- United States

- /

- Residential REITs

- /

- NYSE:MAA

Does MAA’s Share Price Drop Signal Opportunity Amid 2025 REIT Market Changes?

Reviewed by Bailey Pemberton

Wondering what to do with your shares of Mid-America Apartment Communities? You are not alone. The stock has captured investors' attention, not just because it operates one of the country's largest multifamily real estate portfolios, but also thanks to its recent price activity. Over the last week, shares slipped by 2.1%, adding to a 6.0% decline over the past month. Year to date, the stock is down 10.3%, and compared to this time last year, it is still off 8.0%. Yet, looking further out, the numbers creep upward. The stock is up 6.0% over three years and 31.1% over five years, suggesting some resilience in a turbulent market environment.

The backdrop is that the real estate investment trust sector has been sensitive to shifting interest rates and broader market developments, making every move of this stock particularly noteworthy. But what about value? Based on our latest analysis, Mid-America Apartment Communities earns a value score of 4 out of 6. In other words, it ticks 4 of the 6 major undervaluation checks. That sets the stage for a closer look at what those numbers really mean for investors like you.

Let us break down the different ways analysts approach valuation so you can see where Mid-America Apartment Communities stands. Even better, we will wrap up with an approach that ties it all together in a way regular investors can actually use.

Approach 1: Mid-America Apartment Communities Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model forecasts the company’s future adjusted funds from operations and discounts those expected cash flows back to today’s value. This offers a data-driven estimate of intrinsic value that looks beyond headline profit numbers.

For Mid-America Apartment Communities, the current Free Cash Flow over the last twelve months is $952.76 Million. Analyst forecasts suggest this will steadily rise, with expected Free Cash Flow reaching $1.14 Billion by 2029. Further projections (extrapolated by Simply Wall St) show this growth trend continuing through 2035. These forecasts are based on a two-stage model that uses detailed analyst inputs for the next five years and then extends projections further out at reasonable growth rates.

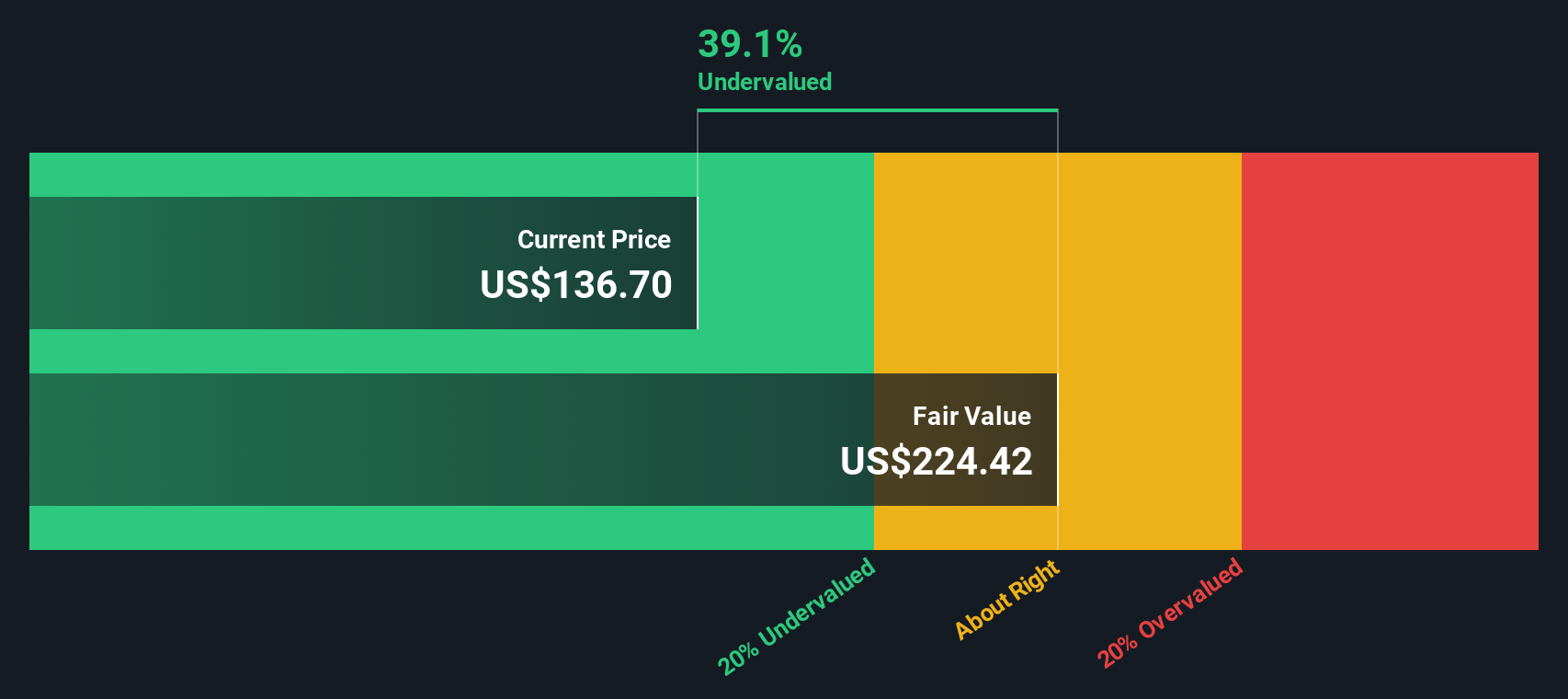

After crunching the numbers, the DCF model calculates a fair value for the shares of $224.42. Compared to the current share price, this estimate implies the stock is trading at a 39.1% discount to its intrinsic value, indicating meaningful undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Mid-America Apartment Communities is undervalued by 39.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Mid-America Apartment Communities Price vs Earnings

For profitable companies like Mid-America Apartment Communities, the Price-to-Earnings (PE) ratio is often the preferred valuation metric. It reflects how much investors are willing to pay today for each dollar of a company’s earnings, making it a direct gauge of profitability. Fundamentally, what counts as a “normal” or “fair” PE ratio depends on growth expectations and perceived risk. Faster-growing, more stable companies typically command higher PE ratios because investors expect earnings to rise in the future. In contrast, risk or slow growth can pull the preferred ratio lower.

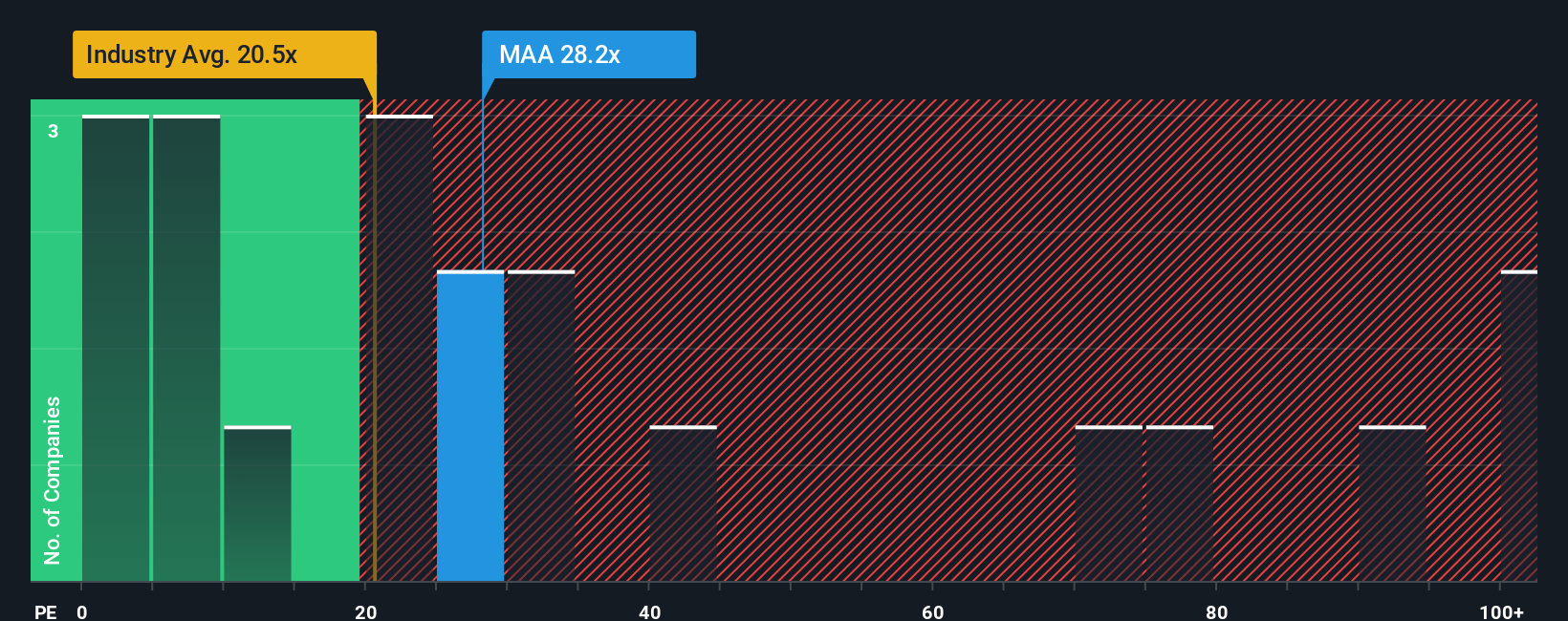

Mid-America Apartment Communities’ current PE ratio sits at 28.18x. For context, this is notably higher than the Residential REITs industry average of 20.5x and falls well below the peer group average of 52.9x. However, just comparing multiples only tells part of the story.

That is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio, here calculated at 28.98x, adjusts for more than just earnings. It incorporates growth outlook, profit margins, risk factors, industry positioning and the company’s size. This leads to a more tailored benchmark for what’s reasonable, rather than relying solely on broad industry or peer group comparisons.

With a current PE of 28.18x versus a Fair Ratio of 28.98x, Mid-America Apartment Communities is trading almost exactly in line with its calculated fair value. The difference is less than 0.10, so by this measure, the stock’s valuation is about right.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Mid-America Apartment Communities Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal story or perspective about a company, connecting what you believe will happen to its revenue, earnings, and profit margins, and allowing you to estimate your own fair value for the stock. This approach goes beyond the numbers by linking your investment thesis to a financial forecast and, ultimately, to a fair value you can compare to the market price.

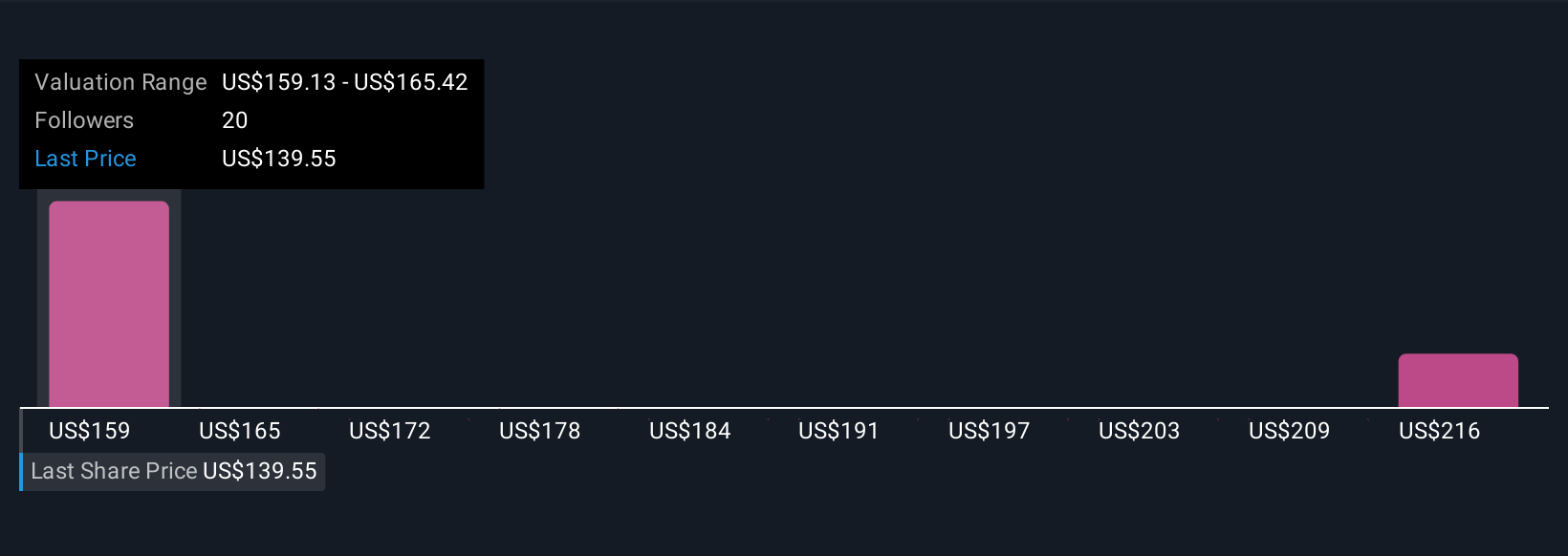

Narratives are easy to create and use on Simply Wall St’s Community page, where millions of investors share their views. They help you decide when to buy or sell by tracking how your fair value stacks up against the current share price. Your Narrative updates automatically when new data or news is released. For example, one Mid-America Apartment Communities Narrative projects strong benefit from tight Sun Belt supply and sees a fair value of $176.00. Another, more cautious Narrative expects risks from new supply and margin pressures, estimating fair value as low as $142.00. Narratives empower you to choose the story that fits your outlook and make clearer, more confident investment decisions.

Do you think there's more to the story for Mid-America Apartment Communities? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MAA

Mid-America Apartment Communities

MAA, an S&P 500 company, is a real estate investment trust (REIT) focused on delivering full-cycle and superior investment performance for shareholders through the ownership, management, acquisition, development and redevelopment of quality apartment communities primarily in the Southeast, Southwest and Mid-Atlantic regions of the United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives