- United States

- /

- Health Care REITs

- /

- NYSE:NHI

Does NHI's New Unsecured Notes Issue Signal a Shift in Long-Term Capital Strategy?

Reviewed by Simply Wall St

- On September 22, 2025, National Health Investors, Inc. announced the issuance of fixed-rate senior unsubordinated unsecured notes as part of a new fixed-income offering, featuring guarantees and callability provisions.

- This type of corporate bond issuance can signal the company’s approach to managing capital costs and liquidity while shaping investor perceptions about future funding and balance sheet strength.

- We'll now consider how this fixed-income offering could influence National Health Investors’ future capital flexibility and investment thesis.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

National Health Investors Investment Narrative Recap

To be a shareholder in National Health Investors, you need to believe in the long-term growth of senior housing, supported by aging demographics and sustained demand for healthcare real estate. The recent issuance of fixed-rate senior unsecured notes could provide added flexibility for funding capital projects or acquisitions but is not likely to materially change the big short-term catalyst: capturing higher occupancy and margins in the SHOP portfolio; tenant concentration remains the biggest near-term risk and is largely unaffected by this offering.

Of the recent announcements, the earnings release in August confirmed revenue and net income growth, underpinning continued dividend payments. This context matters because the company’s ongoing ability to maintain balance sheet strength, as partly reflected in the bond issuance, will be important as it navigates both expansion initiatives and potential tenant challenges.

However, what might surprise some investors is that alongside solid financial results, the company’s vulnerability to disruptions among its largest tenants could prove more impactful than...

Read the full narrative on National Health Investors (it's free!)

National Health Investors' projections see revenues reaching $427.5 million and earnings climbing to $187.4 million by 2028. This outlook is based on anticipated annual revenue growth of 6.8% and a $44.6 million increase in earnings from the current $142.8 million level.

Uncover how National Health Investors' forecasts yield a $83.14 fair value, a 6% upside to its current price.

Exploring Other Perspectives

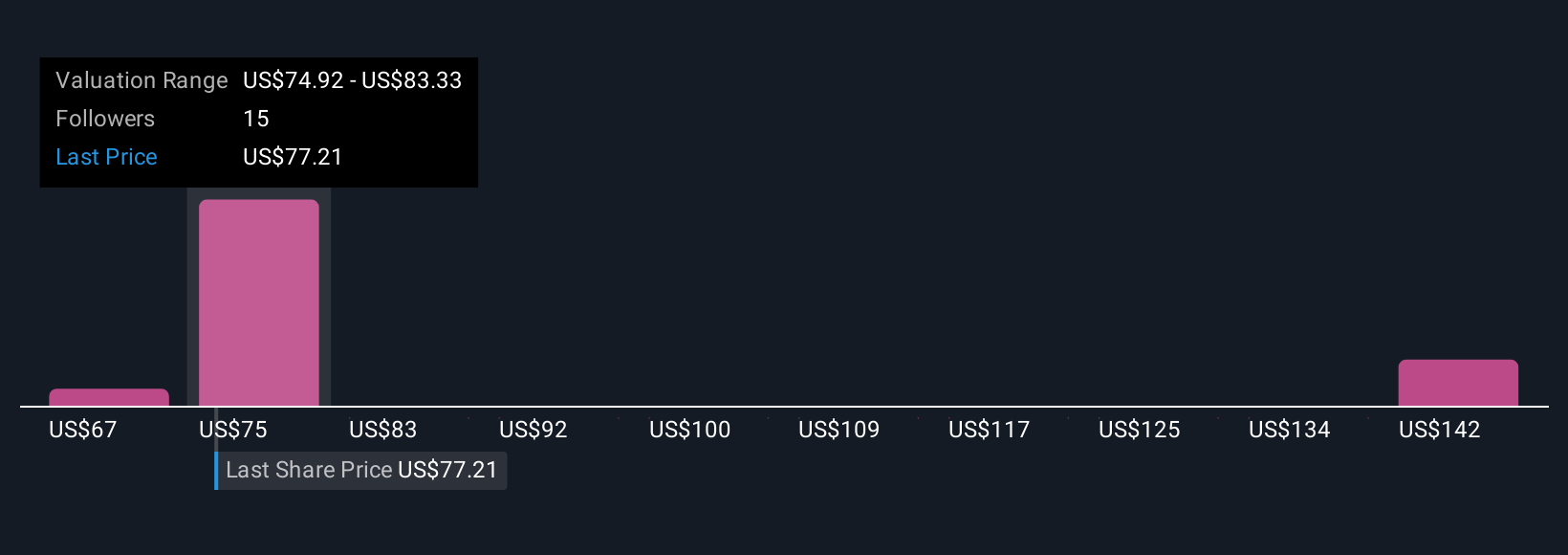

Five fair value estimates from the Simply Wall St Community range from US$66.50 to US$150.70, showing strong divergence. As investors weigh opportunities from NHI’s recent capital maneuvers, persistent tenant concentration risk could shape the company’s future cash flows and price moves.

Explore 5 other fair value estimates on National Health Investors - why the stock might be worth 15% less than the current price!

Build Your Own National Health Investors Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your National Health Investors research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free National Health Investors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate National Health Investors' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Health Investors might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NHI

National Health Investors

Incorporated in 1991, National Health Investors, Inc.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives