- United States

- /

- Industrial REITs

- /

- NYSE:FR

First Industrial Realty Trust (FR): Margin Drop Reinforces Investor Caution on Growth Story

Reviewed by Simply Wall St

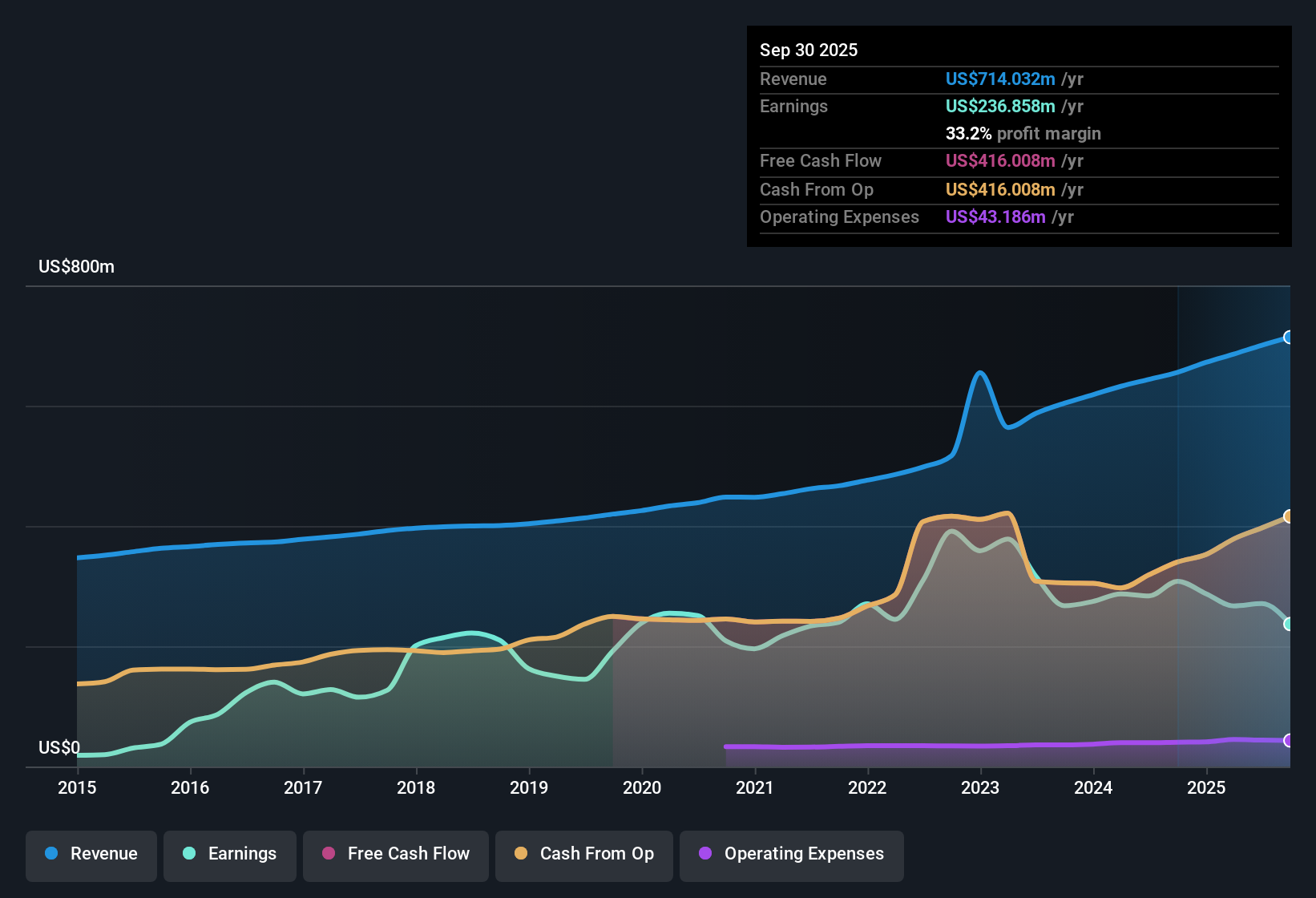

First Industrial Realty Trust (FR) posted a net profit margin of 33.2%, a step down from last year's 47% margin. The five-year average annual earnings growth sits at 3.7%. Looking ahead, the company expects earnings to grow at 5.05% per year and revenue at 7.2% per year, both trailing the broader US market's expected growth. Investors will be closely watching how First Industrial balances profitability and growth in the face of ongoing margin pressures and a financial position flagged as a risk. Its shares currently trade below estimated fair value and offer attractive dividends.

See our full analysis for First Industrial Realty Trust.Next up, we will stack these latest results against the most widely debated market narratives to see which themes get validated and which might be due for a rethink.

See what the community is saying about First Industrial Realty Trust

Margin Compression Adds Pressure to Growth Story

- Profit margins have narrowed to 33.2% from 47% last year, even as average five-year earnings growth holds at 3.7% annually.

- Analysts' consensus view is that further margin slippage is likely, especially as sustained rent increases and low vacancies may normalize.

- Consensus narrative highlights that expectations for persistent double-digit rent spreads and above-average occupancy could overstate future revenue and earnings potential.

- Despite high occupancy today, any shift in tenant demand or market supply could reduce these margins and challenge the bullish outlook.

See whether analysts are too optimistic or just right on margins in the current consensus:

📊 Read the full First Industrial Realty Trust Consensus Narrative.Peer-Level Valuation Despite Industry Premium

- First Industrial's P/E sits at 30.8x, notably higher than the global industrial REIT average of 16.5x but nearly matching the peer group at 31.7x.

- Analysts' consensus view acknowledges this valuation balance, noting that even with shares priced below the DCF fair value of $67.65 and the analyst target of $56.75, industry pricing and margin trends may limit upside.

- With a current share price of $55.11, the stock trades at a narrow discount (2.9%) to the analyst target. This suggests limited expected near-term rerating.

- Valuation is further complicated by the potential for normalized occupancy rates and pressure on net margins as broader industry conditions shift.

Dividend Appeal Remains, But Balance Sheet Risks Emerge

- Shares are described as offering attractive dividends; however, the company’s financial position is flagged as a key risk amid a rising rate environment.

- Analysts' consensus view notes that while First Industrial benefits from access to BBB+ rated, low-cost funding for its developments, higher-for-longer interest rates could raise borrowing costs and compress future margins.

- Consensus narrative points to the oversubscribed $450 million bond offering as evidence of strong market access. It also warns that ongoing rate hikes could offset this advantage over time.

- Stable revenue and NOI growth are not immune to delayed tenant decisions or rising costs, reinforcing margin and earnings uncertainty for future periods.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for First Industrial Realty Trust on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different read on the numbers? Share your take and shape your own narrative in just a few minutes. Do it your way.

A great starting point for your First Industrial Realty Trust research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

First Industrial’s weakening profit margins and increased financial risks mean its growth story faces significant pressure due to a less robust balance sheet. If you’re looking for companies with stronger fundamentals and lower financial risk, check out solid balance sheet and fundamentals stocks screener (1985 results) to find stocks designed to weather market volatility and uncertain interest rates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FR

First Industrial Realty Trust

First Industrial Realty Trust, Inc. (NYSE: FR) is a leading U.S.-only owner, operator, developer and acquirer of logistics properties.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives