- United States

- /

- Specialized REITs

- /

- NYSE:EXR

A Fresh Look at Extra Space Storage (EXR) Valuation Following This Month’s Share Price Decline

Reviewed by Simply Wall St

Extra Space Storage (EXR) stock performance has caught the eye of investors as shares continue to drift lower this month. With a year-to-date decline of more than 11% and shares currently at $131, many are re-evaluating the company’s valuation and future prospects.

See our latest analysis for Extra Space Storage.

This recent slide in Extra Space Storage’s share price, including a 7.98% drop over the past month and a 10.55% slide in the last week, reflects fading momentum as the market digests both rising sector uncertainty and shifting investor sentiment. Over the past year, total shareholder return stands at -18.56%, a reminder that persistent declines have weighed on longer-term performance even as the company remains a significant player in its space.

If you’re looking for other opportunities as storage and real estate stocks lose steam, broaden your search and discover fast growing stocks with high insider ownership.

With shares now trading at a notable discount to analyst price targets, the question remains: is Extra Space Storage genuinely undervalued, or is the market already factoring in slower growth ahead? Could this be a hidden buying opportunity, or is all of the risk already priced in?

Most Popular Narrative: 16.7% Undervalued

With Extra Space Storage shares recently closing at $131.42 while the most popular narrative points to a fair value of $157.75, the consensus among analysts is that the market may be overlooking some key growth elements.

"Operational investments in technology and advanced customer acquisition yield higher conversion rates and customer retention, even as AI transforms the search landscape. These factors support net margin improvements as lower operating costs and higher quality leads drive profitability."

Curious how technology upgrades and margin expansion factor into this bullish scenario? The underlying math relies on an earnings surge and surprising profitability gains. Uncover which pivotal assumptions propel this valuation higher than you might expect.

Result: Fair Value of $157.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising property tax expenses and muted same-store revenue growth could present challenges to margins and may stall the optimistic outlook for Extra Space Storage.

Find out about the key risks to this Extra Space Storage narrative.

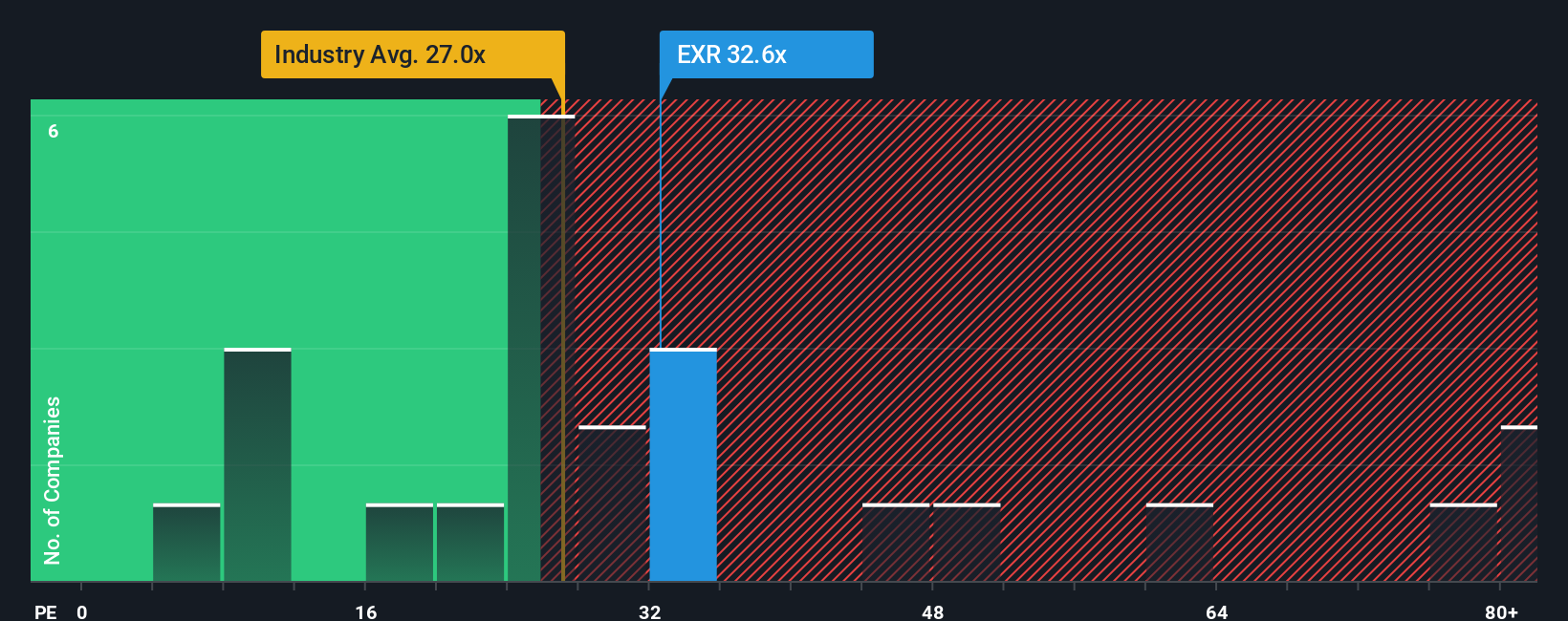

Another View: Multiples Tell a Cautionary Story

From a different perspective, the current share price reflects a higher price-to-earnings ratio than both its peers and the broader industry. At 29.4 times earnings compared to the US Specialized REITs average of 25.9 and a fair ratio of 33.2, Extra Space Storage appears expensive on this measure, not cheap. Could investor optimism be overlooking near-term risks, or is there potential for upside if the market eventually aligns with the fair ratio?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Extra Space Storage Narrative

If you think there’s a different story to be told or want to validate the numbers yourself, you can quickly build your own view in just a few minutes. Do it your way

A great starting point for your Extra Space Storage research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Don’t miss your chance to move with confidence into tomorrow’s biggest market trends. Equip yourself with smart ideas by checking these out now:

- Capture potential high yields and steady income by targeting these 20 dividend stocks with yields > 3%, which offers strong dividends with impressive track records.

- Tap into future healthcare breakthroughs by scanning these 33 healthcare AI stocks, paving the way in life sciences and digital health.

- Get ahead of the curve with these 82 cryptocurrency and blockchain stocks, unlocking possibilities in blockchain, payment innovations, and the rapidly shifting digital economy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Extra Space Storage might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EXR

Extra Space Storage

Extra Space Storage Inc., headquartered in Salt Lake City, Utah, is a self-administered and self-managed REIT and a member of the S&P 500.

6 star dividend payer with solid track record.

Similar Companies

Market Insights

Community Narratives