- United States

- /

- Retail REITs

- /

- NYSE:O

Will Realty Income's (O) $800 Million Bond Offering Reshape Its Long-Term Liquidity Strategy?

Reviewed by Sasha Jovanovic

- In late September 2025, Realty Income Corporation completed an $800 million dual-tranche public offering of senior unsecured notes, with maturities in 2029 and 2033, to enhance liquidity and support operational needs. This move reflects Realty Income's ability to access capital markets for substantial funding, reinforcing its financial flexibility for debt repayment and future growth investments.

- By strengthening its liquidity through these fixed-income offerings, Realty Income signals confidence in its ongoing expansion, especially as it balances US and European market exposures within its large portfolio of essential property assets.

- We'll examine how Realty Income's enhanced liquidity position from the recent bond issuance could influence the company's long-term investment resilience.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Realty Income Investment Narrative Recap

To be a shareholder in Realty Income, I believe you need to be confident in the company's ability to generate steady income from necessity-based retail and industrial properties, while managing growth across both US and European markets. The recent $800 million bond issuance adds substantial liquidity but does not materially change the main near-term catalyst, expansion in Europe, or the biggest risk, which remains execution and currency exposure tied to that international growth. The biggest question is still whether cross-border investment can deliver consistent, accretive returns without adding volatility from shifting forex rates and regional performance.

Among recent announcements, the September dividend increase, to $0.2695 per share, underscores the company's focus on reliability and incremental shareholder returns. The stable and rising dividend stream remains a key catalyst supporting the investment case, especially as Realty Income deploys its expanded capital resources into new markets in Europe and beyond. These ongoing dividend raises signal the company's confidence in its ability to sustain predictable rental income, but their consistency will depend on successfully managing...

Read the full narrative on Realty Income (it's free!)

Realty Income's narrative projects $6.2 billion in revenue and $1.6 billion in earnings by 2028. This requires 4.1% yearly revenue growth and a $691.9 million increase in earnings from the current $908.1 million.

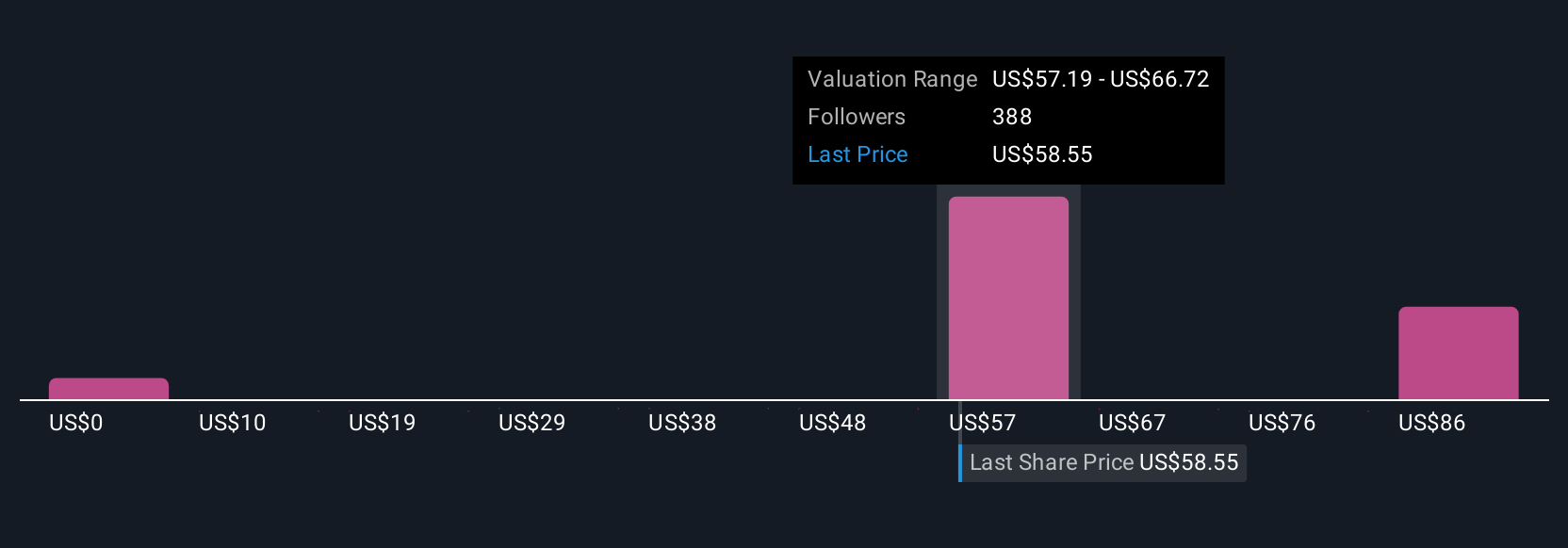

Uncover how Realty Income's forecasts yield a $62.55 fair value, a 4% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community includes 18 fair value estimates for Realty Income, ranging from US$50 to US$93.51 a share. Many highlight the ongoing risk from the company’s increasing exposure to European markets and foreign exchange volatility, reminding you that opinions and forecasts can vary widely and other points of view could change your outlook.

Explore 18 other fair value estimates on Realty Income - why the stock might be worth as much as 55% more than the current price!

Build Your Own Realty Income Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Realty Income research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Realty Income research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Realty Income's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:O

Realty Income

Realty Income (NYSE: O), an S&P 500 company, is real estate partner to the world's leading companies.

6 star dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives