- United States

- /

- Health Care REITs

- /

- NYSE:LTC

Will LTC Properties Rally in 2025 After Strong Recovery in Senior Housing Occupancy?

Reviewed by Bailey Pemberton

If you're staring at LTC Properties and wondering whether to hold, buy, or move on, you're definitely not alone. It is one of those stocks that keeps showing up on value investors’ radars, and for good reason. While the last week and month have been a bit soft with returns dipping -1.7%, LTC Properties has posted an impressive 7.1% climb over the past year and a nearly 39% gain over five years. That kind of long-term resilience has a way of grabbing attention, especially when broader market developments have been shadowed by uncertainty in the real estate sector.

The recent movements are interesting because they hint at something brewing beneath the surface. Despite modest short-term pullbacks, the market may be starting to reassess the risk profile for companies like LTC Properties as conditions in the senior housing and healthcare markets improve. Not all shifts are tied to splashy headlines, but investor sentiment seems to be evolving, with growth potential being recognized again after years of volatility in the space.

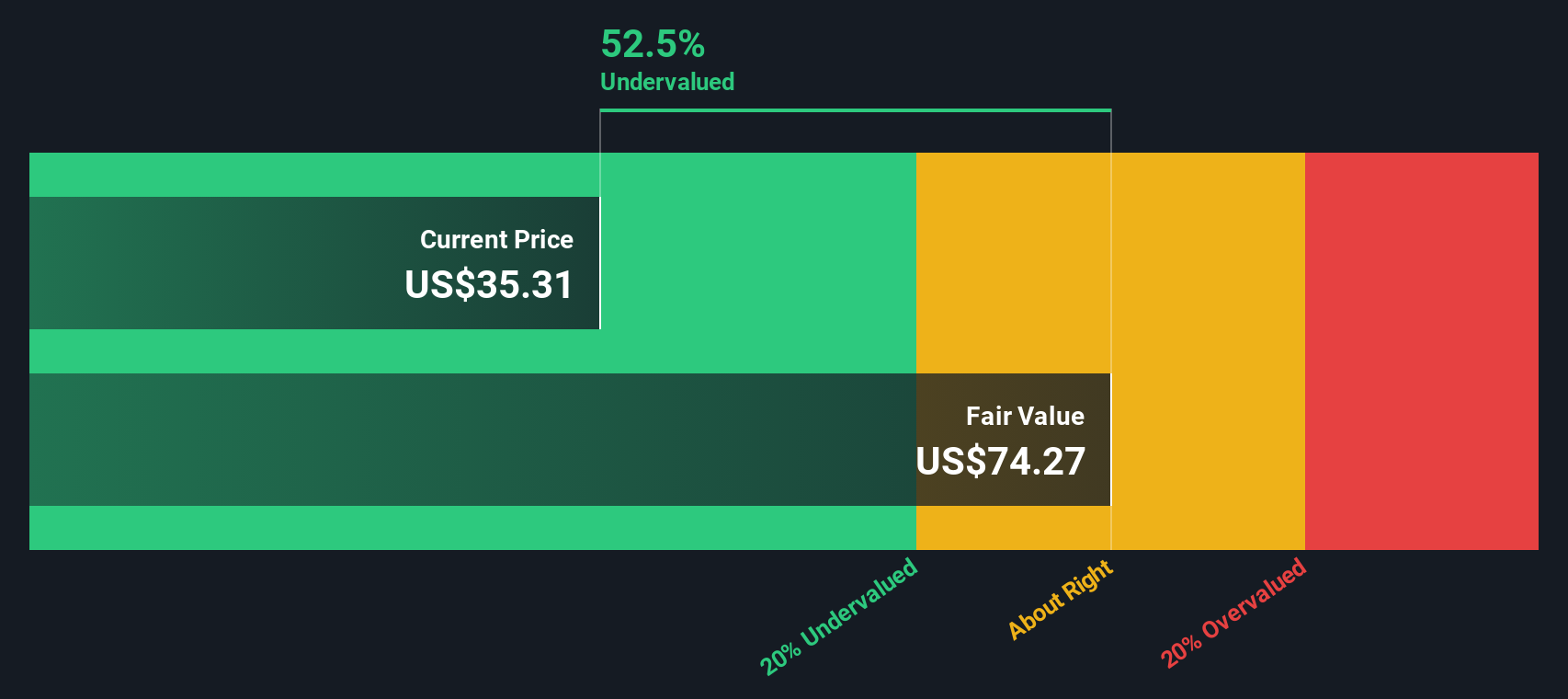

When we dig into the numbers, LTC Properties comes in with a valuation score of 5 out of 6. According to tried-and-tested valuation checks, it looks undervalued across the board except for one. It is a compelling setup, but numbers alone do not always tell the full story. Up next, we will look at the various valuation approaches investors use to judge whether LTC Properties is truly a bargain, before wrapping up with an even better way to put those scores into context.

Why LTC Properties is lagging behind its peers

Approach 1: LTC Properties Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular approach for estimating a stock’s intrinsic value by projecting the company’s future adjusted funds from operations and then discounting those cash flows back to their value today. For LTC Properties, this involves taking current free cash flow figures, applying expected growth rates, and accounting for the time value of money to determine what the business could be worth in the present.

LTC Properties has a current Free Cash Flow (FCF) of $123.43 Million. Over the next five years, analysts expect incremental growth in these cash flows, projecting them to rise to approximately $140 Million by 2028. Beyond this point, longer-term estimates are extrapolated, with FCF projections gradually increasing into the 2030s. All cash flows are considered in US dollars, and figures beyond the analyst forecast period are calculated using reasonable growth assumptions by Simply Wall St.

The result of this DCF analysis estimates LTC Properties’ intrinsic value at $61.83 per share. This suggests the stock is trading at roughly a 41.8% discount compared to its calculated fair value, indicating a solid margin of undervaluation at current levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests LTC Properties is undervalued by 41.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

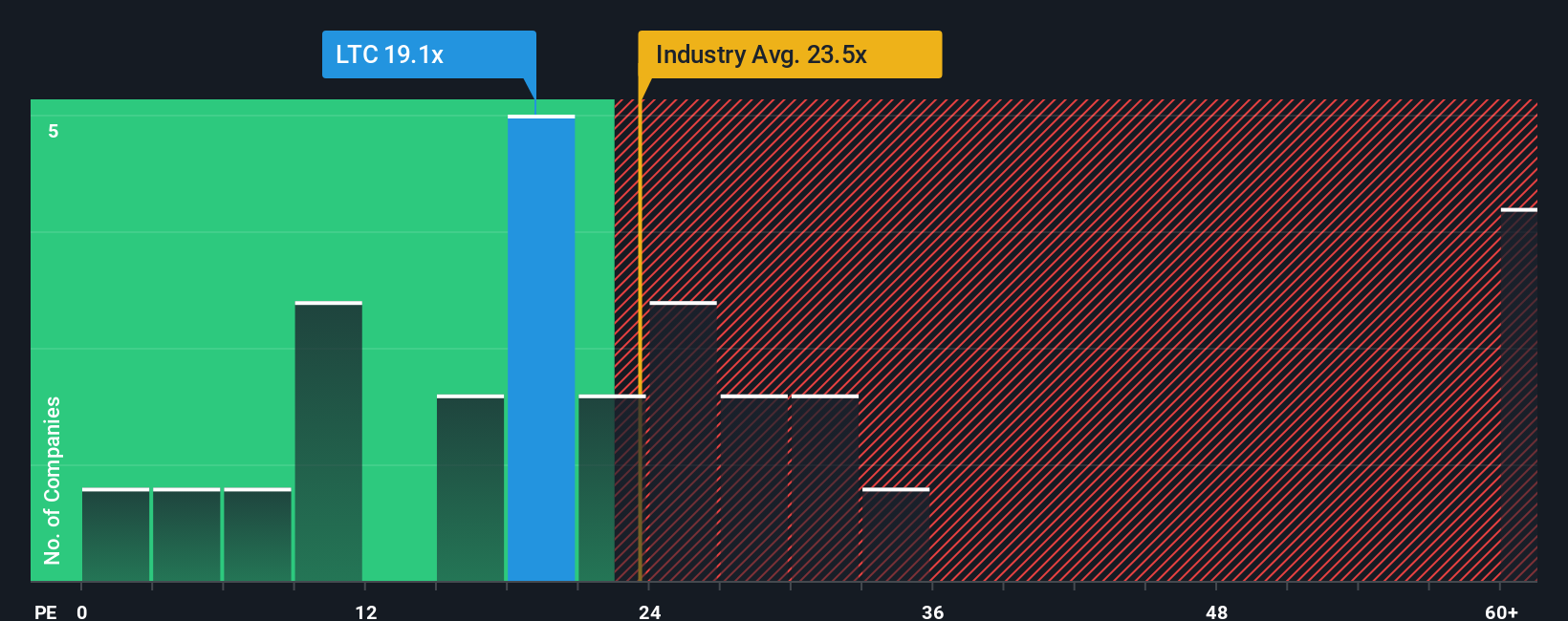

Approach 2: LTC Properties Price vs Earnings

The Price-to-Earnings (PE) ratio is a favored metric for valuing profitable companies such as LTC Properties because it directly relates a company’s share price to its earnings. It gives investors a sense of how much they are paying for each dollar of profit. The PE ratio works best for businesses with consistent profitability, offering a straightforward way to compare firms, industries, and historical valuations.

Growth expectations and perceived risk play a significant role in determining what a "normal" or "fair" PE ratio should be. Companies that deliver reliable earnings growth, or those seen as less risky, tend to command higher PE ratios, as investors are willing to pay a premium for future performance and financial stability. In sectors with more uncertainty or slower growth, the market typically assigns lower multipliers.

Currently, LTC Properties trades at a PE ratio of 20.1x. This is lower than the industry average of 24.3x and also below the average for its peers, which sits at 27.5x. On the surface, this suggests the stock is undervalued compared to its sector. However, Simply Wall St’s Fair Ratio model, built to account for LTC’s specific earnings outlook, profit margin, industry position, and risk profile, calculates a Fair PE of 33.4x. This holistic metric offers an improvement on peer comparisons, which can overlook company-specific strengths and weaknesses.

Given that LTC Properties’ actual PE is significantly lower than its Fair Ratio, the stock appears to be undervalued on this metric as well.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your LTC Properties Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about a company, your perspective on its future, including the numbers you believe in for fair value, future revenue, earnings, and profit margins. Narratives connect the dots between a company's story, your financial forecasts, and an estimate of what the stock should be worth, making the investment process personal and practical.

On Simply Wall St, Narratives are available right on the Community page, used by millions of investors to compare their views and update their thinking as new information arrives. Narratives help you decide when to buy or sell LTC Properties by showing how your Fair Value stacks up against the current share price. Because they update automatically with new earnings or news, your insights always stay current.

For example, some investors may build a Narrative for LTC Properties that expects rapid revenue growth and forecasts a target price as high as $43.00, while others might take a cautious view on industry headwinds and see fair value closer to $34.00. This showcases how Narratives reflect real investor conviction and help you make smarter, more personalized decisions.

Do you think there's more to the story for LTC Properties? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LTC

LTC Properties

LTC is a real estate investment trust (REIT) focused on seniors housing and health care properties, investing through RIDEA, triple-net leases, joint ventures, and structured finance solutions.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives