- United States

- /

- Office REITs

- /

- NYSE:HIW

Here's Why We Think Highwoods Properties (NYSE:HIW) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Highwoods Properties (NYSE:HIW). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Highwoods Properties

Highwoods Properties's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. It's no surprise, then, that I like to invest in companies with EPS growth. As a tree reaches steadily for the sky, Highwoods Properties's EPS has grown 23% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While revenue is looking a bit flat, the good news is EBIT margins improved by 4.1 percentage points to 32%, in the last twelve months. That's something to smile about.

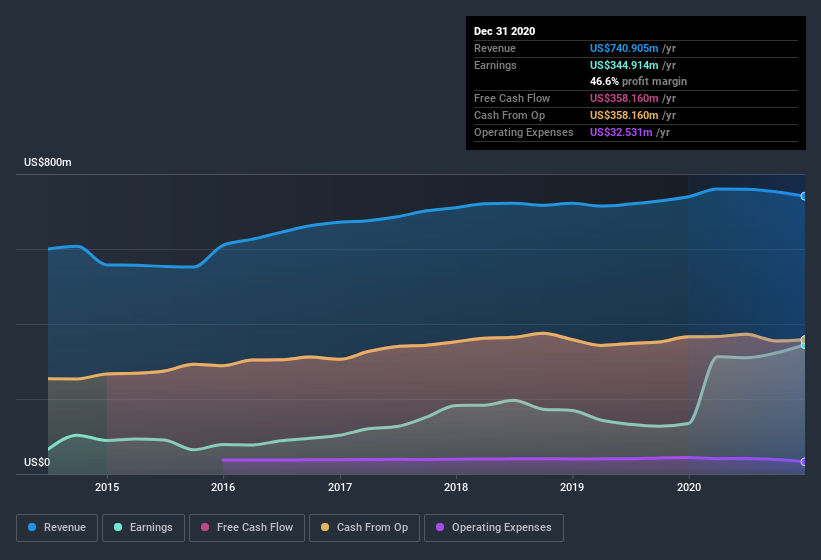

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Highwoods Properties?

Are Highwoods Properties Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's good to see Highwoods Properties insiders walking the walk, by spending US$435k on shares in just twelve months. And when you consider that there was no insider selling, you can understand why shareholders might believe that lady luck will grace this business. We also note that it was the Independent Chairman of the Board, Carlos Evans, who made the biggest single acquisition, paying US$337k for shares at about US$33.70 each.

Along with the insider buying, another encouraging sign for Highwoods Properties is that insiders, as a group, have a considerable shareholding. With a whopping US$61m worth of shares as a group, insiders have plenty riding on the company's success. That's certainly enough to make me think that management will be very focussed on long term growth.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Ted Klinck is paid comparatively modestly to CEOs at similar sized companies. I discovered that the median total compensation for the CEOs of companies like Highwoods Properties with market caps between US$2.0b and US$6.4b is about US$5.0m.

Highwoods Properties offered total compensation worth US$3.3m to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does Highwoods Properties Deserve A Spot On Your Watchlist?

You can't deny that Highwoods Properties has grown its earnings per share at a very impressive rate. That's attractive. On top of that, insiders own a significant stake in the company and have been buying more shares. So it's fair to say I think this stock may well deserve a spot on your watchlist. You still need to take note of risks, for example - Highwoods Properties has 3 warning signs (and 2 which are concerning) we think you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Highwoods Properties, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Highwoods Properties, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Highwoods Properties, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Highwoods Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:HIW

Highwoods Properties

Highwoods Properties, Inc., headquartered in Raleigh, is a publicly-traded (NYSE:HIW), fully-integrated office real estate investment trust (“REIT”) that owns, develops, acquires, leases and manages properties primarily in the best business districts (BBDs) of Atlanta, Charlotte, Dallas, Nashville, Orlando, Raleigh, Richmond and Tampa.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives