- United States

- /

- Industrial REITs

- /

- NYSE:IIPR

Does IIPR's Latest Dividend Declaration Reveal Steadfast Cash Flow or Mask Deeper Tenant Risks?

Reviewed by Simply Wall St

- Innovative Industrial Properties recently declared a third quarter 2025 dividend of US$1.90 per common share and a US$0.5625 quarterly dividend on its 9.00% Series A Cumulative Redeemable Preferred Stock, both payable to shareholders on October 15, 2025.

- This move affirms the company's ongoing commitment to shareholder returns even as the cannabis-sector REIT adapts to an evolving industry landscape.

- With the board reaffirming quarterly dividends, we'll explore how this signals confidence in cash flow amid sector and tenant headwinds.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Innovative Industrial Properties Investment Narrative Recap

To be a shareholder in Innovative Industrial Properties, you need to believe in the company's ability to sustain attractive dividends despite sector challenges and evolving revenue sources. The declaration of the third quarter 2025 dividend signals management’s ongoing confidence in cash flow, but this action does not materially change the immediate outlook for either the sector’s biggest risk, increasing tenant distress, or its main catalyst, ongoing portfolio diversification.

Among recent announcements, the Q2 2025 earnings report stands out, showing revenue and net income declines compared to the prior year. This result highlights the pressure from tenant issues within the cannabis sector, reinforcing the critical role of rent collections and the company’s ongoing strategic investments outside of cannabis as potential stabilizers. Yet, while dividends have been reaffirmed, investors should consider the risk that...

Read the full narrative on Innovative Industrial Properties (it's free!)

Innovative Industrial Properties is projected to reach $257.0 million in revenue and $105.7 million in earnings by 2028. This outlook is based on a forecasted annual revenue decline of 3.7% and a decrease of $26.2 million in earnings from the current $131.9 million.

Uncover how Innovative Industrial Properties' forecasts yield a $57.00 fair value, in line with its current price.

Exploring Other Perspectives

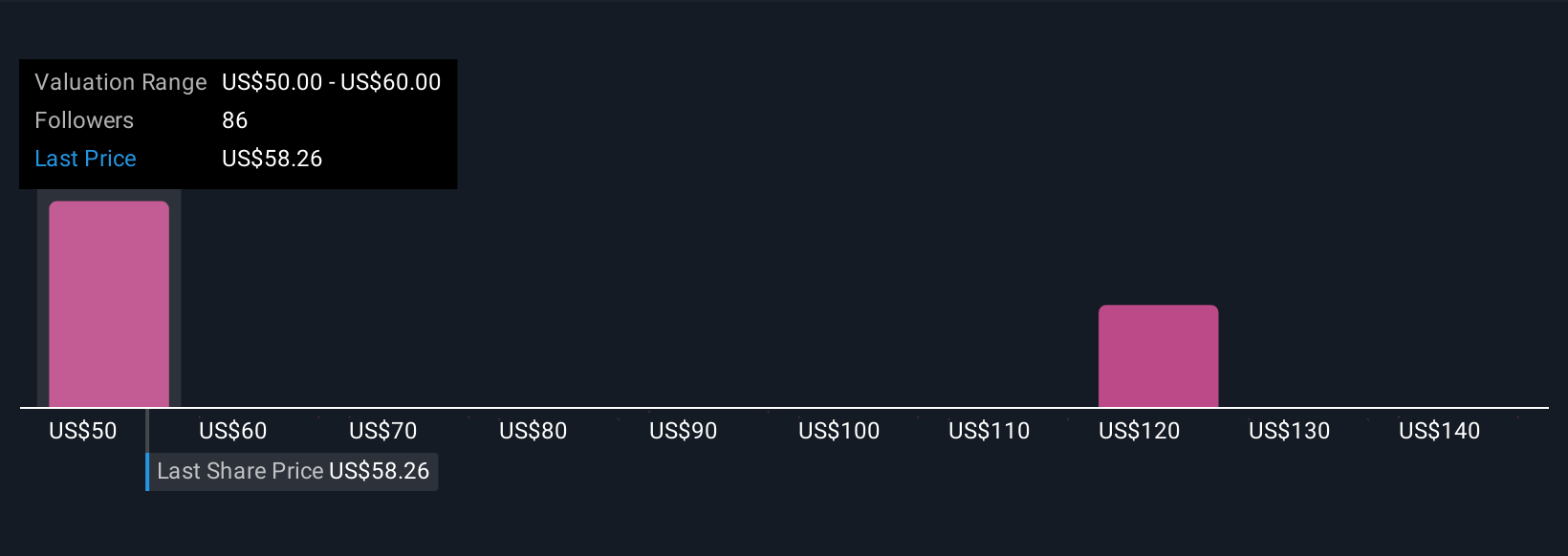

Fair value estimates from 11 Simply Wall St Community members range from US$50 to US$150 per share. While many see meaningful upside, concerns about tenant distress highlight that outcomes could still vary widely for shareholders.

Explore 11 other fair value estimates on Innovative Industrial Properties - why the stock might be worth over 2x more than the current price!

Build Your Own Innovative Industrial Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Innovative Industrial Properties research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Innovative Industrial Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Innovative Industrial Properties' overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IIPR

Innovative Industrial Properties

A real estate investment trust (REIT) focused on the acquisition, ownership and management of specialized industrial properties leased to experienced, state-licensed operators for their regulated cannabis facilities.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives