- United States

- /

- Health Care REITs

- /

- NYSE:LTC

Most Shareholders Will Probably Find That The CEO Compensation For LTC Properties, Inc. (NYSE:LTC) Is Reasonable

Despite positive share price growth of 16% for LTC Properties, Inc. (NYSE:LTC) over the last few years, earnings growth has been disappointing, which suggests something is amiss. Some of these issues will occupy shareholders' minds as the AGM rolls around on 27 May 2021. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

See our latest analysis for LTC Properties

Comparing LTC Properties, Inc.'s CEO Compensation With the industry

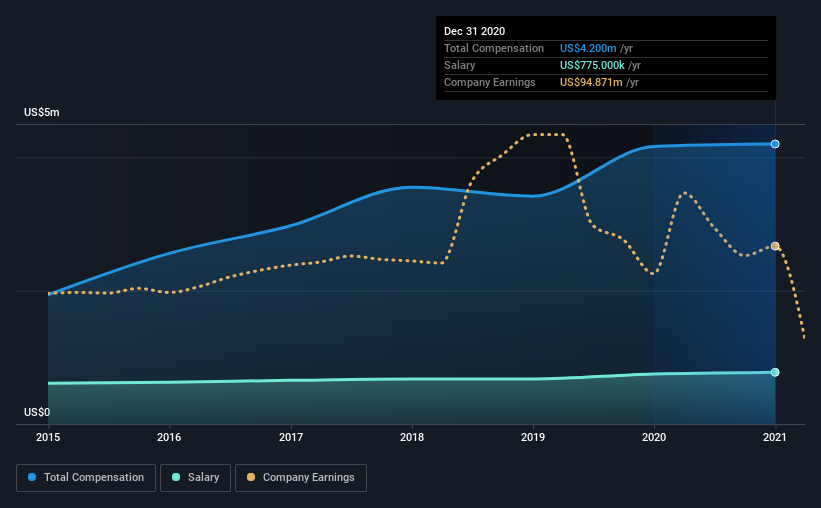

Our data indicates that LTC Properties, Inc. has a market capitalization of US$1.5b, and total annual CEO compensation was reported as US$4.2m for the year to December 2020. That's mostly flat as compared to the prior year's compensation. We think total compensation is more important but our data shows that the CEO salary is lower, at US$775k.

For comparison, other companies in the same industry with market capitalizations ranging between US$1.0b and US$3.2b had a median total CEO compensation of US$4.2m. This suggests that LTC Properties remunerates its CEO largely in line with the industry average. What's more, Wendy Simpson holds US$15m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$775k | US$750k | 18% |

| Other | US$3.4m | US$3.4m | 82% |

| Total Compensation | US$4.2m | US$4.2m | 100% |

On an industry level, roughly 15% of total compensation represents salary and 85% is other remuneration. According to our research, LTC Properties has allocated a higher percentage of pay to salary in comparison to the wider industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

LTC Properties, Inc.'s Growth

Over the last three years, LTC Properties, Inc. has shrunk its funds from operations (FFO) by 9.7% per year. In the last year, its revenue is down 18%.

Few shareholders would be pleased to read that FFO have declined. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has LTC Properties, Inc. Been A Good Investment?

LTC Properties, Inc. has generated a total shareholder return of 16% over three years, so most shareholders would be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

To Conclude...

Despite the positive returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about whether these returns will continue. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 3 warning signs for LTC Properties (of which 1 is significant!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading LTC Properties or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:LTC

LTC Properties

LTC is a real estate investment trust (REIT) focused on seniors housing and health care properties, investing through RIDEA, triple-net leases, joint ventures, and structured finance solutions.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives