- United States

- /

- Retail REITs

- /

- NYSE:IVT

InvenTrust Properties (IVT): Evaluating Valuation After Strategic Debt Extension and Rate Lock Moves

Reviewed by Simply Wall St

InvenTrust Properties (NYSE:IVT) has just wrapped up a series of moves that should catch the eye of anyone watching its balance sheet. The company extended the maturities on two major unsecured term loans, now reaching out to 2030 and 2031, and locked in new fixed rates through forward-starting swaps. For investors, this kind of refinancing supports greater flexibility, especially as InvenTrust continues to manage its real estate portfolio and long-term debt commitments. The timing also speaks to a capital strategy designed to weather changing economic conditions without unwanted surprises.

The news comes at a time when InvenTrust’s share price has shown modest but meaningful momentum, with a 9% gain over the past month and a nearly 4% return over the past three months. Over the last year, total return stands at just under 4%, suggesting a measured response to recent developments and shifting market sentiment. While its annual revenue has grown by 8%, net income has softened, signaling a company in transition rather than meteoric growth. Still, the market’s response to the refinancing hints that risk perceptions could be shifting for the better.

After this latest financial reset and the stock’s steady performance, the big question remains: is InvenTrust trading at a bargain with room to run, or is the market already factoring in the company’s next phase of growth?

Most Popular Narrative: 10.8% Undervalued

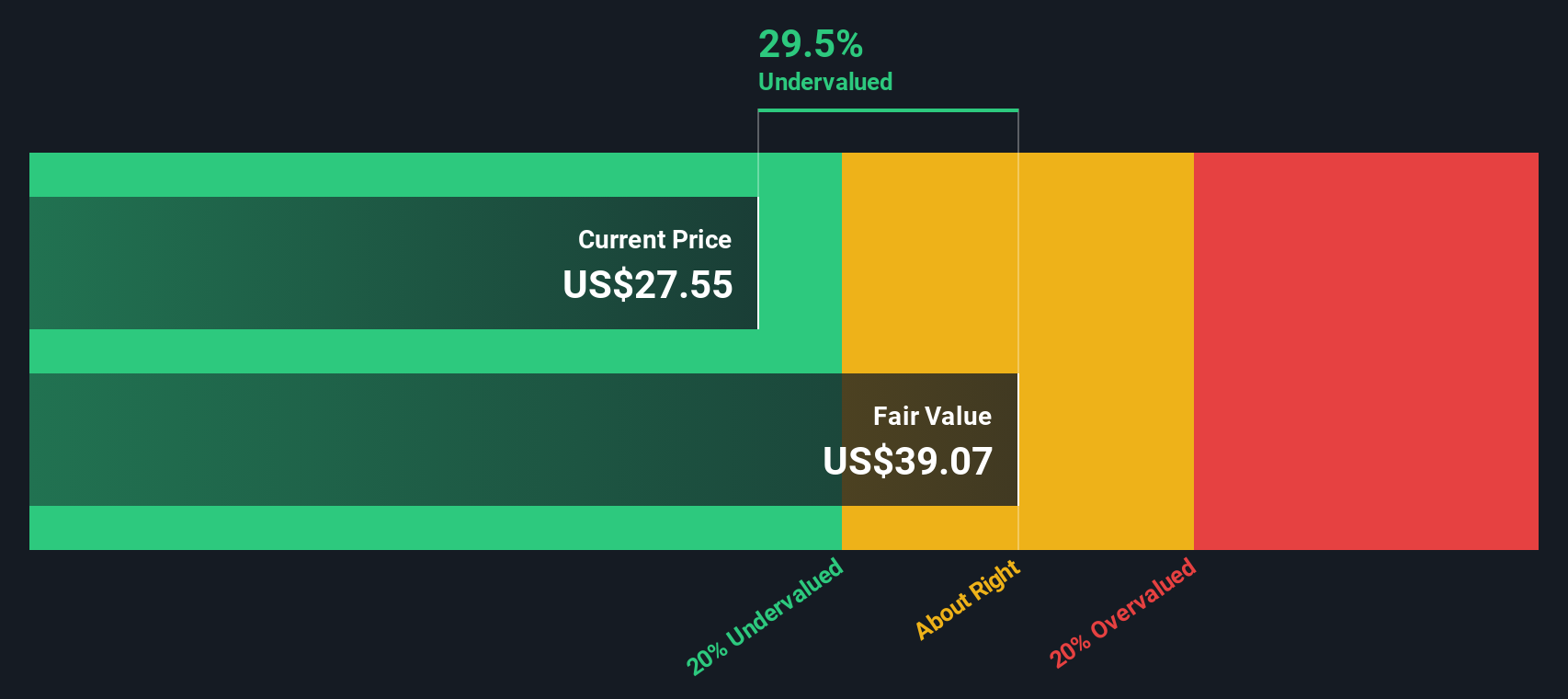

Analyst consensus suggests InvenTrust Properties is trading below its fair value, with the company currently priced at a discount compared to their estimated target price.

Strategic redeployment of capital into high-growth Sun Belt and Southeast markets is expected to drive above-peer rental growth and NOI expansion. This is due to favorable demographic trends and business-friendly environments, which should support higher revenues and long-term earnings growth.

Curious how analysts reach such an optimistic valuation? There is a daring set of projections at the heart of this narrative, combining bold growth ambitions and evolving profitability. Explore the unique mix of future earnings and financial multiples that underpin this discounted fair value, and see whether the numbers truly add up.

Result: Fair Value of $33.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, if Sun Belt demographics cool or competition for grocery-anchored assets intensifies, InvenTrust’s margin and income outlook could quickly change direction.

Find out about the key risks to this InvenTrust Properties narrative.Another View: DCF Tells a Similar Story

Looking through a different lens, our DCF model also suggests the market is underestimating InvenTrust’s intrinsic worth. But models rely on assumptions. Will the company’s real-world performance live up to the forecasts?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out InvenTrust Properties for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own InvenTrust Properties Narrative

If you have a different perspective or want to dig into the numbers yourself, you can easily craft your own story in just a few minutes. Do it your way

A great starting point for your InvenTrust Properties research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Winning Investment Ideas?

Stay ahead of the curve by tapping into a world of fresh opportunities. Miss this, and you could miss tomorrow’s breakout trends and hidden value gems.

- Uncover robust returns by tracking dividend stocks with yields > 3%, which offers yields above 3% for reliable income even in uncertain markets.

- Seize the tech edge with AI penny stocks as it fuels the next wave of artificial intelligence breakthroughs and transformative businesses.

- Scoop up undervalued potential before the crowd sees it by searching through undervalued stocks based on cash flows based on sustainable cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:IVT

InvenTrust Properties

InvenTrust Properties Corp. (the “Company,” "IVT," or "InvenTrust") is a premier Sun Belt, multi-tenant essential retail REIT that owns, leases, redevelops, acquires and manages grocery-anchored neighborhood and community centers as well as high-quality power centers that often have a grocery component.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives