- United States

- /

- Residential REITs

- /

- NYSE:INVH

Here's Why I Think Invitation Homes (NYSE:INVH) Might Deserve Your Attention Today

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Invitation Homes (NYSE:INVH). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Invitation Homes

Invitation Homes's Improving Profits

In the last three years Invitation Homes's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. It's good to see that Invitation Homes's EPS have grown from US$0.32 to US$0.36 over twelve months. That's a 12% gain; respectable growth in the broader scheme of things.

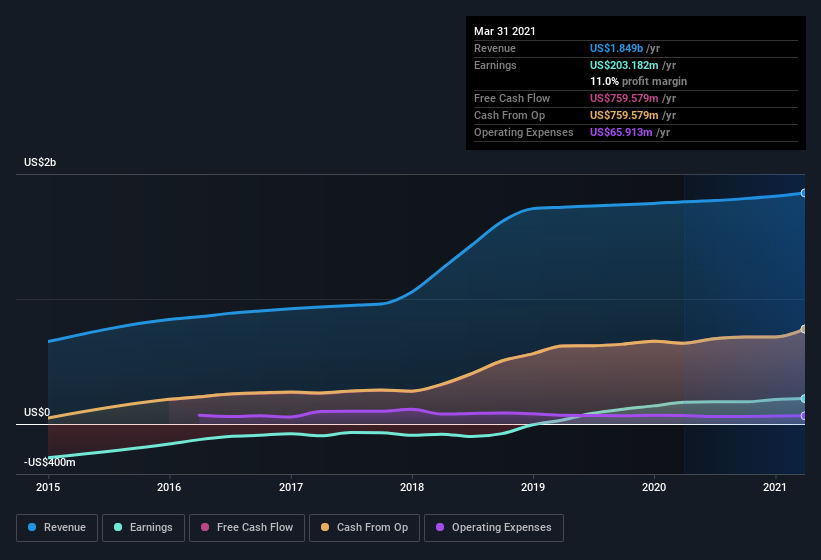

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Invitation Homes's EBIT margins were flat over the last year, revenue grew by a solid 3.9% to US$1.8b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Invitation Homes's future profits.

Are Invitation Homes Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a US$23b company like Invitation Homes. But we do take comfort from the fact that they are investors in the company. Given insiders own a small fortune of shares, currently valued at US$67m, they have plenty of motivation to push the business to succeed. That's certainly enough to make me think that management will be very focussed on long term growth.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, I'd say they are indeed. I discovered that the median total compensation for the CEOs of companies like Invitation Homes, with market caps over US$8.0b, is about US$11m.

The Invitation Homes CEO received total compensation of just US$5.5m in the year to . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Is Invitation Homes Worth Keeping An Eye On?

One positive for Invitation Homes is that it is growing EPS. That's nice to see. The fact that EPS is growing is a genuine positive for Invitation Homes, but the pretty picture gets better than that. With a meaningful level of insider ownership, and reasonable CEO pay, a reasonable mind might conclude that this is one stock worth watching. Don't forget that there may still be risks. For instance, we've identified 3 warning signs for Invitation Homes (1 can't be ignored) you should be aware of.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Invitation Homes, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:INVH

Invitation Homes

Invitation Homes, an S&P 500 company, is the nation’s premier single-family home leasing and management company, meeting changing lifestyle demands by providing access to high-quality, updated homes with valued features such as close proximity to jobs and access to good schools.

Fair value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives