.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives