- United States

- /

- Retail REITs

- /

- NYSE:O

How Investors Are Reacting To Realty Income (O) Reaffirming Guidance Amid Portfolio Growth and High Occupancy

Reviewed by Simply Wall St

- Earlier in the past week, Realty Income reaffirmed its full-year outlook after posting a strong second-quarter with 98.6% portfolio occupancy and continued expansion into industrial, gaming, and data center properties, as well as international markets.

- An important insight is the company's ability to weather tenant pressures while building a diversified pipeline and potentially benefiting from lower borrowing costs amid expected Federal Reserve rate cuts.

- Let's explore how Realty Income's steady occupancy and reaffirmed outlook shape the company's investment narrative moving forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Realty Income Investment Narrative Recap

To be a shareholder in Realty Income, you need to believe in the company’s ability to maintain consistently high occupancy rates and reliable monthly dividends while expanding into new sectors and geographies. The recent news, reaffirmed full-year outlook with 98.6% occupancy and stable expansion, supports this narrative, but does not materially shift the short-term catalyst of sustained rent collections or the key risk of international exposure and tenant concentration.

Among the recent announcements, Realty Income’s declared 662nd consecutive monthly dividend and a minor dividend increase stand out, signaling continuing income reliability. This is highly relevant in the context of the recent earnings report, which showed resilient performance but also highlighted pressures from changing tenant dynamics and sector diversification, factors investors are closely watching as the company balances growth and risk.

On the other hand, investors should be aware of the heightened foreign currency and regulatory risks as the company sharply increases European acquisitions ...

Read the full narrative on Realty Income (it's free!)

Realty Income's outlook predicts $6.1 billion in revenue and $1.6 billion in earnings by 2028. This assumes a 3.9% annual revenue growth rate and a $691.9 million increase in earnings from the current $908.1 million.

Uncover how Realty Income's forecasts yield a $62.45 fair value, a 6% upside to its current price.

Exploring Other Perspectives

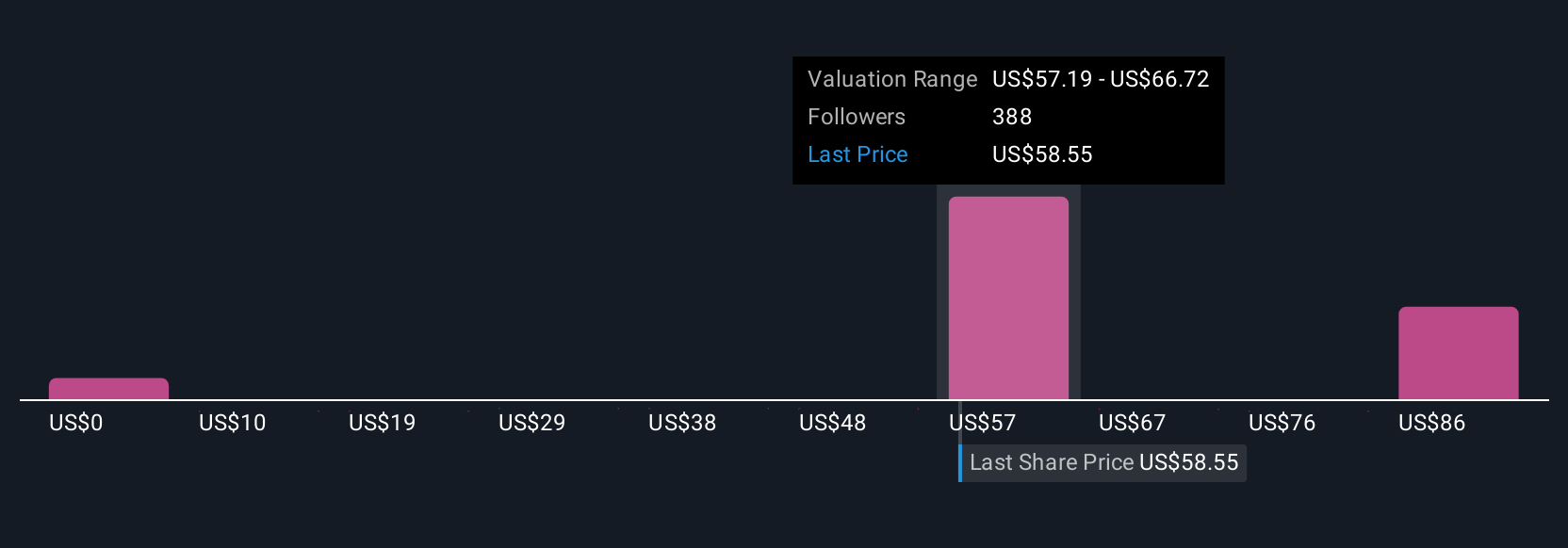

Retail investors in the Simply Wall St Community calculated 32 different fair values for Realty Income, from as low as US$9.50 to US$95.03 per share. While many see appeal in the company’s dependable dividend history, the pronounced international expansion means opinions on future returns can differ widely, inviting you to compare these varied perspectives before deciding where you stand.

Explore 32 other fair value estimates on Realty Income - why the stock might be worth less than half the current price!

Build Your Own Realty Income Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Realty Income research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Realty Income research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Realty Income's overall financial health at a glance.

No Opportunity In Realty Income?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:O

Realty Income

Realty Income (NYSE: O), an S&P 500 company, is real estate partner to the world's leading companies.

6 star dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives