- United States

- /

- Specialized REITs

- /

- NYSE:FCPT

How Investors May Respond To Four Corners Property Trust (FCPT) Expanding Into Essential Service and Healthcare Real Estate

Reviewed by Sasha Jovanovic

- In recent weeks, Four Corners Property Trust announced acquisitions exceeding US$35 million, including five Christian Brothers Automotive sites, VCA Animal Hospital properties, and four Burger King locations, each under long-term leases in high-traffic, resilient retail corridors across multiple states.

- This series of diversified acquisitions highlights FCPT's drive to expand beyond restaurant real estate and strengthen exposure to essential service and healthcare tenants, which are often seen as more insulated from e-commerce and economic volatility.

- We’ll now examine how FCPT’s push into essential service and healthcare properties impacts its long-term investment narrative and risk profile.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Four Corners Property Trust Investment Narrative Recap

To be a shareholder in Four Corners Property Trust, you have to believe that expanding into e-commerce resistant sectors like essential services and healthcare will outpace the long-term risks from high casual dining exposure and modest rent escalators. The recent property acquisitions signal commitment to diversification, but do not materially change the primary short-term catalyst (reducing concentration risk) or the biggest current risk (potential earnings compression amid fixed lease terms in an inflationary environment).

The acquisition of five Christian Brothers Automotive sites for US$22.6 million stands out, with each property under a long-term, corporate-backed lease in strong, high-traffic corridors. This move further supports FCPT’s efforts to broaden its tenant base and reduce its reliance on the casual dining sector for future stability.

Yet, even as diversification is pursued, investors should pay attention to how much exposure still remains to a single sector like casual dining…

Read the full narrative on Four Corners Property Trust (it's free!)

Four Corners Property Trust's narrative projects $344.5 million in revenue and $144.2 million in earnings by 2028. This requires 7.2% yearly revenue growth and a $38.4 million earnings increase from the current $105.8 million.

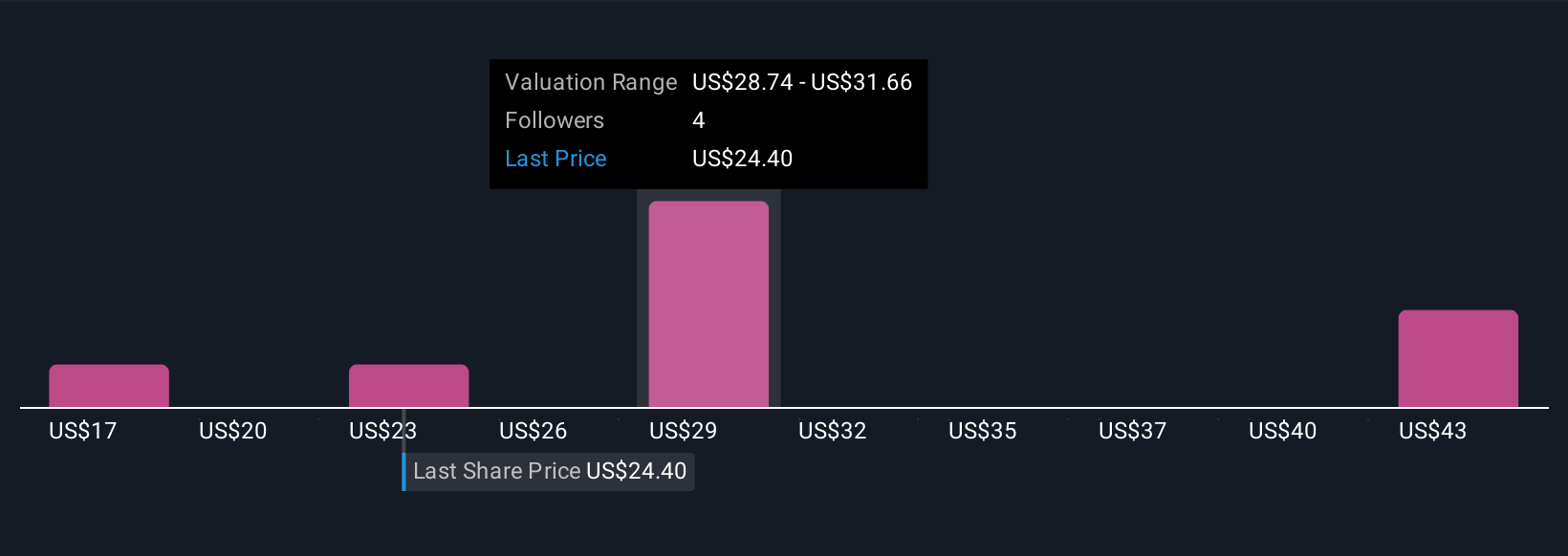

Uncover how Four Corners Property Trust's forecasts yield a $29.38 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offer three separate fair value estimates for FCPT, ranging from US$23 to US$46.29. While opinions differ widely, ongoing high concentration in casual dining remains important for anyone assessing FCPT’s resilience and long-term earnings potential.

Explore 3 other fair value estimates on Four Corners Property Trust - why the stock might be worth as much as 91% more than the current price!

Build Your Own Four Corners Property Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Four Corners Property Trust research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Four Corners Property Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Four Corners Property Trust's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCPT

Four Corners Property Trust

FCPT is a real estate investment trust primarily engaged in the ownership, acquisition and leasing of restaurant and retail properties.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives