- United States

- /

- Specialized REITs

- /

- NYSE:FCPT

How Investors May Respond To Four Corners Property Trust (FCPT) Surging Rental Income and Diversification Moves

Reviewed by Sasha Jovanovic

- Four Corners Property Trust recently reported 11% growth in Q2 2025 rental income, with adjusted funds from operations per share rising 2.8% and portfolio occupancy reaching 99.4%, as the company diversified further into automotive and medical retail.

- An interesting insight is the company now has US$500 million available for acquisitions, reinforcing its disciplined capital management and ongoing diversification efforts despite broader market headwinds.

- We’ll explore how rising rental income and portfolio expansion may impact Four Corners Property Trust’s investment outlook and risk profile.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Four Corners Property Trust Investment Narrative Recap

To be a shareholder of Four Corners Property Trust today, you need to believe in the long-term durability and adaptability of net lease retail, particularly the resilience of sectors like automotive and medical retail. The recent 11% rise in rental income, record occupancy, and expanded diversification may help soften short-term concentration risks, though the company remains meaningfully exposed to casual dining trends, so while the positive news supports the main growth catalyst, it does not eliminate the most important risk facing the business. One recent announcement most relevant to this update is the acquisition of multiple automotive and animal hospital properties in September 2025, financed from the US$500 million available for acquisitions. These purchases further push portfolio diversification, directly addressing the catalyst of reducing reliance on casual dining and enhancing stability through broader essential service exposure. However, it’s important for investors to recognize that even with this progress, the company’s long-term leases and modest rent escalators could limit flexibility if...

Read the full narrative on Four Corners Property Trust (it's free!)

Four Corners Property Trust is projected to reach $344.5 million in revenue and $144.2 million in earnings by 2028. This outlook assumes a 7.2% annual revenue growth rate and a $38.4 million increase in earnings from the current level of $105.8 million.

Uncover how Four Corners Property Trust's forecasts yield a $29.38 fair value, a 21% upside to its current price.

Exploring Other Perspectives

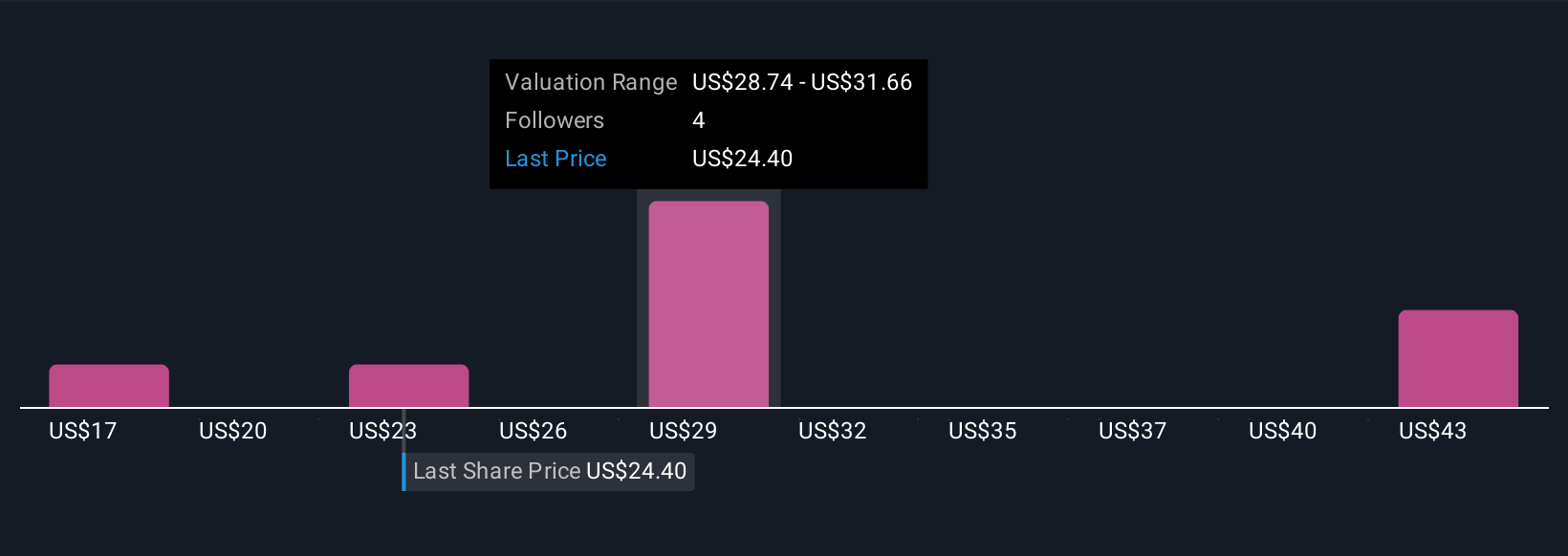

Community fair value estimates for FCPT range widely, from US$17.09 to US$46.25, across 4 Simply Wall St Community analyses. With ongoing sector concentration risks, it’s worth comparing how these varied viewpoints reflect differing assumptions about sustained rental income and portfolio performance.

Explore 4 other fair value estimates on Four Corners Property Trust - why the stock might be worth as much as 90% more than the current price!

Build Your Own Four Corners Property Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Four Corners Property Trust research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Four Corners Property Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Four Corners Property Trust's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCPT

Four Corners Property Trust

FCPT is a real estate investment trust primarily engaged in the ownership, acquisition and leasing of restaurant and retail properties.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives