- United States

- /

- Industrial REITs

- /

- NYSE:LXP

LXP Industrial Trust (LXP): Assessing Valuation After $140 Million 2028 Note Repurchase Announcement

Reviewed by Simply Wall St

LXP Industrial Trust (LXP) is moving forward with a significant step in its debt management strategy, announcing the purchase of $140 million worth of its 2028 notes after demand at the early tender deadline exceeded the company’s cap.

See our latest analysis for LXP Industrial Trust.

With shares of LXP Industrial Trust climbing over 16% in the past three months and showing a year-to-date share price return of 21.1%, investors have taken notice as management executes bold moves like the recent debt buyback. Over the longer term, the real estate trust’s total shareholder return stands at nearly 20% across five years. Recent price action suggests momentum is building as confidence in LXP’s financial strategy grows.

If this kind of strategic shift has you searching for more potential movers, now is an excellent moment to broaden your perspectives and discover fast growing stocks with high insider ownership

With shares outperforming the market and a sizable discount to some valuation metrics, the question is whether LXP Industrial Trust remains undervalued or if recent gains mean future growth is already reflected in the price.

Most Popular Narrative: 6.1% Undervalued

The most widely followed narrative sees fair value at $10.33, slightly above LXP Industrial Trust’s latest closing price of $9.70. This view weighs ongoing rental momentum and business strategy against looming pressures, priming investors for a deeper exploration of the company’s future trajectory.

“Continuous demand from e-commerce, 3PLs, and advanced manufacturers for modern, strategically located logistics facilities, especially in Sunbelt and Midwest markets benefiting from reshoring and supply chain reconfiguration, is supporting high occupancy (guidance of 97 to 99 percent) and robust leasing activity, likely driving steady revenue and NOI growth.”

Big expectations drive this value target. The forecast assumes booming rent growth, high occupancy, but also rapidly changing profit dynamics and a valuation multiple rarely seen outside booming industries. Which specific financial leaps and risks are analysts betting on to reach this price? Unlock the full narrative and see what’s fueling such ambitious projections.

Result: Fair Value of $10.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising vacancies from tenant consolidations or unexpected drops in market rents could quickly undermine optimistic earnings and revenue growth assumptions for LXP Industrial Trust.

Find out about the key risks to this LXP Industrial Trust narrative.

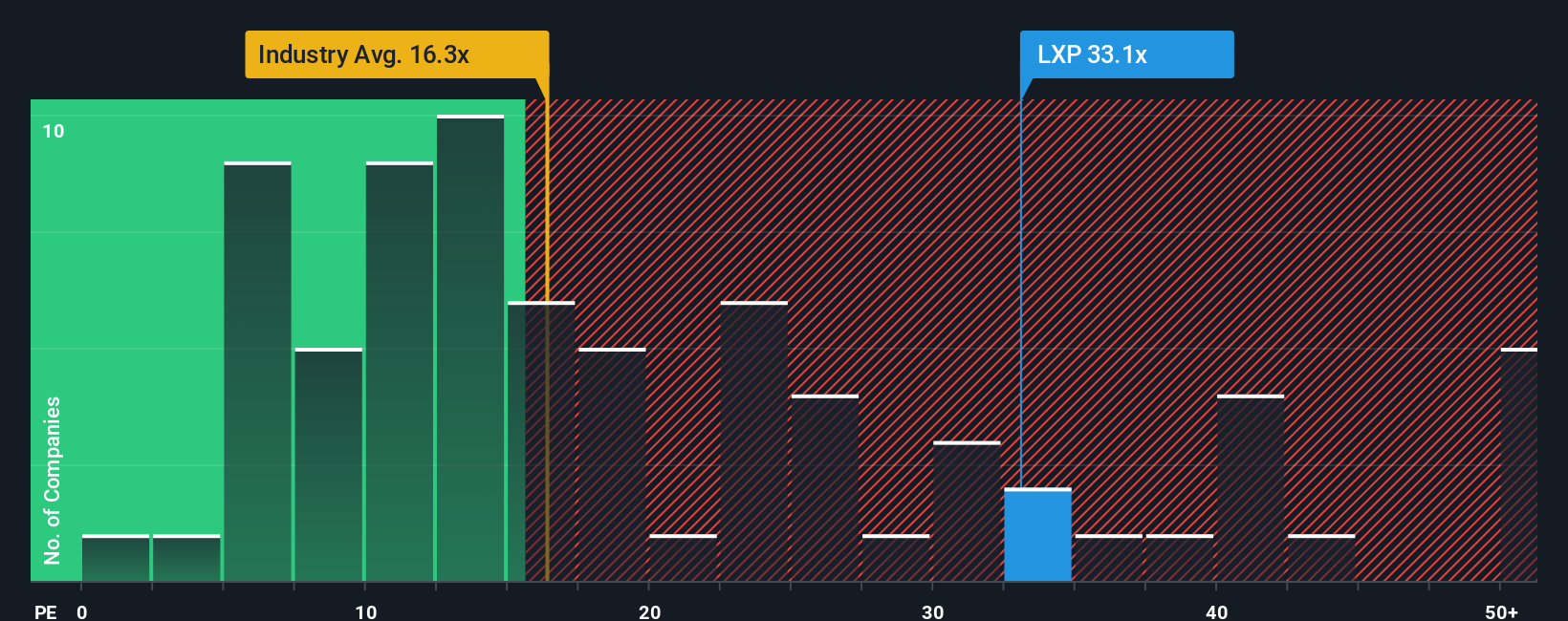

Another View: Multiples Suggest a Different Story

While many see LXP Industrial Trust as undervalued by fair value estimates, its current price-to-earnings ratio stands at 35.5x, well above the peer average of 20.4x and the fair ratio of 11.1x. This premium could signal optimism, but it also raises questions about whether today’s price already reflects future growth.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LXP Industrial Trust Narrative

If you see the story differently or want to dig deeper into the numbers yourself, you can shape your own perspective in just a few minutes. Do it your way

A great starting point for your LXP Industrial Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Opportunities in the market are constantly evolving, and smart investors know that casting a wider net is the key to finding the next big winner. Don’t watch from the sidelines while others capitalize on momentum. Expand your search with handpicked stock ideas using powerful filters tailored for growth, value, and innovation.

- Secure reliable income streams with these 17 dividend stocks with yields > 3% offering strong yields and the potential for steady performance even in changing markets.

- Tap into the next tech wave by screening for breakthroughs and rapid expansion among these 24 AI penny stocks at the forefront of artificial intelligence advancements.

- Boost your portfolio’s upside with smart picks from these 875 undervalued stocks based on cash flows that are currently trading below their intrinsic value based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LXP

LXP Industrial Trust

LXP Industrial Trust (NYSE: LXP) is a publicly traded real estate investment trust (REIT) focused on Class A warehouse and distribution investments in 12 target markets across the Sunbelt and lower Midwest.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives