- United States

- /

- Real Estate

- /

- NYSE:FPH

Would Shareholders Who Purchased Five Point Holdings'(NYSE:FPH) Stock Three Years Be Happy With The Share price Today?

Five Point Holdings, LLC (NYSE:FPH) shareholders should be happy to see the share price up 29% in the last month. But that doesn't change the fact that the returns over the last three years have been disappointing. Regrettably, the share price slid 61% in that period. Some might say the recent bounce is to be expected after such a bad drop. The rise has some hopeful, but turnarounds are often precarious.

View our latest analysis for Five Point Holdings

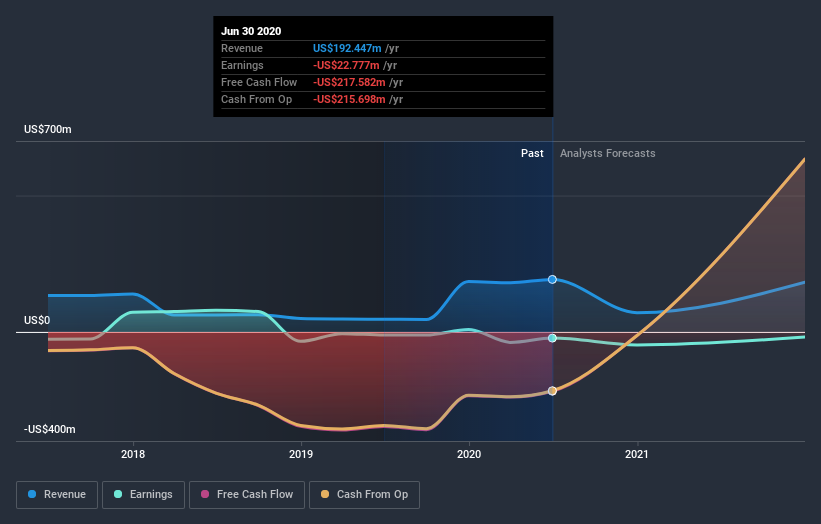

Five Point Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years, Five Point Holdings saw its revenue grow by 14% per year, compound. That's a fairly respectable growth rate. So some shareholders would be frustrated with the compound loss of 17% per year. The market must have had really high expectations to be disappointed with this progress. It would be well worth taking a closer look at the company, to determine growth trends (and balance sheet strength).

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Over the last year, Five Point Holdings shareholders took a loss of 19%. In contrast the market gained about 19%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Unfortunately, the longer term story isn't pretty, with investment losses running at 17% per year over three years. We'd need clear signs of growth in the underlying business before we could muster much enthusiasm for this one. If you would like to research Five Point Holdings in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading Five Point Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSE:FPH

Five Point Holdings

Designs, owns, and develops mixed-use planned communities in Orange County, Los Angeles County, and San Francisco County.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives