- United States

- /

- Industrial REITs

- /

- NYSE:FR

First Industrial Realty Trust (FR) Lifts Guidance as Leasing Activity and Rents Rise—What Drives the Outlook?

Reviewed by Sasha Jovanovic

- First Industrial Realty Trust, Inc. reported third-quarter 2025 results, with revenue rising to US$181.43 million and net income of US$65.31 million, alongside an upward revision in full-year guidance for funds from operations.

- The company achieved significant leasing momentum, securing over 772,000 square feet across new development projects and realizing above-average increases in cash rental rates, underscoring continued strong demand in the industrial sector.

- We’ll examine how First Industrial Realty Trust’s raised full-year outlook and robust leasing activity influence the company's investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

First Industrial Realty Trust Investment Narrative Recap

To be a shareholder of First Industrial Realty Trust, an investor needs to believe in sustained demand for industrial real estate, fueled by e-commerce and supply chain modernization. The recent results, highlighting strong leasing momentum, double-digit rental rate growth, and an upward revision to full-year guidance, reinforce optimism around these trends in the near term, but don't materially alter the biggest short-term risk: a potential cooling of tenant demand and normalization of rental rates.

Among the latest company announcements, the upward revision of full-year funds from operations guidance stands out. This reflects a boost in confidence following robust leasing activity, and directly supports the catalyst of ongoing rent growth and high occupancy in supply-constrained markets, suggesting that First Industrial's strong demand backdrop and successful development leasing remain critical to its investment case.

However, investors should also be mindful that, despite this upbeat news, any softening in industrial sector demand could quickly shift...

Read the full narrative on First Industrial Realty Trust (it's free!)

First Industrial Realty Trust's outlook forecasts $866.2 million in revenue and $270.0 million in earnings by 2028. This is based on an anticipated annual revenue growth rate of 7.3%, but earnings are projected to decrease by $0.9 million from their current level of $270.9 million.

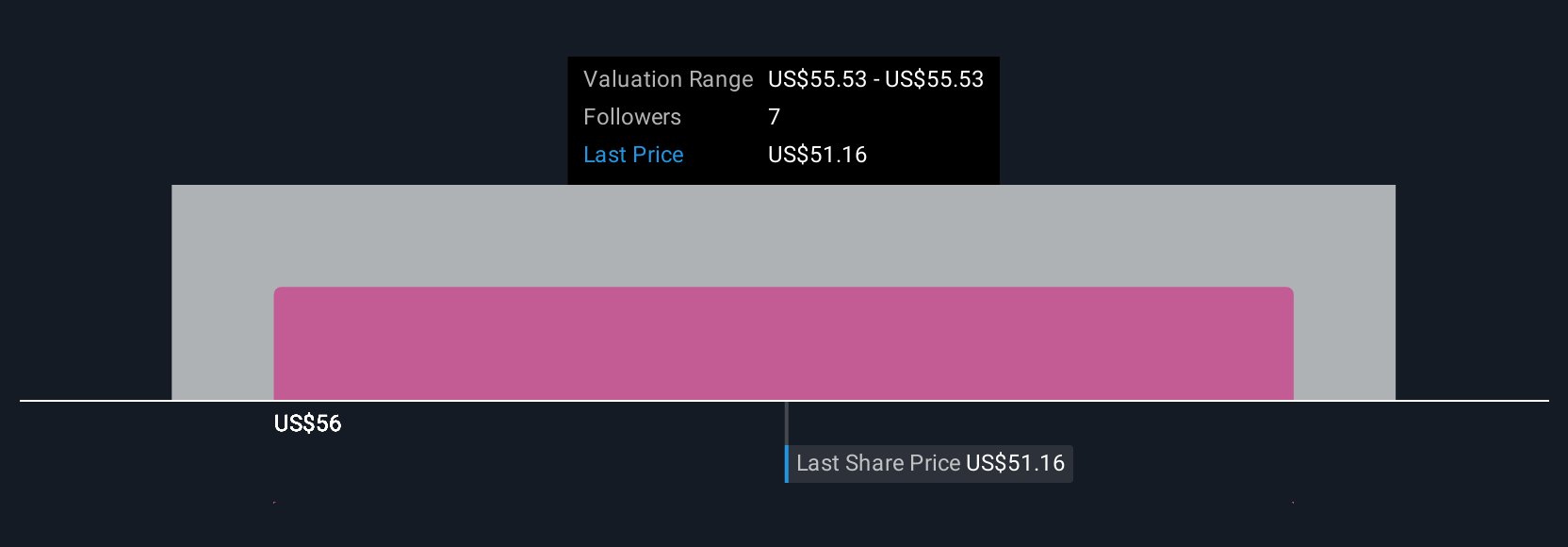

Uncover how First Industrial Realty Trust's forecasts yield a $56.33 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 1 fair value estimate at US$56.33, showing tight consensus before this recent news. If persistent rental rate growth softens, your view of future performance may be very different from others, so compare several analyses before forming your opinion.

Explore another fair value estimate on First Industrial Realty Trust - why the stock might be worth as much as $56.33!

Build Your Own First Industrial Realty Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Industrial Realty Trust research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free First Industrial Realty Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Industrial Realty Trust's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FR

First Industrial Realty Trust

First Industrial Realty Trust, Inc. (NYSE: FR) is a leading U.S.-only owner, operator, developer and acquirer of logistics properties.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives