- United States

- /

- Industrial REITs

- /

- NYSE:IIPR

Innovative Industrial Properties (NYSE:IIPR) Reports Q1 Earnings Drop, Completes US$20 Million Buyback

Reviewed by Simply Wall St

Innovative Industrial Properties (NYSE:IIPR) recently announced its Q1 2025 earnings, reporting declines in sales, revenue, and net income compared to the previous year, alongside the completion of a share buyback program. Over the past month, the company's stock price rose by 2.4%, a movement that aligns directionally with the broader market gains. The earnings decline might have added weight to the overall market trend, while the share repurchase could have provided some support. Despite various market influences, the company’s price movements remained broadly aligned with the market's overall trajectory.

Find companies with promising cash flow potential yet trading below their fair value.

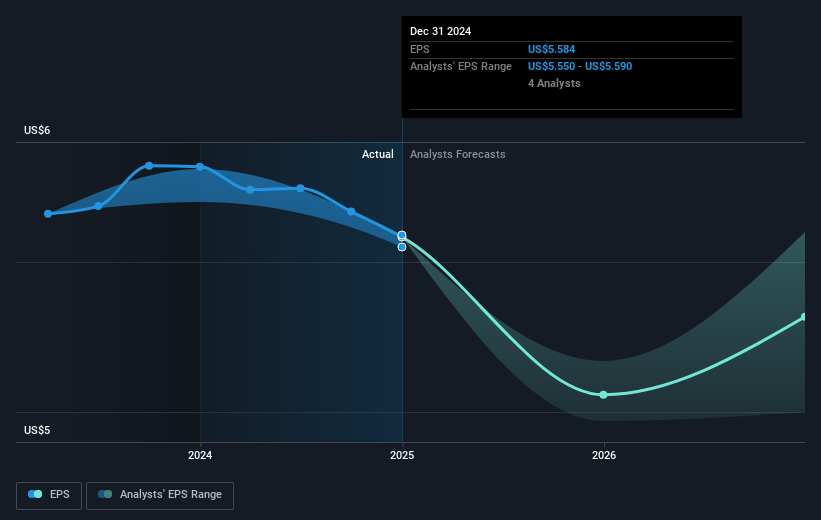

Innovative Industrial Properties' recent earnings report and share buyback announcement potentially influence the company's broader narrative, reflecting shifts in market dynamics and corporate strategy. The decline in sales, revenue, and net income may contribute to revised forecasts, aligning with analysts' expectations of a 6.2% annual revenue decrease and shrinking profit margins over the next three years. These developments could impact the company's ability to capitalize on potential cannabis market reforms and expansions, potentially challenging its revenue growth and earnings stability.

Over a five-year span, IIPR's total return, including dividends, was 3.19%, highlighting limited growth relative to the longer-term potential observed by analysts. In comparison, the company underperformed the US Industrial REITs industry in the past year, which posted a 4.4% decline, and additionally underperformed the broader US market that saw a 7.7% return. This uneven performance underscores the challenges faced by the company in the regulated cannabis market amidst broader economic factors and industry-specific risks.

The recent share price increase of 2.4%, while positive, remains below the consensus price target of US$67.0, indicating that analysts see potential for further appreciation. This target suggests a 21.3% potential upside from the current share price of US$52.75, assuming the company successfully navigates market conditions and capitalizes on future opportunities within the cannabis industry. The recent news, particularly the resumption of rent payments from PharmaCann and cannabis regulation prospects, may play critical roles in determining whether IIPR can achieve these growth targets and reach its projected fair value amid ongoing market challenges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IIPR

Innovative Industrial Properties

A real estate investment trust (REIT) focused on the acquisition, ownership and management of specialized industrial properties leased to experienced, state-licensed operators for their regulated cannabis facilities.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives