- United States

- /

- Health Care REITs

- /

- NYSE:MPW

Reassessing Medical Properties Trust (MPW): Is the Recent Share Price Rebound Backed by Value?

Reviewed by Simply Wall St

Medical Properties Trust (MPW) has quietly staged a comeback, with the stock up about 10% over the past month and roughly 18% in the past 3 months, drawing fresh attention from income-focused investors.

See our latest analysis for Medical Properties Trust.

Zooming out, that recent strength comes after a bruising few years, with the share price still well below prior highs even as the year to date share price return tops 30% and the 1 year total shareholder return now comfortably positive. This hints that investors are reassessing the risk profile as asset sales progress and liquidity fears ease.

If MPW’s rebound has you rethinking the space, it could be a good moment to explore other healthcare stocks that might offer a similar mix of income potential and defensiveness.

But with Medical Properties Trust still trading far below its long term highs despite a sharp rebound and signs of stabilizing fundamentals, is this a genuine value opportunity for new capital or has the market already priced in the recovery?

Most Popular Narrative: 6% Overvalued

With Medical Properties Trust last closing at $5.45 against a narrative fair value of $5.14, the most widely followed view now sees only modest downside and a tighter margin of safety.

The analysts have a consensus price target of $4.857 for Medical Properties Trust based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $6.0, and the most bearish reporting a price target of just $4.0.

It is not immediately clear how a loss making REIT is modeled to achieve solid profitability, richer margins and a premium future earnings multiple, all under an 11.76% discount rate. The moving parts behind that turnaround story are not obvious from the headline numbers.

Result: Fair Value of $5.14 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering tenant concentration and elevated refinancing costs still threaten earnings stability and could quickly undermine the current recovery narrative.

Find out about the key risks to this Medical Properties Trust narrative.

Another Angle on Value

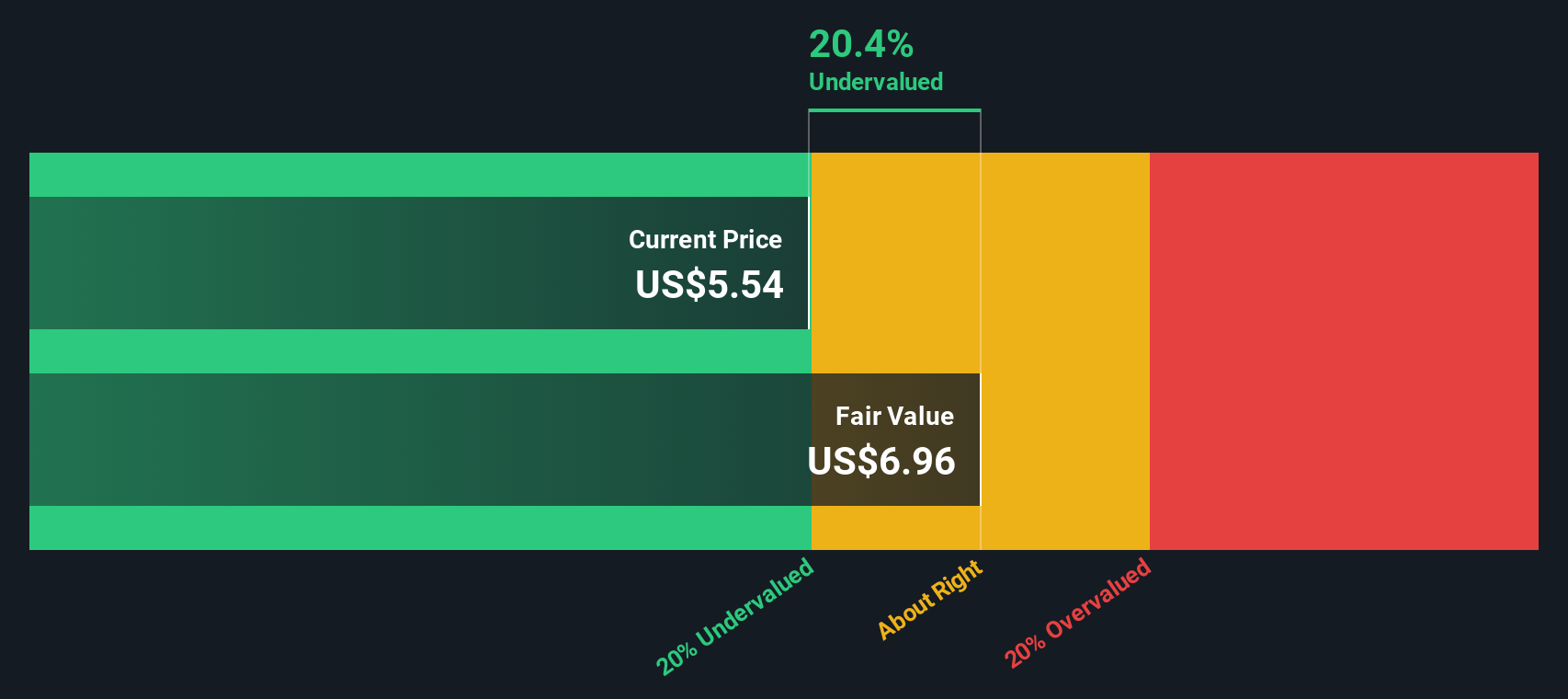

While the analyst driven fair value suggests modest overvaluation, our SWS DCF model points the other way, indicating MPW trades about 24% below its estimated intrinsic value. If cash flows do stabilize as expected, is the current price quietly offering a margin of safety?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Medical Properties Trust Narrative

If you see the story differently and prefer to dig into the numbers yourself, you can craft a personalized view in just a few minutes: Do it your way.

A great starting point for your Medical Properties Trust research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If MPW has sharpened your interest in opportunity and risk, do not stop here. The right screener could surface your next market beating idea.

- Capture potential mispricings early by targeting companies flagged as undervalued through these 896 undervalued stocks based on cash flows, grounded in projected cash flows rather than hype.

- Position your portfolio for structural growth by zeroing in on innovation leaders using these 27 AI penny stocks at the forefront of applied artificial intelligence.

- Strengthen your income stream by focusing on consistent payers via these 15 dividend stocks with yields > 3% that combine yield with resilient business fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MPW

Medical Properties Trust

A self-advised real estate investment trust formed in 2003 to acquire and develop net-leased hospital facilities.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026