- United States

- /

- Retail REITs

- /

- NYSE:NTST

NETSTREIT (NTST): Assessing Valuation After Major Financing and Strengthened Balance Sheet for Future Growth

Reviewed by Kshitija Bhandaru

NETSTREIT is drawing attention after closing $450 million in new term loan commitments and amending its credit agreements. These moves boost its financial flexibility for future acquisitions and strategic growth.

See our latest analysis for NETSTREIT.

On the heels of announcing major new financing, NETSTREIT has seen a gradual build in momentum, with its share price steadily recovering and a 1-year total shareholder return of 20.8%. Recent moves, including an equity offering and analyst coverage upgrades, have further highlighted growing confidence in its growth potential and stronger balance sheet.

If these strategic shifts have you looking for other standout opportunities, this could be the right moment to broaden your horizons and discover fast growing stocks with high insider ownership

With the stock not far from analyst price targets and recent gains highlighting its recovery, investors are left to consider if NETSTREIT remains undervalued or if the market has already priced in all its future growth potential.

Most Popular Narrative: 6.7% Undervalued

With NETSTREIT’s last close at $18.39 and the most popular narrative pointing to a fair value around $19.72, the current price sits noticeably below the consensus benchmark. This dynamic sets the stage for a valuation story focused on expected transformations in cash flows and profitability.

Population and household growth in key U.S. Sun Belt and suburban regions continues to fuel strong demand for necessity-based retail locations. This allows NETSTREIT to maintain low vacancy rates, attract high-quality tenants, and drive stable rental revenue growth over the long term.

Curious how this outlook results in a premium tag for NETSTREIT? There is a bold profit forecast and a risky future earnings multiple that make this narrative stand out from the crowd. Want to know if growth expectations are realistic or a stretch? Dive in to discover how those headline numbers play into the story.

Result: Fair Value of $19.72 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued e-commerce growth or high tenant concentration could challenge NETSTREIT’s outlook. These factors could potentially slow revenue gains and impact margin stability.

Find out about the key risks to this NETSTREIT narrative.

Another View: The Multiples Perspective

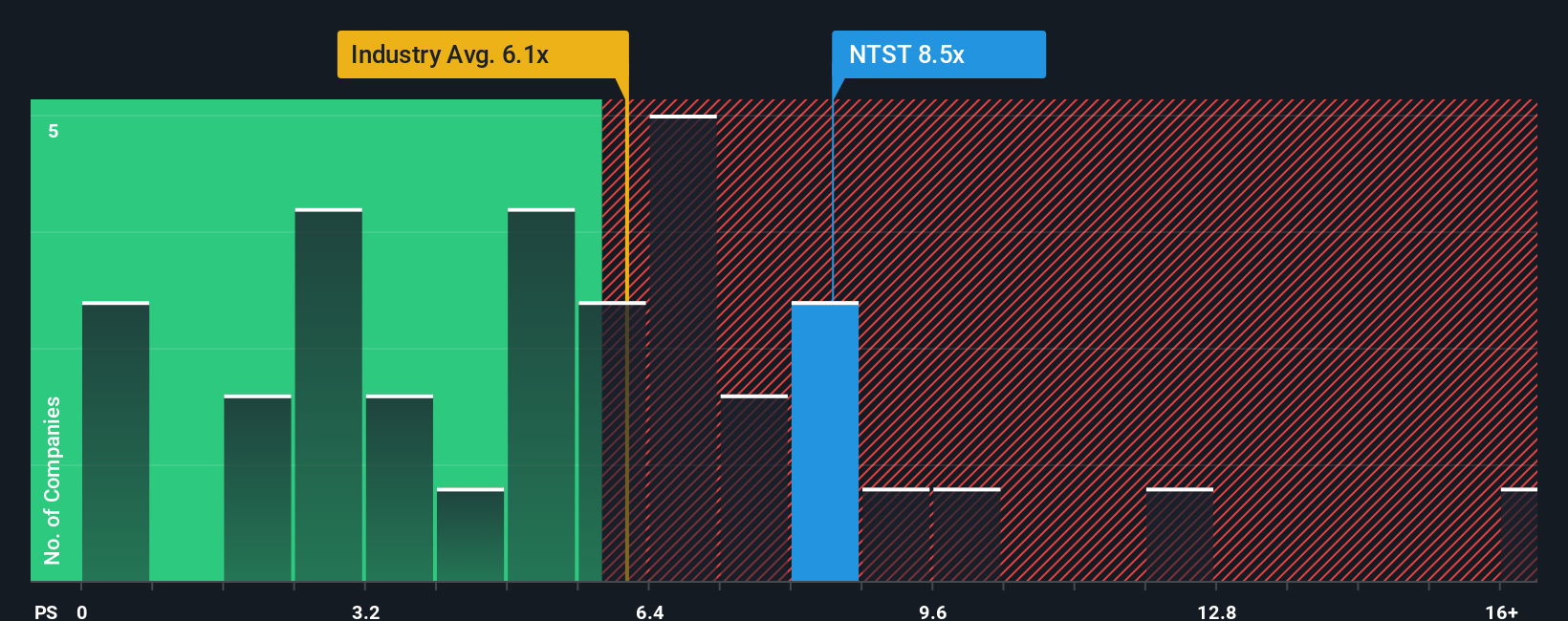

While the dominant narrative points to NETSTREIT being undervalued versus analyst price targets, a look at its price-to-sales ratio paints a more expensive picture. NETSTREIT trades at 8.5x sales, which is notably higher than the industry average of 6.3x and exceeds its fair ratio of 7.3x. This positions the stock at a premium and suggests there may be less margin for error if growth stalls. Does this premium signal confidence, or is it stretching expectations too far?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NETSTREIT Narrative

If you see the story differently or want to take a hands-on approach, you can analyze the data and craft your own perspective in just minutes, Do it your way

A great starting point for your NETSTREIT research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Unlock even more growth potential by using the Simply Wall Street Screener. Smart investors know that the real edge comes from finding the next opportunity before others do. Don’t let these standout ideas pass you by.

- Tap into high-yield opportunities by checking out these 19 dividend stocks with yields > 3%, offering strong income streams and robust financials for steady, reliable returns.

- Ride the AI wave and spot emerging leaders shaping tomorrow’s technology landscape with these 24 AI penny stocks.

- Amplify your go-big-or-go-home strategy through these 3568 penny stocks with strong financials, making waves with impressive fundamentals and untapped upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NETSTREIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NTST

NETSTREIT

An internally managed real estate investment trust (REIT) based in Dallas, Texas that specializes in acquiring single-tenant net lease retail properties nationwide.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives