- United States

- /

- Retail REITs

- /

- NYSE:NTST

How US$450 Million in New Term Loans Could Shape NETSTREIT's (NTST) Long-Term Growth Prospects

Reviewed by Sasha Jovanovic

- In September 2025, NETSTREIT Corp. announced the closing of US$450.0 million in additional term loan commitments and amendments to its credit facilities with several major banks, including PNC Bank, Wells Fargo, and Truist Bank, featuring both fully and partially hedged interest rates on newly established term loans.

- This significant financing, combined with a recent public equity offering, increases the company’s financial flexibility to fund future acquisition growth and has drawn positive attention from analysts due to improvements in portfolio quality and credit strength.

- We’ll now explore how this infusion of US$450.0 million in new term loan agreements may impact NETSTREIT’s long-term growth narrative and risk profile.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

NETSTREIT Investment Narrative Recap

Owning NETSTREIT typically means believing in the sustainable demand for essential retail real estate and the company's ability to drive rent growth through disciplined acquisitions and tenant selection. The recent US$450.0 million term loan closing enhances liquidity, potentially supporting near-term acquisition growth and portfolio expansion, but does not materially address the ongoing risks tied to tenant concentration in necessity retail or exposure to shifts in consumer behavior, which remain key concerns.

Among recent developments, the July 2025 public equity offering stands out as particularly relevant, as it combined with new debt financing to boost NETSTREIT’s access to capital for opportunistic acquisitions. With both initiatives in place, the company is better positioned to respond to attractive deal flow or defend against slowdowns in property transactions, now with improved balance sheet flexibility.

In contrast, investors should be aware that financial flexibility alone does not fully offset the impact of concentrated tenant exposure, especially if...

Read the full narrative on NETSTREIT (it's free!)

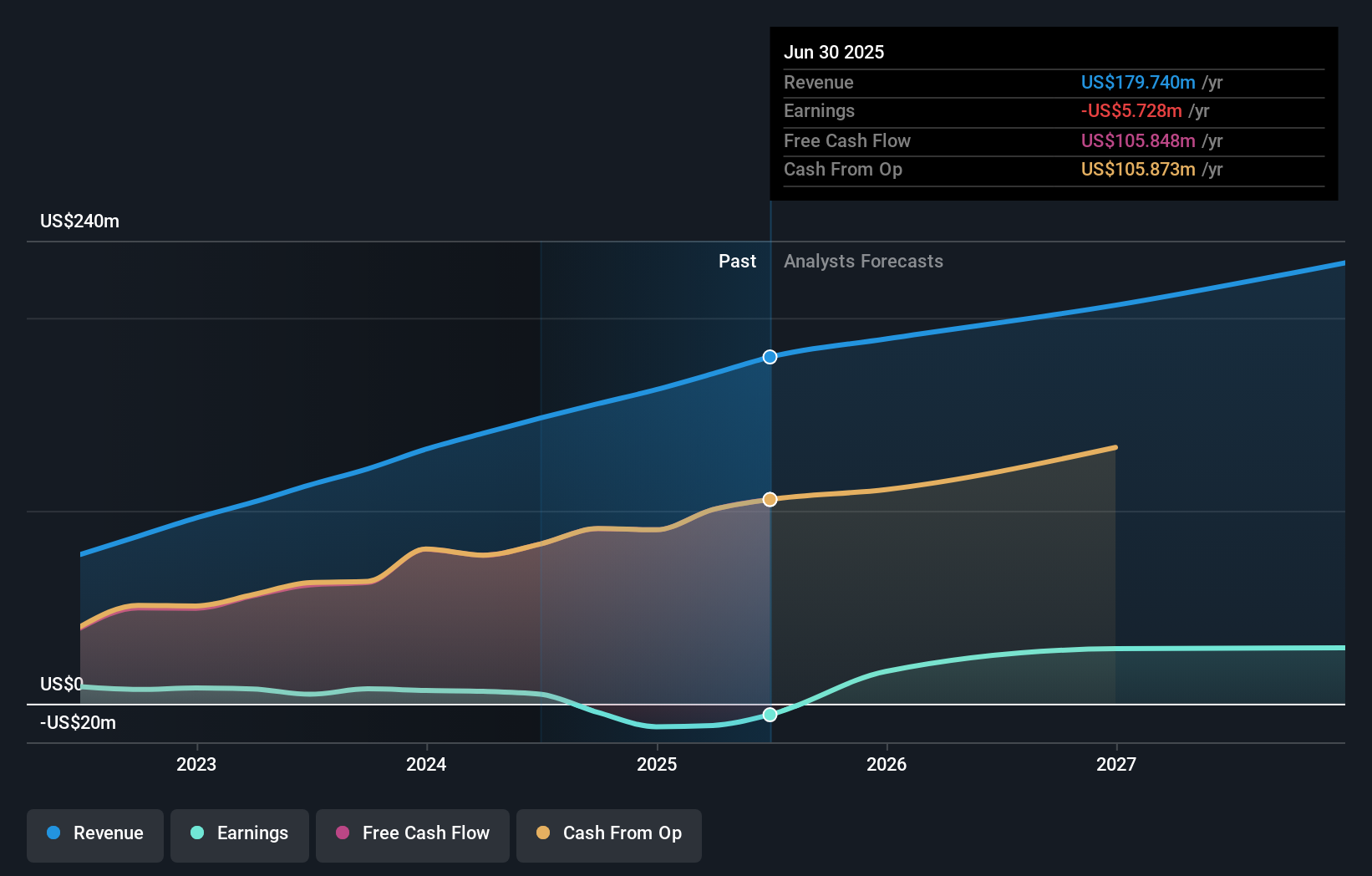

NETSTREIT's narrative projects $237.7 million revenue and $26.6 million earnings by 2028. This requires 9.8% yearly revenue growth and a $32.3 million earnings increase from -$5.7 million today.

Uncover how NETSTREIT's forecasts yield a $19.72 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community valued NETSTREIT between US$19.72 and US$42.13 per share, reflecting wide-ranging growth projections. Expectations for continued necessity-based retail demand remain central to long-term performance, so it makes sense to compare different assumptions and weigh several viewpoints.

Explore 2 other fair value estimates on NETSTREIT - why the stock might be worth over 2x more than the current price!

Build Your Own NETSTREIT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NETSTREIT research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NETSTREIT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NETSTREIT's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NETSTREIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NTST

NETSTREIT

An internally managed real estate investment trust (REIT) based in Dallas, Texas that specializes in acquiring single-tenant net lease retail properties nationwide.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives