- United States

- /

- Industrial REITs

- /

- NYSE:LXP

LXP Industrial Trust (LXP): Assessing Valuation After Strategic Asset Sales and Debt Reduction Moves

Reviewed by Kshitija Bhandaru

LXP Industrial Trust (LXP) has just wrapped up the sale of two vacant development projects, generating approximately $151 million in net proceeds from a transaction priced well above book value. This fresh capital is already being put to use as the company launches a tender offer targeting a portion of its outstanding 6.750% notes due 2028.

See our latest analysis for LXP Industrial Trust.

LXP’s sale of development properties and the new debt tender offer seem to be giving the stock a fresh narrative. After a relatively muted period, momentum is gradually returning, as reflected in both its recent share price gains and a modest 1-year total shareholder return of 0.02%. With strategic moves like these, investors appear to be recalibrating growth expectations and adjusting risk perceptions.

If you’re interested in what else is capturing investor attention right now, consider expanding your horizons and discover fast growing stocks with high insider ownership

With recent strategic moves putting cash on the balance sheet and momentum returning to the share price, the big question is whether LXP Industrial Trust is now undervalued or if the market already reflects its improved outlook. Could this be a buying opportunity, or has future growth been priced in?

Most Popular Narrative: 9.4% Undervalued

The most followed analyst narrative sees LXP’s fair value at $10.33, implying a moderate upside from its last close at $9.36. This view is shaped by expectations that LXP’s strategy and sector momentum can fuel stronger long-term cash flow, despite short-term uncertainties.

LXP’s focused capital recycling and portfolio repositioning toward high-quality, Class A, single-tenant facilities in supply-constrained, business-friendly states position the company to benefit from favorable supply-demand dynamics. This could translate to sustained net margin expansion and improved earnings quality.

Curious what bold assumptions underpin this valuation upgrade? Discover the growth forecasts, margin bets, and the surprising profit projections that power this narrative's fair value. There are details that even industry veterans might not expect.

Result: Fair Value of $10.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated exposure to single-tenant assets and potential challenges in re-leasing large spaces could pressure LXP’s margins if demand unexpectedly weakens.

Find out about the key risks to this LXP Industrial Trust narrative.

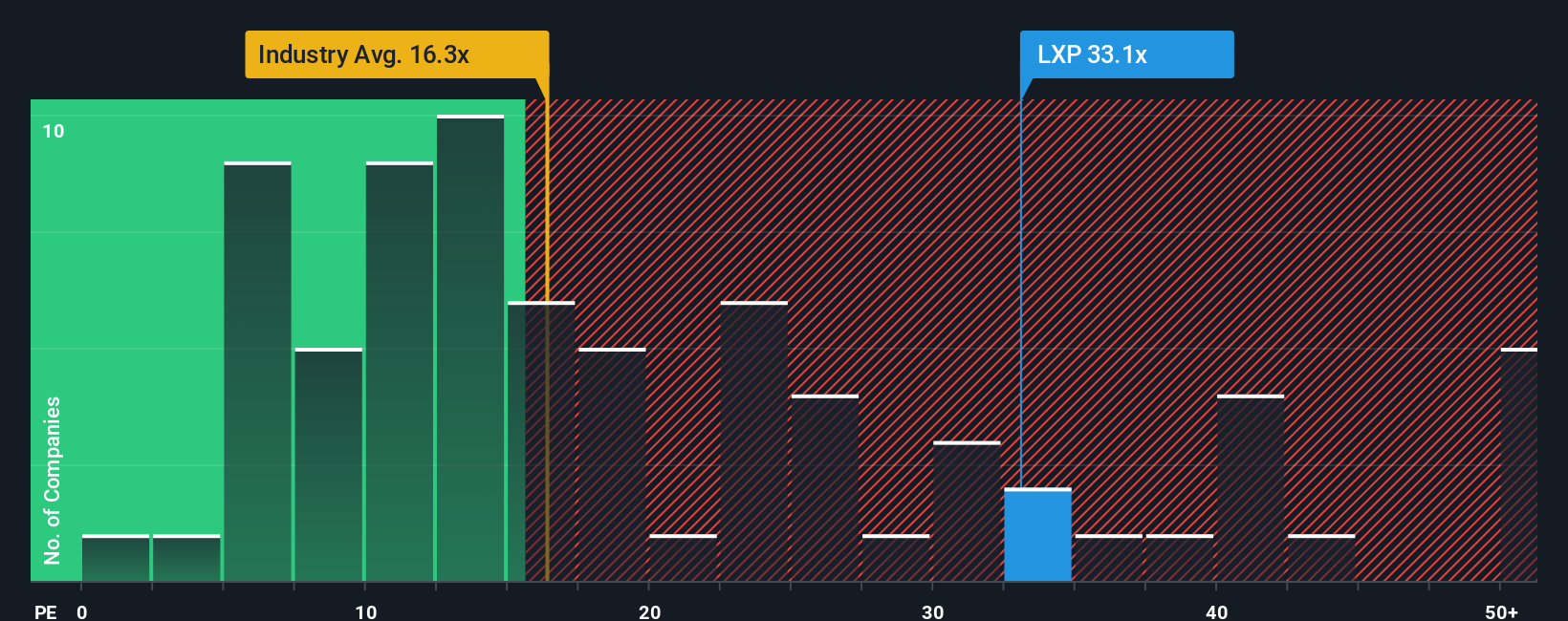

Another View: Mind the Price Tag

Looking through the lens of earnings multiples, LXP appears pricey. Its current price-to-earnings ratio is 34.3x, which is almost double the global Industrial REITs average of 16.7x and much higher than its peer average of 18.4x. Compared to the fair ratio of 10.7x, there is a significant premium. This suggests the market is already assigning a lot of value to future expectations. Could this optimism be overdone, or is there something the market knows that the numbers do not?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LXP Industrial Trust Narrative

If you have a different perspective or want to evaluate the facts for yourself, you can craft your own view in just a few minutes. Do it your way

A great starting point for your LXP Industrial Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead and step up your investing game by checking out sectors bursting with potential. If you miss these, you could be passing up tomorrow’s biggest winners.

- Unlock high-yield opportunities and get a jump on the latest trends by checking out these 19 dividend stocks with yields > 3% with consistently strong payouts and reliable performance.

- Catch the momentum behind market disruption by scanning these 24 AI penny stocks shaping artificial intelligence’s next wave of growth and innovation.

- Spot undervalued gems before the crowd by browsing these 896 undervalued stocks based on cash flows offering strong fundamentals and attractive valuations others might overlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LXP

LXP Industrial Trust

LXP Industrial Trust (NYSE: LXP) is a publicly traded real estate investment trust (REIT) focused on Class A warehouse and distribution investments in 12 target markets across the Sunbelt and lower Midwest.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives