- United States

- /

- Health Care REITs

- /

- NYSE:MPW

Medical Properties Trust (MPW) Rises 5.4% on New Lease Deal and Dividend—Has the Turnaround Arrived?

Reviewed by Simply Wall St

- Medical Properties Trust recently announced a $45 million annual lease agreement with NOR Healthcare Systems Corp., committed up to $60 million for seismic improvements, and confirmed shareholders will receive an $0.08 per share dividend after the September 11 ex-dividend date.

- These initiatives, combined with upward analyst revisions and stability in earnings expectations, have contributed to renewed optimism about the company’s direction and ability to sustain investor returns.

- We'll examine how the new NOR Healthcare lease and capital improvements affect Medical Properties Trust's investment outlook and risk profile.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Medical Properties Trust Investment Narrative Recap

Being a shareholder in Medical Properties Trust requires confidence in the company’s ability to stabilize rental income by quickly re-tenanting hospital assets formerly leased to financially troubled operators. The recent NOR Healthcare lease and capital improvements offer a revenue boost but do not materially reduce the main risks, which remain tenant credit reliability and the impact of distressed asset sales on earnings and margins in the near term.

The NOR lease agreement stands out in current news flow, bringing in $45 million in annual rent and up to $60 million in planned seismic improvements. While this increases immediate revenue potential, analysts still flag that the ability of new and existing tenants to consistently meet rent obligations is a key variable influencing short-term business momentum.

By contrast, the real source of uncertainty for investors remains the company’s exposure to incremental asset impairments and below-book-value property sales, which ...

Read the full narrative on Medical Properties Trust (it's free!)

Medical Properties Trust's outlook estimates $1.1 billion in revenue and $136.7 million in earnings by 2028. This implies annual revenue growth of 3.1% and an earnings increase of about $1.54 billion from current earnings of -$1.4 billion.

Uncover how Medical Properties Trust's forecasts yield a $4.86 fair value, in line with its current price.

Exploring Other Perspectives

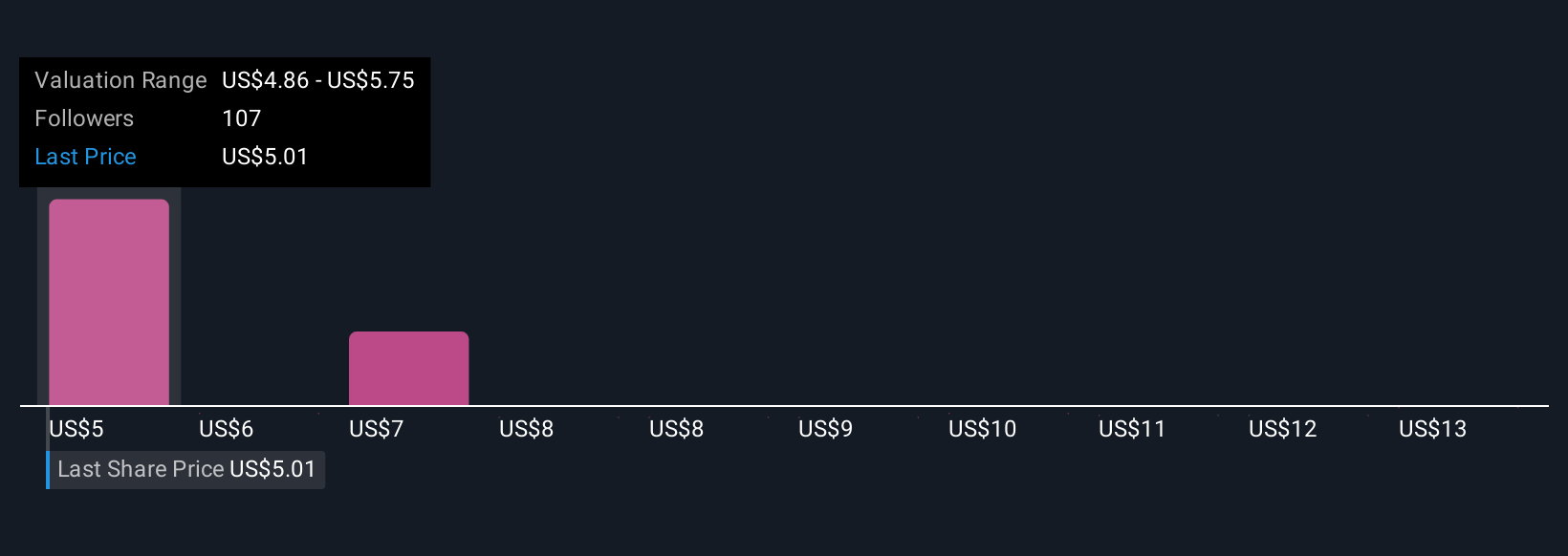

Thirteen fair value estimates from the Simply Wall St Community place Medical Properties Trust’s worth anywhere from US$4.86 to US$13.75 per share. While these private investor views differ widely, ongoing tenant concentration and credit risks may weigh on the company’s ability to achieve consistent earnings recovery. Explore additional viewpoints to see how market participants weigh these risks.

Explore 13 other fair value estimates on Medical Properties Trust - why the stock might be worth just $4.86!

Build Your Own Medical Properties Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Medical Properties Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Medical Properties Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Medical Properties Trust's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MPW

Medical Properties Trust

A self-advised real estate investment trust formed in 2003 to acquire and develop net-leased hospital facilities.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives