- United States

- /

- Health Care REITs

- /

- NasdaqGS:DHC

Undervalued Small Caps In US With Insider Buying To Consider

Reviewed by Simply Wall St

In the past week, the United States market has climbed 1.8%, contributing to a significant 25% increase over the last year, with earnings projected to grow by 15% annually in the coming years. In this robust market environment, identifying small-cap stocks with strong fundamentals and insider buying can present promising opportunities for investors seeking potential value.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| German American Bancorp | 14.2x | 4.7x | 49.75% | ★★★★☆☆ |

| Quanex Building Products | 32.3x | 0.8x | 39.39% | ★★★★☆☆ |

| First United | 13.0x | 3.0x | 46.74% | ★★★★☆☆ |

| McEwen Mining | 4.3x | 2.2x | 43.97% | ★★★★☆☆ |

| Innovex International | 9.2x | 2.1x | 47.64% | ★★★★☆☆ |

| Flowco Holdings | 8.2x | 1.5x | 41.16% | ★★★★☆☆ |

| Franklin Financial Services | 10.5x | 2.1x | 33.50% | ★★★☆☆☆ |

| ProPetro Holding | NA | 0.7x | 14.13% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -73.11% | ★★★☆☆☆ |

| Sabre | NA | 0.4x | -66.83% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

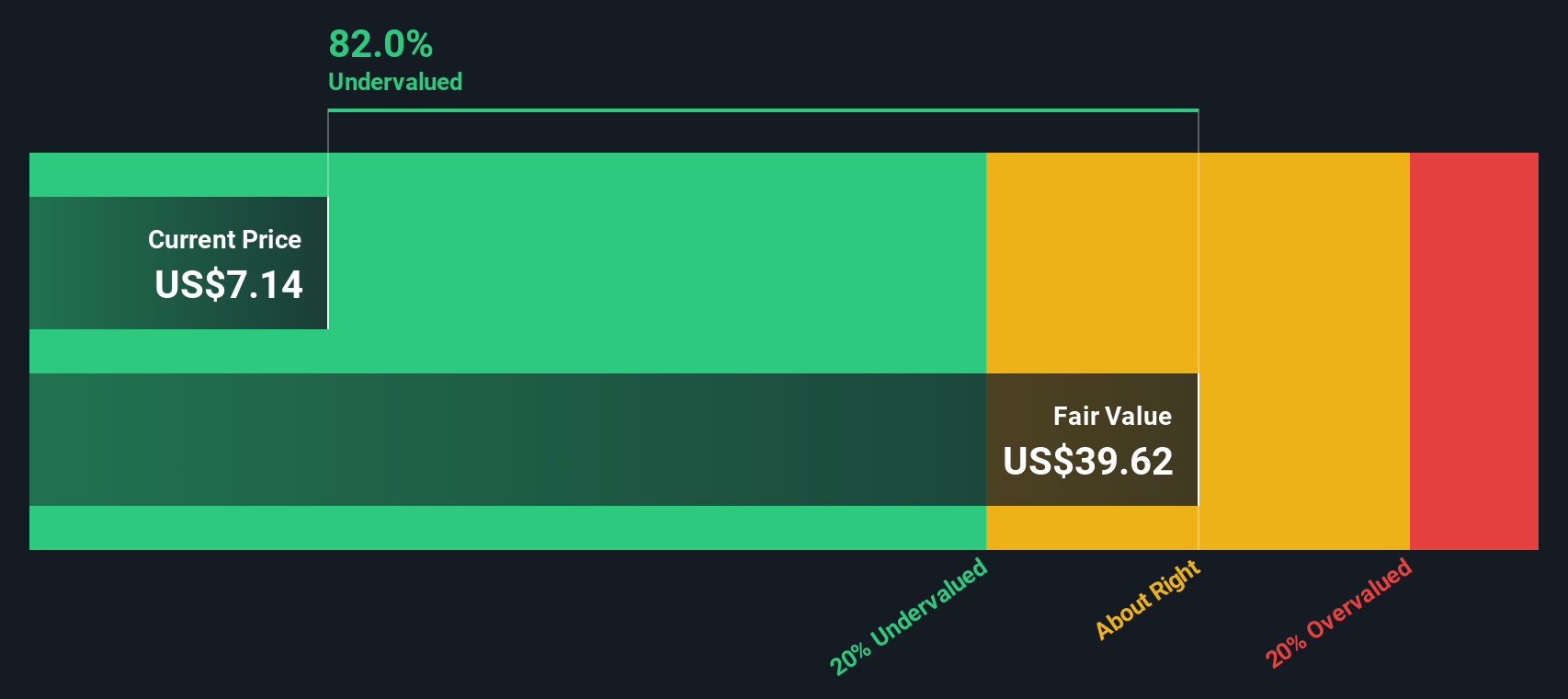

Diversified Healthcare Trust (NasdaqGS:DHC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Diversified Healthcare Trust operates in the healthcare real estate sector, focusing on medical office and life science properties as well as senior housing, with a market capitalization of approximately $1.24 billion.

Operations: The company generates revenue primarily from its Senior Housing Operating Portfolio, which contributes significantly to its total income. Over recent periods, the gross profit margin has shown a declining trend, reaching 16.87% in late 2024. Operating expenses and non-operating expenses are substantial components of the cost structure, impacting overall profitability.

PE: -1.4x

Diversified Healthcare Trust, a small player in the U.S. market, faces challenges with its financial position as debt isn't well-covered by operating cash flow and relies entirely on external borrowing. Despite these hurdles, insider confidence is evident with recent share purchases in January 2025. The company reported a net loss of US$98.69 million for Q3 2024 but continues to distribute dividends at US$0.01 per share quarterly, signaling commitment to shareholders amidst financial strain.

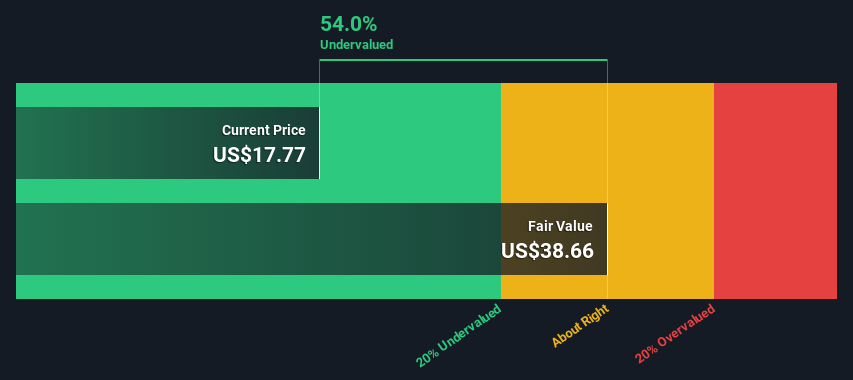

Proficient Auto Logistics (NasdaqGS:PAL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Proficient Auto Logistics is a company specializing in the transportation and logistics of automobiles, with a market capitalization of $1.25 billion.

Operations: For the period ending September 2024 and January 2025, Proficient Auto Logistics reported revenue of $147.41 million with a consistent gross profit margin of 20.16%. The company experienced a net income loss, reflected by a net income margin of -3.99%, influenced by operating expenses totaling $35.60 million and general & administrative expenses amounting to $22.32 million.

PE: -47.3x

Proficient Auto Logistics, a smaller company in the U.S., recently appointed Brenda Frank to its board, enhancing governance with her extensive HR expertise. Despite reporting a net loss of US$1.37 million for Q3 2024, insider confidence is evident as an executive acquired 54,000 shares worth US$496,800. This purchase increased their holdings by nearly 8%, suggesting belief in potential growth. However, reliance on external borrowing poses financial risks despite projected earnings growth of over 84% annually.

- Get an in-depth perspective on Proficient Auto Logistics' performance by reading our valuation report here.

Assess Proficient Auto Logistics' past performance with our detailed historical performance reports.

FrontView REIT (NYSE:FVR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: FrontView REIT focuses on the acquisition, leasing, and ownership of net leased properties with a market cap of $2.45 billion.

Operations: FrontView REIT generates revenue primarily through the acquisition, leasing, and ownership of net leased properties. The company has seen fluctuations in its net income margin, with recent data showing a negative trend at -1.56%. Operating expenses and non-operating expenses are significant components of their cost structure, impacting overall profitability.

PE: -295.7x

FrontView REIT, a smaller company in the real estate sector, recently joined the S&P TMI Index and reported improved financials for Q3 2024 with sales rising to US$14.53 million from US$11.62 million year-on-year, while narrowing its net loss to US$2.43 million from US$3.56 million. Insider confidence is evident as founder Stephen Preston purchased 6,352 shares worth over US$116K in December 2024. Despite relying on external borrowing for funding, earnings are projected to grow significantly at over 101% annually.

- Navigate through the intricacies of FrontView REIT with our comprehensive valuation report here.

Gain insights into FrontView REIT's past trends and performance with our Past report.

Where To Now?

- Unlock our comprehensive list of 44 Undervalued US Small Caps With Insider Buying by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DHC

Diversified Healthcare Trust

DHC is a real estate investment trust focused on owning high-quality healthcare properties located throughout the United States.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success