- United States

- /

- Health Care REITs

- /

- NYSE:NHI

A Look at National Health Investors (NHI) Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

National Health Investors (NHI) has seen its shares drift higher recently, with a modest gain of 1% today and more momentum over the past week. Investors are watching how the company’s longer-term performance holds up as market conditions continue to change.

See our latest analysis for National Health Investors.

National Health Investors has built up some positive momentum this year, with the share price recently settling at $75.52 and the 1-year total shareholder return reaching 3.8%. While the past 90 days showed a notable lift, taking the three- and five-year total returns to over 60% and 86% respectively, investors remain tuned in for any shifts as the broader real estate landscape evolves.

If you’re interested in expanding your search beyond healthcare real estate, now is a great time to discover fast growing stocks with high insider ownership.

With shares trading just below their analyst target and recent momentum on its side, the big question now is whether National Health Investors is undervalued or if the market has already accounted for its future growth potential.

Most Popular Narrative: 9.2% Undervalued

National Health Investors closed at $75.52, while the most widely followed narrative sets its fair value higher and suggests room for continued gains if these assumptions play out as expected. Investor focus is turning to the key factors powering this difference in outlook.

“Continued strategic shift towards outpatient and post-acute care is promoting demand for the types of facilities in NHI's portfolio. This trend is enhancing tenant stability and offering greater potential for long-term earnings and rent escalations.”

Curious how analysts reach a bullish fair value above today's price? The growth gameplan centers on ambitious revenue expansion, improved profit margins, and a high future profit multiple. Explore which assumptions could propel shares well above their peer group.

Result: Fair Value of $83.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing integration risks and concentrated tenant exposure could quickly erode margins or disrupt the earnings trajectory if challenges intensify.

Find out about the key risks to this National Health Investors narrative.

Another View: Value Signals Point in Opposite Directions

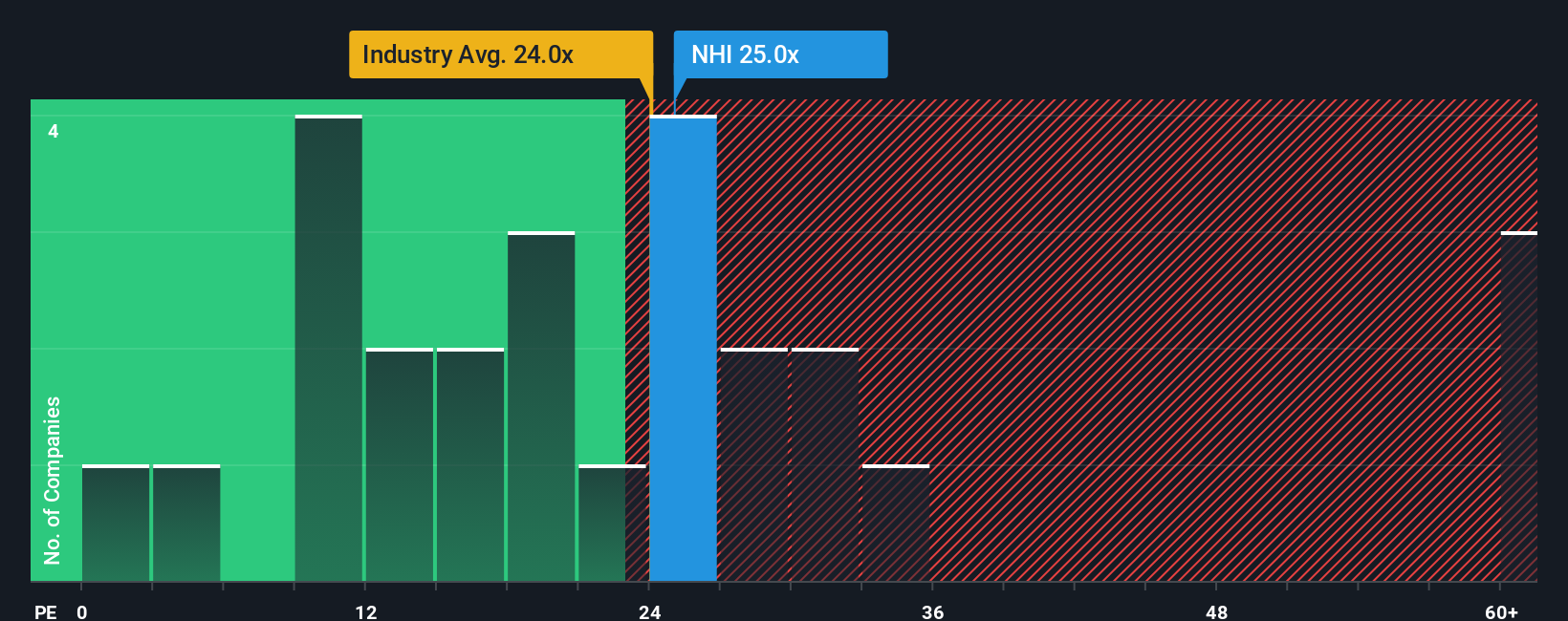

Looking at valuation through the lens of earnings multiples, National Health Investors appears expensive compared to the global health care REITs industry, trading at 25.1x earnings versus the industry’s 24.5x. However, when set against its peer average of 28.2x and an estimated fair ratio of 34.4x, NHI looks attractively priced. This split between market, peer, and fair ratios shapes a real opportunity or risk. Which valuation narrative holds more weight for investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own National Health Investors Narrative

If you see things differently or want to dig into the numbers firsthand, it's quick and easy to build your own perspective on National Health Investors in just a few minutes. Do it your way.

A great starting point for your National Health Investors research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t just stop with National Health Investors. Make sure you’re in the best position possible by finding stocks that match your goals with the Simply Wall St Screener.

- Unlock stable passive income streams by reviewing these 17 dividend stocks with yields > 3% with attractive yields and a track record of strong returns.

- Target undervalued opportunities early and maximize potential gains by checking out these 871 undervalued stocks based on cash flows that industry insiders are watching closely.

- Ride the next big wave in healthcare tech as you explore these 33 healthcare AI stocks pushing the boundaries of medicine and patient care.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Health Investors might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NHI

National Health Investors

Incorporated in 1991, National Health Investors, Inc.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives