- United States

- /

- Specialized REITs

- /

- NYSE:IRM

How Jefferies' Upgrade and Digital Focus Could Shape Iron Mountain’s (IRM) Long-Term Story

Reviewed by Sasha Jovanovic

- In late September, Jefferies upgraded Iron Mountain to a Buy rating, highlighting the company's accelerated shift toward asset lifecycle management, digital solutions, and data centers.

- An important insight is that growth in these new business segments is projected to account for nearly 44% of Iron Mountain’s revenue by 2029, as emphasized by Jefferies analysts.

- We’ll consider how analyst optimism about Iron Mountain’s digital and data center expansion could influence its long-term investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Iron Mountain Investment Narrative Recap

To be a shareholder in Iron Mountain today, you need confidence in its transition from a legacy records storage REIT to a hybrid of digital solutions and data center provider. The Jefferies upgrade spotlights this narrative, but it does not change that the most important near-term catalyst remains execution in digital and data centers, while elevated debt and interest costs are still the primary risk facing the business.

The September €1.2 billion senior note offering stands out as highly relevant, helping Iron Mountain refinance existing debt and preserve liquidity for capital-intensive digital and data center investments. Continued discipline around capital structure will be essential as the company expands its higher-growth segments, supporting what Jefferies identified as core to its long-term revenue mix.

On the other hand, investors should be alert to the risk that aggressive data center expansion could...

Read the full narrative on Iron Mountain (it's free!)

Iron Mountain's outlook anticipates $8.3 billion in revenue and $775.8 million in earnings by 2028. Achieving these targets would require annual revenue growth of 9.0% and an earnings increase of $734.5 million from the current earnings of $41.3 million.

Uncover how Iron Mountain's forecasts yield a $114.50 fair value, a 9% upside to its current price.

Exploring Other Perspectives

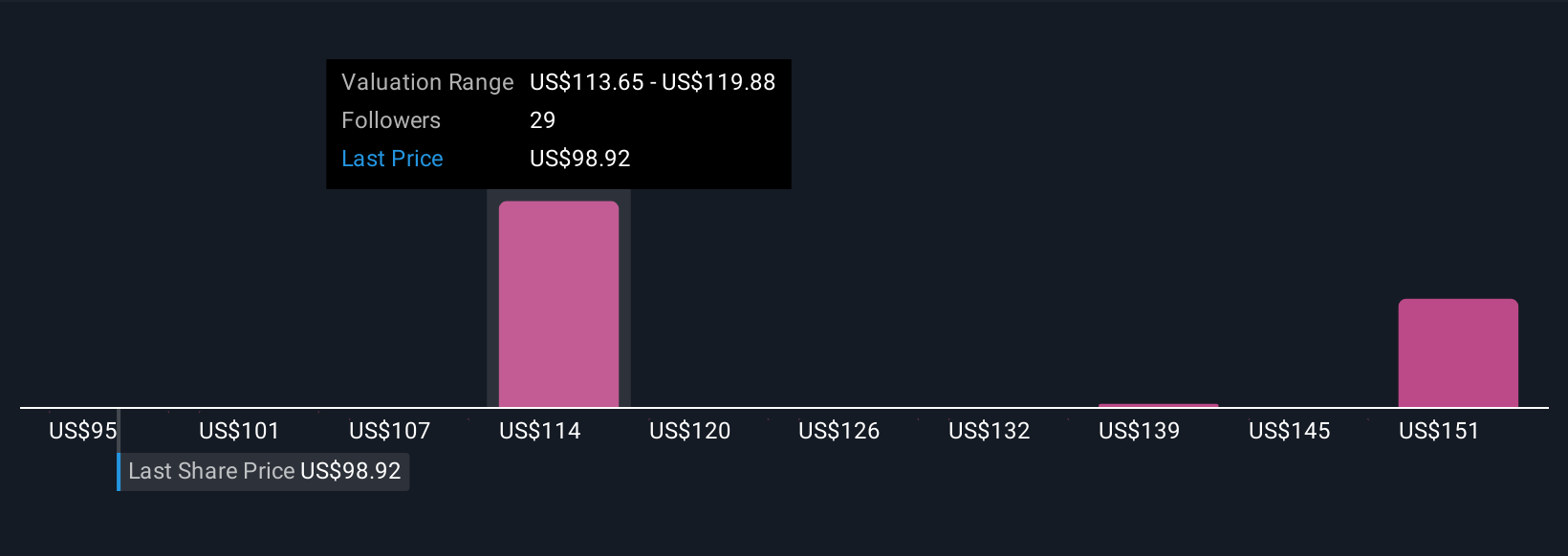

Six private investors in the Simply Wall St Community estimate Iron Mountain’s fair value to range from US$94.95 to US$158.37 per share. While digital and data centers are set to drive future performance, opinions differ widely on the outlook so be sure to consider several viewpoints yourself.

Explore 6 other fair value estimates on Iron Mountain - why the stock might be worth as much as 51% more than the current price!

Build Your Own Iron Mountain Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Iron Mountain research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Iron Mountain research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Iron Mountain's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 32 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IRM

Iron Mountain

Iron Mountain Incorporated (NYSE: IRM) is trusted by more than 240,000 customers in 61 countries, including approximately 95% of the Fortune 1000, to help unlock value and intelligence from their assets through services that transcend the physical and digital worlds.

Undervalued with moderate risk.

Similar Companies

Market Insights

Community Narratives