- United States

- /

- Banks

- /

- NasdaqGS:SHBI

Undervalued Small Caps With Insider Action In US For February 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it has seen a significant rise of 22% over the past year with earnings forecasted to grow by 15% annually. In this context, identifying small-cap stocks that are potentially undervalued and exhibit insider activity can be an intriguing strategy for investors looking to capitalize on emerging opportunities in a growing market.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| ProPetro Holding | NA | 0.6x | 27.75% | ★★★★★★ |

| PCB Bancorp | 11.1x | 2.9x | 35.83% | ★★★★★☆ |

| McEwen Mining | 4.3x | 2.2x | 43.87% | ★★★★★☆ |

| OptimizeRx | NA | 1.2x | 40.42% | ★★★★★☆ |

| Quanex Building Products | 28.5x | 0.7x | 45.26% | ★★★★☆☆ |

| German American Bancorp | 14.5x | 4.9x | 47.45% | ★★★☆☆☆ |

| Citizens & Northern | 12.6x | 3.1x | 44.02% | ★★★☆☆☆ |

| First United | 12.9x | 2.9x | 47.06% | ★★★☆☆☆ |

| ChromaDex | 283.0x | 4.6x | 34.56% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -71.44% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

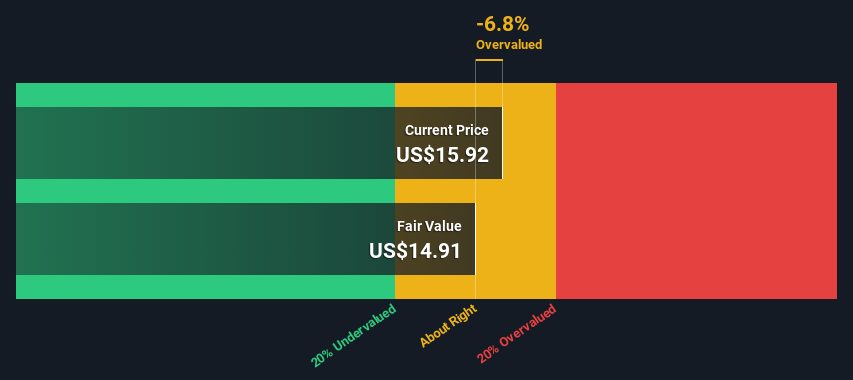

Citizens & Northern (NasdaqCM:CZNC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Citizens & Northern operates primarily in the community banking sector, providing financial services and solutions, with a market capitalization of approximately $0.47 billion.

Operations: The company generates revenue primarily through its community banking operations, with a recent quarterly revenue of $106.13 million. Operating expenses are a significant cost component, reaching $74.26 million in the latest period, while general and administrative expenses account for $60.35 million of this amount. The net income margin has shown variability over time, most recently recorded at 24.28%.

PE: 12.6x

Citizens & Northern, a smaller player in the financial sector, recently declared a quarterly dividend of US$0.28 per share, payable on February 14, 2025. Despite completing a minor buyback of 26,034 shares for US$0.44 million by December 2024, insider confidence remains evident with ongoing purchases throughout last year. Their earnings are projected to grow at an annual rate of 8.56%, supported by a low allowance for bad loans at 84%.

- Navigate through the intricacies of Citizens & Northern with our comprehensive valuation report here.

Understand Citizens & Northern's track record by examining our Past report.

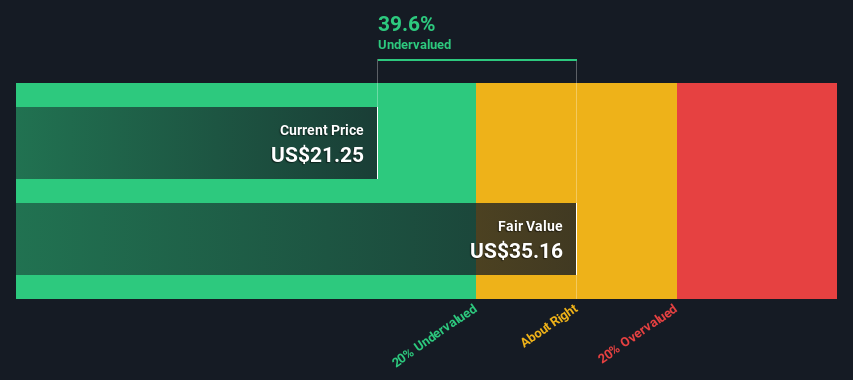

Shore Bancshares (NasdaqGS:SHBI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shore Bancshares operates as a community banking organization, providing financial services primarily through its network of branches, with a market capitalization of approximately $0.22 billion.

Operations: The company generates revenue primarily from community banking, with a recent figure of $196.96 million. It consistently achieves a gross profit margin of 100%, indicating that all revenue translates into gross profit. Operating expenses are significant, with general and administrative expenses reaching $99.45 million in the latest period. The net income margin has shown variability, recently recorded at 22.28%.

PE: 12.0x

Shore Bancshares, a smaller player in the financial sector, recently reported an increase in net income to US$13.28 million for Q4 2024 from US$10.49 million the previous year, reflecting strong earnings momentum. Insider confidence is evident with recent share purchases by company leaders. The company's earnings are projected to grow at 12.89% annually, suggesting potential for future expansion despite upcoming executive changes with their CFO retiring in August 2025 for personal reasons.

- Delve into the full analysis valuation report here for a deeper understanding of Shore Bancshares.

Examine Shore Bancshares' past performance report to understand how it has performed in the past.

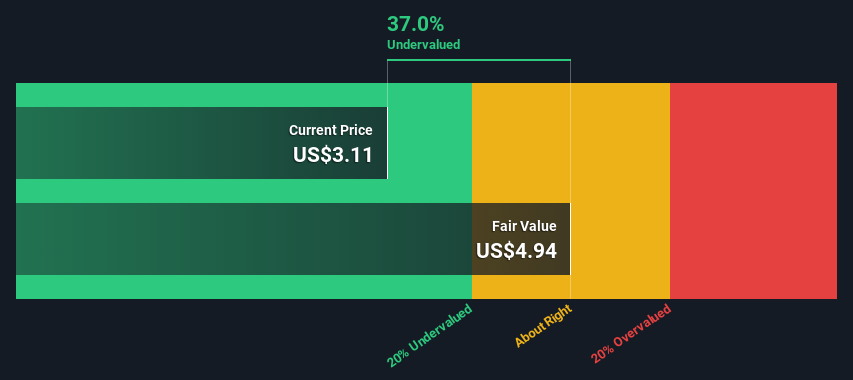

Hudson Pacific Properties (NYSE:HPP)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hudson Pacific Properties is a real estate investment trust that focuses on owning, operating, and developing office and studio properties, with a market capitalization of approximately $1.19 billion.

Operations: Hudson Pacific Properties generates revenue primarily from its Office and Studio segments, with the Office segment contributing significantly more. The company's cost of goods sold (COGS) has been increasing over time, impacting its gross profit margin, which recently stood at 46.18%. Operating expenses are substantial and include significant depreciation and amortization costs. The net income margin has shown a declining trend, reaching -34.82% in the most recent period analyzed.

PE: -1.5x

Hudson Pacific Properties, a smaller stock in the U.S. market, recently closed on selling a non-core Palo Alto office for US$24.8 million, using proceeds to reduce debt. Despite reporting a net loss of US$92.72 million for Q3 2024 and suspending common stock dividends, insider confidence is evident with Independent Director Barry Sholem purchasing 80,000 shares worth US$535,200. This activity suggests potential internal optimism despite current financial challenges and high volatility in share price over recent months.

Key Takeaways

- Unlock more gems! Our Undervalued US Small Caps With Insider Buying screener has unearthed 43 more companies for you to explore.Click here to unveil our expertly curated list of 46 Undervalued US Small Caps With Insider Buying.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHBI

Shore Bancshares

Operates as a bank holding company for the Shore United Bank, N.A.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives