- United States

- /

- Retail REITs

- /

- NYSE:O

A Fresh Look at Realty Income (O) Valuation After Recent Period of Steady Performance

Reviewed by Simply Wall St

See our latest analysis for Realty Income.

Realty Income’s share price ticked up modestly to $56.80 after a run of mild intraday swings, echoing a broader pause across real estate stocks. Momentum has been steady, with the year-to-date share price return sitting close to 8%. Its one-year total shareholder return of just over 6% illustrates a consistent, if unspectacular, performance over both short and long stretches.

If steady income plays like Realty Income are on your radar, it’s also worth broadening your search and discovering fast growing stocks with high insider ownership

That leaves investors with a key question: Is Realty Income’s recent stability masking a potential undervaluation, or has the market already priced in all of the company’s future growth prospects?

Most Popular Narrative: 7.3% Undervalued

According to andre_santos, the latest fair value estimate for Realty Income is $61.26, just above the recent close at $56.80. The market seems to be leaving some room for upside, especially as dividend growth paces cool down.

Fair Value (Historical Dividend Yield): $66.20

💰 Dividend Discount Model: Stable Growth (Weight: 60%)

We apply the Gordon Growth Model, assuming:

• Dividend growth rate (g): 3.25% (assuming a rate a little below its 10 year average growth of ~3.5%)

• Next year’s dividend (D1): $3.333 (current dividend of $3.228 grown by 3.25%)

• Required return (r): 9% (15% margin of safety minus the dividend yield of ~6%)

P = 3.333 / (0.09 - 0.0325) = 57.97

Fair Value (DDM: Stable Growth): $57.97

Valuation Summary

Given the expectation that Realty Income’s dividend growth will decelerate in the coming years, greater weight will be assigned to the Dividend Discount Model. This model reflects more appropriately the anticipated slowdown in dividend growth. In contrast, the Historical Yield method assumes mean reversion, which introduces a higher degree of uncertainty, and so it will have a lower weight on the valuation.

Want a look behind the curtain? This fair value is built on some bold assumptions about payout growth, risk premiums, and future yield trends. Only by digging in can you see which ingredient really tips the scale.

Result: Fair Value of $61.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower future dividend growth or a continued cooling in real estate demand could quickly challenge the case for undervaluation.

Find out about the key risks to this Realty Income narrative.

Another View: Ratio-Based Valuation Flags Caution

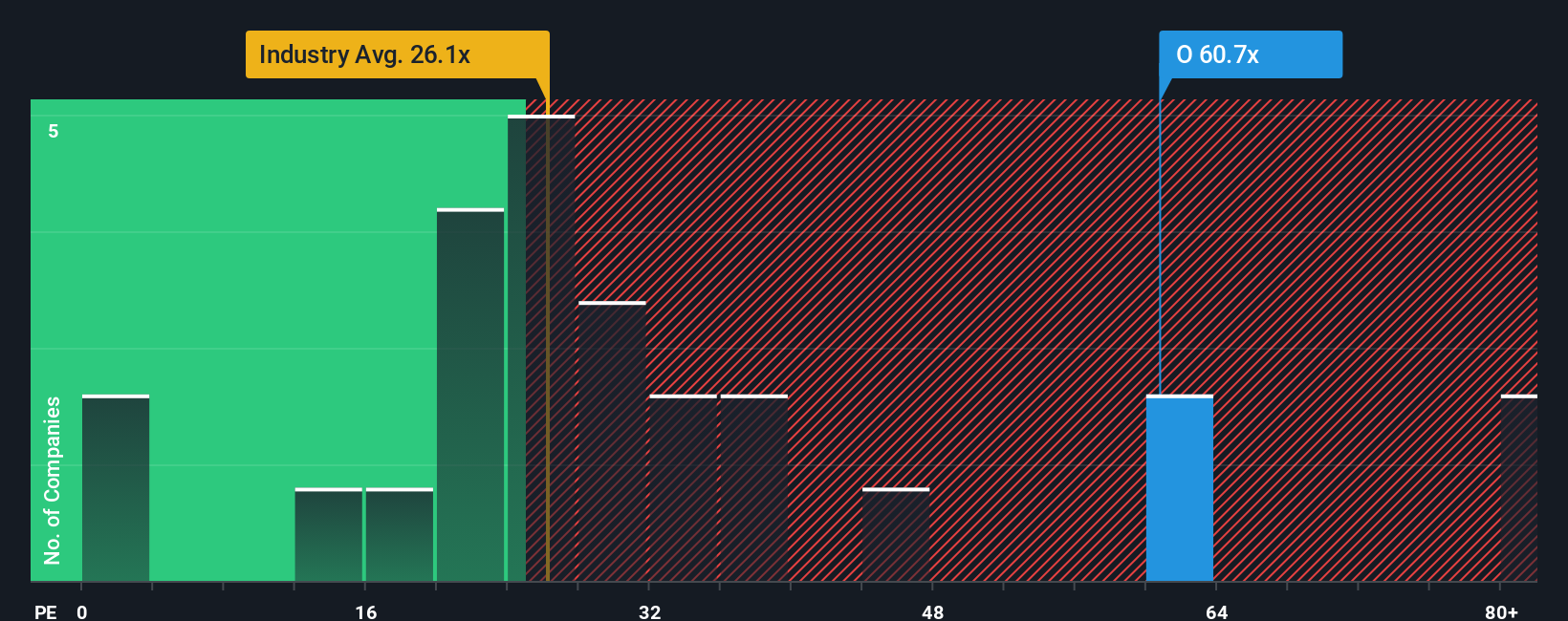

Looking at Realty Income through its price-to-earnings ratio, things change. The company trades at 54.3 times earnings, which is higher than the US Retail REITs industry average of 26.5 times and above the peer group average of 32.2. Even compared to the fair ratio of 37.5, the current price looks stretched. This premium suggests investors may be taking on added valuation risk if growth expectations are merely steady. Could the market be overlooking something, or is caution warranted here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Realty Income Narrative

If these views do not match your own or you prefer to dive into the numbers yourself, you can craft a personalized narrative in just a few minutes with Do it your way

A great starting point for your Realty Income research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investing means always staying curious. Give yourself the edge by checking out other handpicked opportunities that you might not have considered yet.

- Tap into market momentum by following these 886 undervalued stocks based on cash flows to see which businesses could offer serious upside.

- Ride the wave of artificial intelligence breakthroughs with these 25 AI penny stocks as they reshape industries and drive returns.

- Boost your portfolio with steady income through these 16 dividend stocks with yields > 3% and find yields that stand out in today’s market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:O

Realty Income

Realty Income (NYSE: O), an S&P 500 company, is real estate partner to the world's leading companies.

6 star dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives