- United States

- /

- Retail REITs

- /

- NYSE:O

Is Realty Income Attractive After Recent 4.5% Dip and Acquisition Headlines?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Realty Income is a good buy at today's price, you are not alone, and we're about to break it down in plain terms.

- Despite a recent dip of 4.5% over the past month, Realty Income is still up 8.0% year-to-date and has delivered a solid 6.3% gain over the past year.

- Recent headlines have weighed on the real estate sector, with rising interest rate concerns and market speculation on future rent growth sending shares on a bit of a roller coaster. Realty Income has also been mentioned in discussions around potential property acquisitions, adding to the buzz and possible shifts in investor sentiment.

- On our quick valuation scan, Realty Income earns a 2 out of 6 score for undervaluation. There is more to this story, though, and we will explore multiple approaches to value, including a perspective you may not have considered before.

Realty Income scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Realty Income Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a common approach for estimating a company's intrinsic value. It works by projecting Realty Income's future cash flows, in this case using adjusted funds from operations, and then discounting those forecasts back to today's value using a required rate of return. This gives investors an idea of what the company is really worth based on its potential to generate cash in the years ahead.

Currently, Realty Income's free cash flow stands at $3.62 billion. Analysts have provided estimates up to five years ahead, with projections indicating the company's free cash flow could reach approximately $4.70 billion by the end of 2029. After the five-year mark, further growth in cash flows is extrapolated using established models, offering a glimpse at long-term prospects.

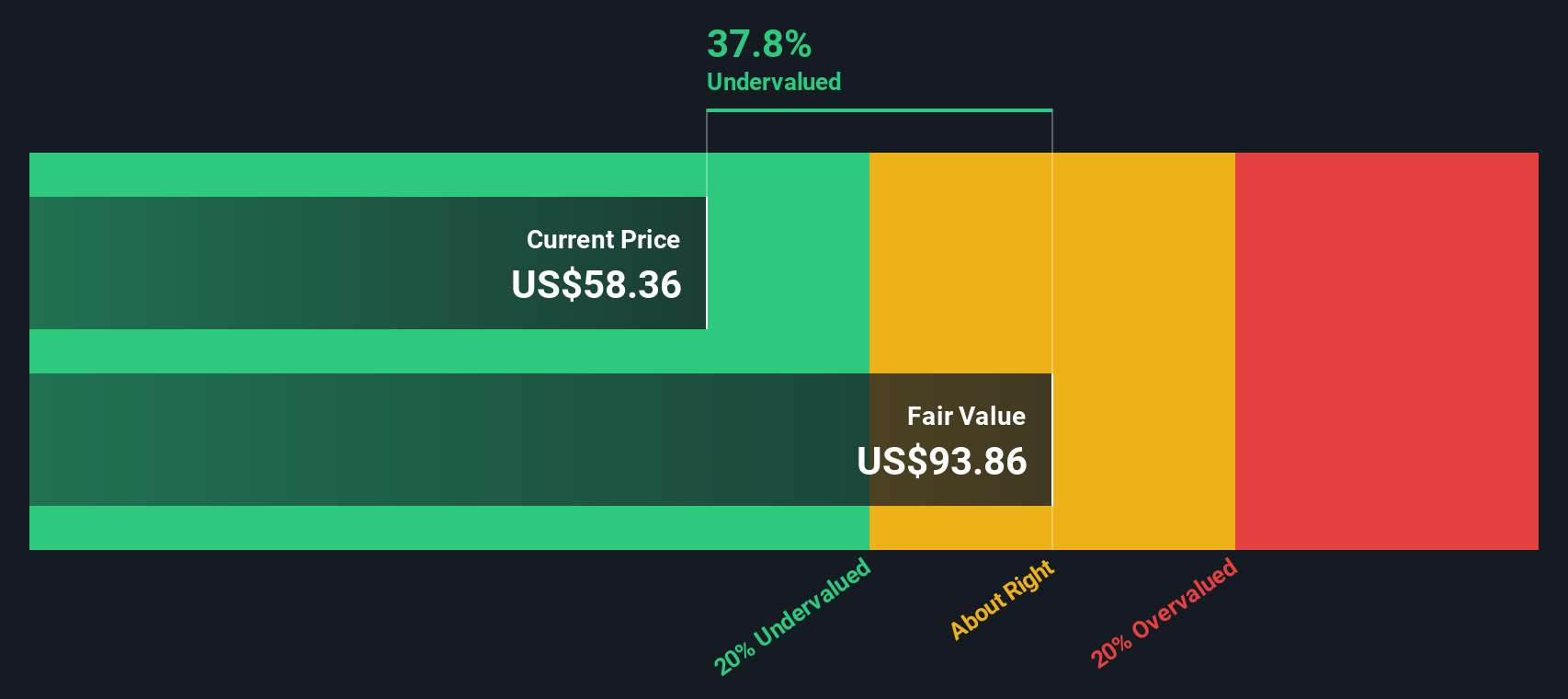

Based on the two-stage DCF approach, the intrinsic value of Realty Income's shares comes out to $96.93. This implies the stock is trading at a 41.4% discount to its estimated fair value, suggesting a significant margin of safety for investors. In other words, the DCF points to Realty Income being meaningfully undervalued at the current share price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Realty Income is undervalued by 41.4%. Track this in your watchlist or portfolio, or discover 879 more undervalued stocks based on cash flows.

Approach 2: Realty Income Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most widely used valuation measures for profitable companies. It helps investors understand how much they are paying for each dollar of a company's earnings, making it particularly relevant for evaluating established, income-generating businesses like Realty Income.

Typically, a company's fair PE ratio reflects its growth prospects and the perceived risk of its earnings stream. Faster-growing companies or those with more stable earnings can justify higher PE ratios. In contrast, slower growth or higher risk tends to warrant lower PEs.

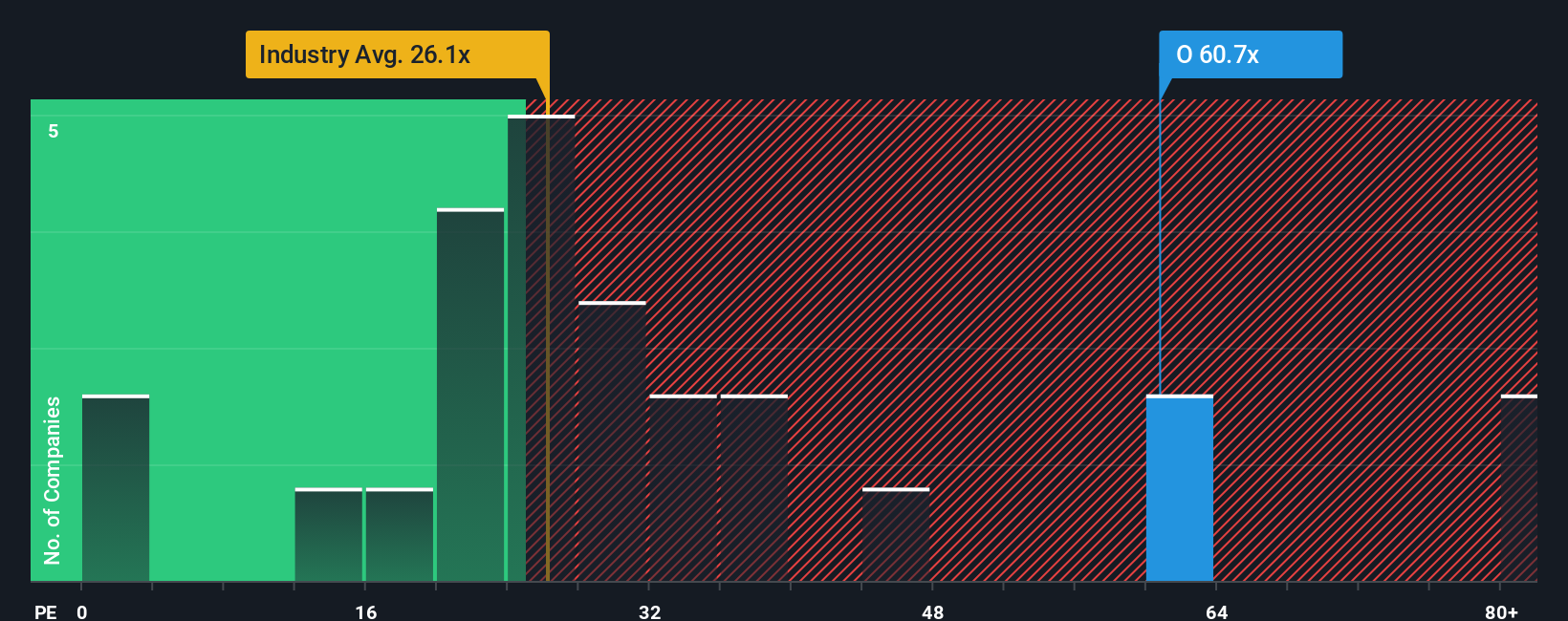

Right now, Realty Income trades at a PE ratio of 54.3x, which is significantly higher than the Retail REITs industry average of 26.5x and also above the peer average of 32.2x. Instead of comparing Realty Income solely to its peers or industry, Simply Wall St’s “Fair Ratio” offers a more tailored perspective. The Fair Ratio for Realty Income is 37.5x, calculated based on factors like its earnings growth, risk profile, profit margins, industry, and market capitalization. This makes it a more holistic benchmark than the raw industry or peer average, which can overlook key differences between companies.

Comparing Realty Income’s current PE ratio (54.3x) to the Fair Ratio (37.5x), the stock appears overvalued on this metric. The current valuation exceeds what would be expected, even after accounting for growth, risk, and profitability factors.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Realty Income Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, story-driven explanation that connects your perspective on Realty Income to your financial expectations, weaving your views about its business and future directly into a forecast and a fair value, all in one place.

Rather than relying solely on traditional ratios or analyst models, a Narrative empowers you to outline your own assumptions: what you believe about Realty Income’s revenue growth, profit margins, or market opportunities, and how those assumptions shape your opinion of its value. This bridges the gap between numbers and story, making it much easier to understand why a stock might be a buy or a sell for you personally.

Anyone can build or review Narratives right within the Simply Wall St Community page. Millions of investors already do, making it a uniquely accessible tool for smarter decisions. Narratives are dynamic, meaning they instantly update when news breaks or earnings are released, ensuring your valuation always reflects the latest information.

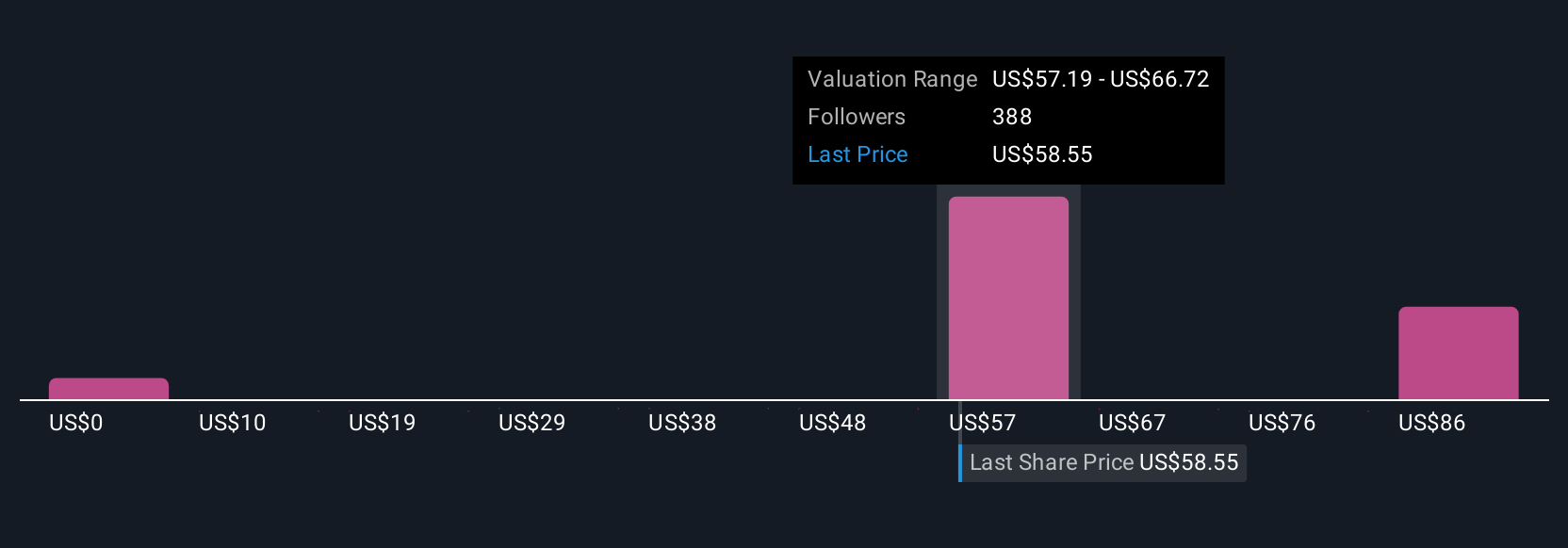

For example, some investors are highly optimistic about Realty Income, forecasting $75 per share based on sustained dividend growth and global expansion. Others are more cautious, estimating fair value closer to $59 due to moderating dividend increases and sector risks. Narratives put these perspectives side by side so you can compare, debate, and ultimately decide if Realty Income fits your investment story and objectives.

Do you think there's more to the story for Realty Income? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:O

Realty Income

Realty Income (NYSE: O), an S&P 500 company, is real estate partner to the world's leading companies.

6 star dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives