- United States

- /

- Specialized REITs

- /

- NYSE:OUT

A Fresh Look at OUTFRONT Media (OUT) Valuation Following AWS-Powered Push Into Digital OOH Advertising

Reviewed by Kshitija Bhandaru

OUTFRONT Media (OUT) just revealed a new partnership with Amazon Web Services aimed at bringing artificial intelligence, cloud tools, and automation to the out-of-home advertising market. The move focuses on streamlining how agencies and brands plan, buy, and measure campaigns across both static and digital formats, making the process feel much more like other digital channels.

See our latest analysis for OUTFRONT Media.

Even as OUTFRONT Media takes a bold step forward with AWS to digitize out-of-home advertising, the stock has seen a modest 1.22% total return over the past year. Its longer-term 61.98% five-year total shareholder return shows resilience and potential for further gains.

If this kind of transformation sparks your interest, it could be the perfect time to expand your search and discover fast growing stocks with high insider ownership

With shares trading nearly 10% below analyst price targets and showing a significant discount to intrinsic value, investors may be wondering whether OUTFRONT Media is an overlooked opportunity following its digital transformation, or if the market has already accounted for its future growth potential.

Most Popular Narrative: 9% Undervalued

OUTFRONT Media's current share price trails the most widely followed narrative's fair value estimate, suggesting substantial upside remains if expectations play out as projected.

The company's enhanced focus on data analytics, programmatic buying, and improved audience measurement (via investment in ad tech and centralized operations) positions it to capture more digital ad budgets. This serves to drive higher occupancy rates and increased revenue per asset.

What’s the driver behind this bullish target? Imagine revenue power and margin expansion converging with a new era of digital ad dominance. Want to see how aggressive growth numbers and next-level efficiency transform OUTFRONT’s potential? Find out what else shapes this forecast.

Result: Fair Value of $19.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing shifts in advertiser budgets toward digital channels and declines in legacy billboard revenues could limit OUTFRONT Media’s growth if not offset by progress in digital advertising.

Find out about the key risks to this OUTFRONT Media narrative.

Another View: Looking at Value Through Industry Lenses

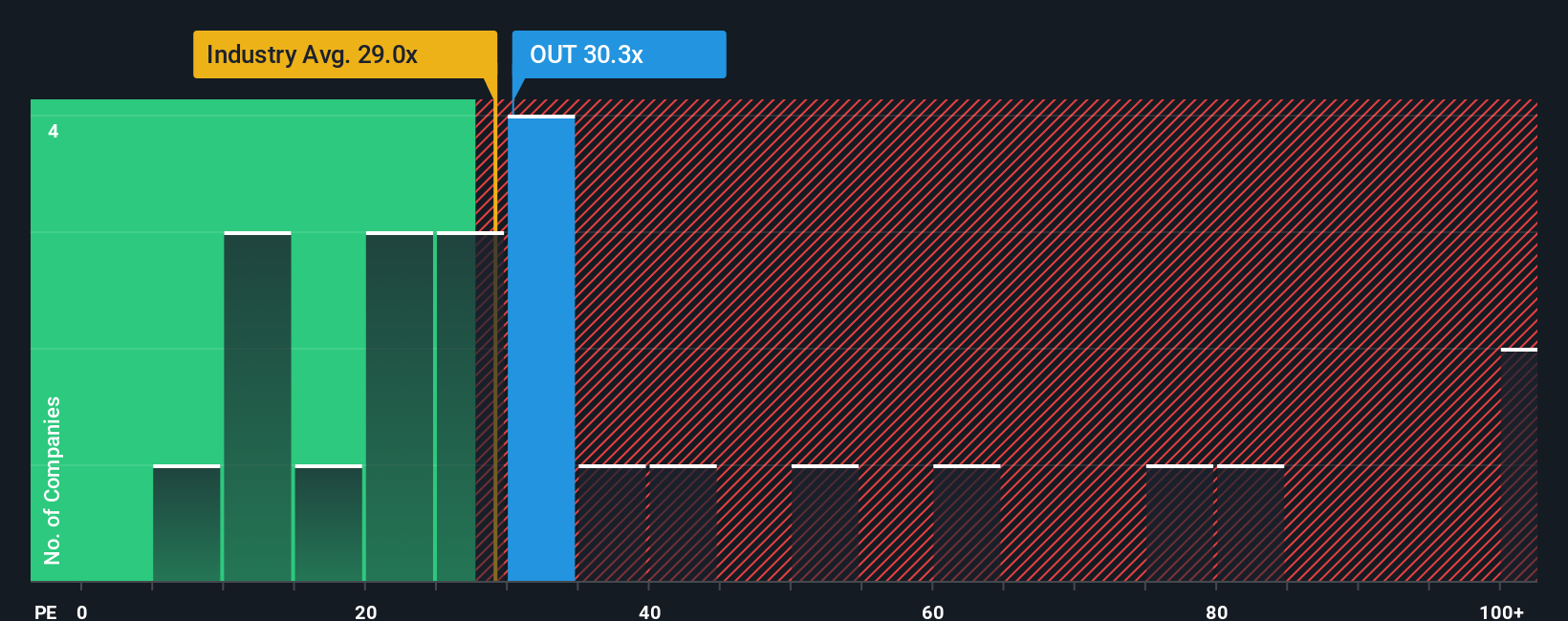

While analyst forecasts suggest OUTFRONT Media is trading near its fair value, a closer look at its price-to-earnings ratio paints a different picture. OUT’s current multiple of 30.1x is higher than the industry average of 28.8x, but still well below the peer average of 43.6x and the fair ratio of 44.6x.

This gap means the stock could be undervalued if the market moves toward the fair ratio. However, it also highlights some valuation risk if the industry average weighs more heavily. Which way will investor sentiment turn next?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own OUTFRONT Media Narrative

If you want to test a different view or put data to work your own way, dive in and build your own narrative quickly and confidently. Do it your way

A great starting point for your OUTFRONT Media research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Smart investors don’t stop at a single opportunity. Uncover more potential by tapping into carefully curated stock lists targeting unique market trends and growth stories.

- Capitalize on under-appreciated companies by checking out these 877 undervalued stocks based on cash flows, which is packed with stocks trading beneath their real worth.

- Supercharge your portfolio with the innovators shaping tomorrow by starting with these 24 AI penny stocks, focused on artificial intelligence breakthroughs and next-level automation.

- Unlock truly passive income strategies and steady returns by scanning these 18 dividend stocks with yields > 3%, featuring firms offering attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OUT

OUTFRONT Media

OUTFRONT is one of the largest and most trusted out-of-home media companies in the U.S., helping brands connect with audiences in the moments and environments that matter most.

Good value with reasonable growth potential.

Market Insights

Community Narratives