- United States

- /

- Health Care REITs

- /

- NYSE:OHI

Omega Healthcare Investors (OHI): Evaluating Valuation After Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

Omega Healthcare Investors (NYSE:OHI) is on investors’ radars as it continues its steady performance in the healthcare real estate market. Over the past three months, the stock has climbed 13%, reflecting growing interest in this sector.

See our latest analysis for Omega Healthcare Investors.

Momentum has quietly gathered for Omega Healthcare Investors, with its 13% share price climb over the last three months signaling growing optimism around the real estate healthcare sector. Over the past year, total shareholder return has reached nearly 12%, and those who have stuck with the stock for the longer haul have enjoyed standout 3- and 5-year total returns approaching 79% and 98% respectively. The combination of recent gains and steady long-term performance suggests investors are beginning to price in improved fundamentals and potential growth drivers ahead.

If you’re tracking trends in healthcare REITs, it may be the perfect time to discover opportunities through our See the full list for free.

But with the recent rally and long-term gains already in place, is Omega Healthcare Investors now trading at an appealing discount? Or is the current share price already factoring in expectations for future growth?

Most Popular Narrative: 5.1% Undervalued

The most widely followed narrative sees Omega Healthcare Investors' fair value at $43.87, just above the last close price of $41.62. This points to some headroom, but it all hinges on forecasts that set the tone for what comes next.

Omega's disciplined balance sheet management and opportunistic use of both debt and equity (with a low leverage ratio at decade lows and largely fixed-rate debt) position the company to pursue high-yield acquisitions and portfolio expansion at accretive rates. This supports long-term AFFO and net earnings growth.

Want to know the growth blueprint behind this high valuation? The key drivers hinge on ambitious expectations for earnings, margins, and sector-beating rent coverage. Intrigued by what sets this pricing apart? Uncover the quantitative assumptions and bullish projections that power this upbeat narrative.

Result: Fair Value of $43.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concerns remain, including potential tenant financial strain and regulatory changes. Both of these factors could limit Omega Healthcare Investors’ earnings momentum going forward.

Find out about the key risks to this Omega Healthcare Investors narrative.

Another View: Market Ratios Suggest a Cautious Outlook

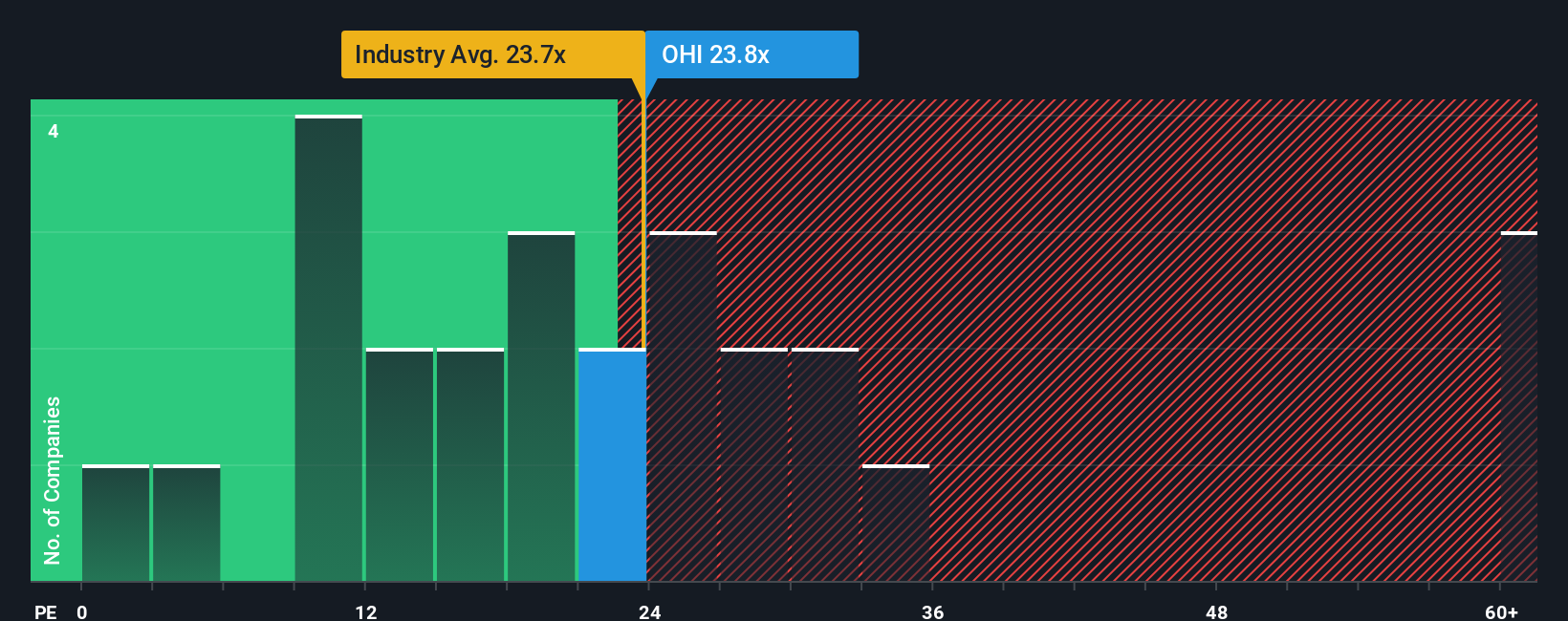

Looking at valuation through the company's earnings ratio provides a different angle. Omega Healthcare Investors trades at 27 times earnings, which is steeper than the global Health Care REITs industry average of 24.1 times. While its ratio is much lower than peers at 74.1 times and below its fair ratio of 35.1, this premium raises questions about how much upside remains and if expectations have already been priced in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Omega Healthcare Investors Narrative

If you see things differently or want to dive into the numbers firsthand, crafting your own take takes less than three minutes. Do it your way

A great starting point for your Omega Healthcare Investors research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock fresh opportunities others might overlook. Put our research power to work and find stocks with game-changing growth or hidden value before the crowd.

- Capitalize on the crypto frontier by checking out these 78 cryptocurrency and blockchain stocks poised for major growth in decentralized finance and blockchain innovation.

- Boost your portfolio with reliable income by evaluating these 19 dividend stocks with yields > 3% delivering robust yields and financial stability beyond market volatility.

- Seize the AI advantage as you browse these 24 AI penny stocks that are pushing boundaries with automation, machine learning breakthroughs, and disruptive technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OHI

Omega Healthcare Investors

A Real Estate Investment Trust (“REIT”) providing financing and capital to the long-term healthcare industry in the United States and the United Kingdom with a focus on skilled nursing and assisted living facilities, including care homes in the United Kingdom.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives