- United States

- /

- Specialized REITs

- /

- NYSE:NSA

Does NSA's New IRE Venture Signal a Shift in Long-term Growth Strategy?

Reviewed by Sasha Jovanovic

- National Storage Affiliates Trust recently reported its third quarter 2025 financial results, reaffirmed its full-year earnings guidance with an expectation for total revenue growth between a 3% decline and a 2% decline, and announced a new joint venture with IRE aimed at deploying approximately US$350 million in value-add self storage investments.

- Despite year-over-year declines in revenue and net income, the company is focusing on long-term growth through significant capital commitments and expanded collaboration within targeted growth markets.

- With the reaffirmation of guidance alongside the new IRE joint venture, we'll explore how this dual focus shapes the company's evolving investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

National Storage Affiliates Trust Investment Narrative Recap

To be a shareholder in National Storage Affiliates Trust right now, you'd need to believe that its strategic moves, like reaffirming earnings guidance despite revenue declines and launching new joint ventures, will help offset current pressures such as declining occupancy, expense growth, and limited acquisition activity. The recent joint venture with IRE is a positive, but the reaffirmation of guidance implies the big picture hasn't fundamentally changed; interest rate and demand-driven risks remain the most important short-term catalysts and threats, with this news having only a moderate impact.

The newly announced joint venture with IRE stands out as highly relevant, NSA is committing significant capital to value-add self storage investments, which could lay the groundwork for future growth. While this potentially helps counterbalance slower acquisition activity and margin pressures, the new investment does not fundamentally change the present challenge of expense growth outpacing revenue gains.

On the other hand, investors should be aware that rising competition and expense pressures could mean the company's ability to sustain current dividends will depend on more than just...

Read the full narrative on National Storage Affiliates Trust (it's free!)

National Storage Affiliates Trust is projected to reach $801.6 million in revenue and $56.7 million in earnings by 2028. This implies an annual revenue growth rate of 2.6% and an increase in earnings of $9.3 million from the current $47.4 million.

Uncover how National Storage Affiliates Trust's forecasts yield a $33.77 fair value, a 15% upside to its current price.

Exploring Other Perspectives

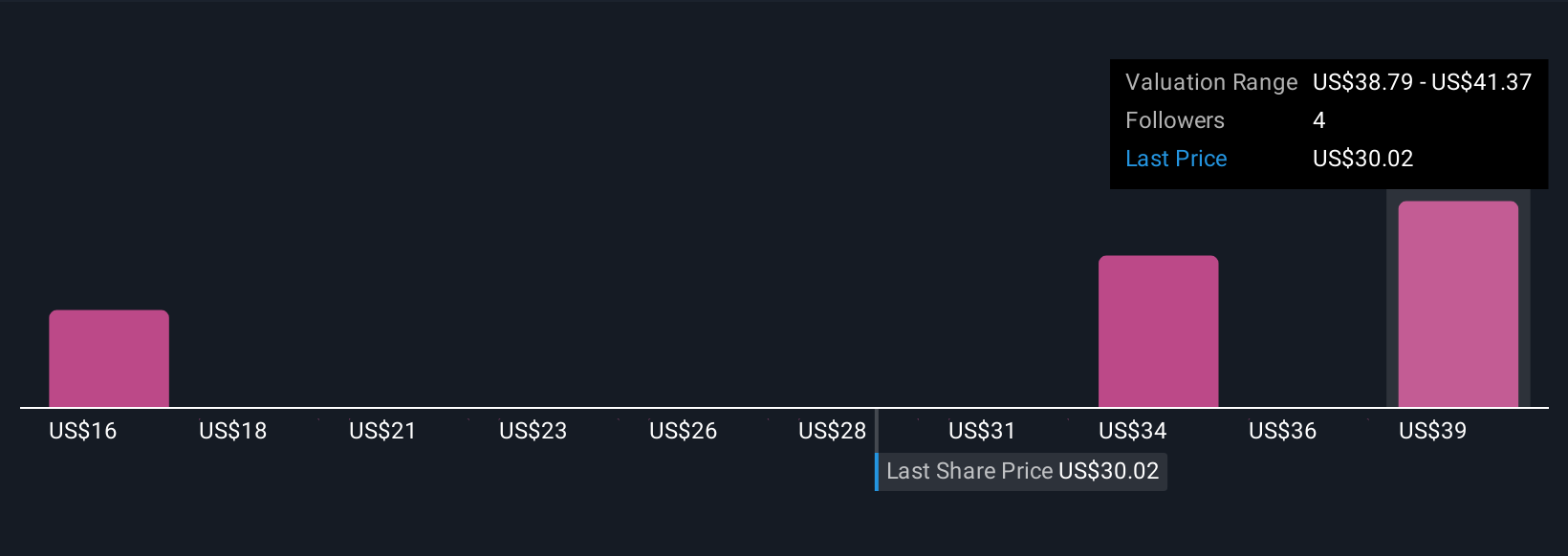

Four fair value estimates from the Simply Wall St Community span US$15.61 to US$41.18 per share, showing a wide range of views on NSA. While share price opinions diverge, concerns about persistent expense growth and margin compression continue to influence future expectations, compare these perspectives before making any conclusions.

Explore 4 other fair value estimates on National Storage Affiliates Trust - why the stock might be worth as much as 40% more than the current price!

Build Your Own National Storage Affiliates Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your National Storage Affiliates Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free National Storage Affiliates Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate National Storage Affiliates Trust's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Storage Affiliates Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NSA

National Storage Affiliates Trust

A real estate investment trust headquartered in Greenwood Village, Colorado, focused on the ownership, operation and acquisition of self-storage properties predominantly located within the top 100 metropolitan statistical areas throughout the United States.

6 star dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives