- United States

- /

- REITS

- /

- NYSE:OLP

Investors Who Bought One Liberty Properties (NYSE:OLP) Shares A Year Ago Are Now Down 35%

It's easy to match the overall market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. For example, the One Liberty Properties, Inc. (NYSE:OLP) share price is down 35% in the last year. That falls noticeably short of the market return of around -4.3%. However, the longer term returns haven't been so bad, with the stock down 21% in the last three years. Unfortunately the share price momentum is still quite negative, with prices down 33% in thirty days. But this could be related to poor market conditions -- stocks are down 21% in the same time.

View our latest analysis for One Liberty Properties

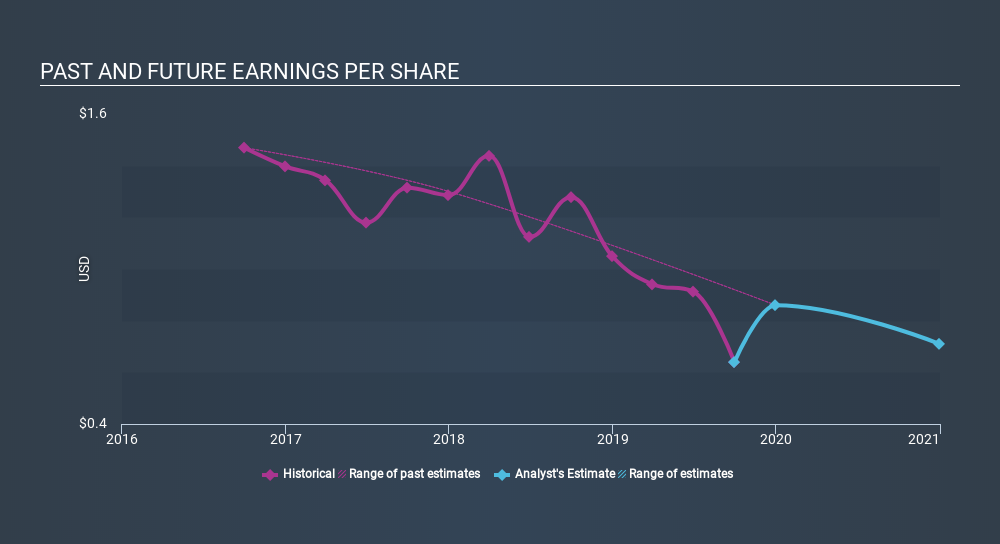

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Unhappily, One Liberty Properties had to report a 50% decline in EPS over the last year. This fall in the EPS is significantly worse than the 35% the share price fall. It may have been that the weak EPS was not as bad as some had feared.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on One Liberty Properties's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, One Liberty Properties's TSR for the last year was -31%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

We regret to report that One Liberty Properties shareholders are down 31% for the year (even including dividends) . Unfortunately, that's worse than the broader market decline of 4.3%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 0.8%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand One Liberty Properties better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for One Liberty Properties you should be aware of.

We will like One Liberty Properties better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:OLP

One Liberty Properties

One Liberty is a self-administered and self-managed real estate investment trust incorporated in Maryland in 1982.

Undervalued moderate and pays a dividend.

Market Insights

Community Narratives