- United States

- /

- Residential REITs

- /

- NYSE:ESS

Is Essex Property Trust’s Q2 Beat and Raised Guidance Reshaping the ESS Investment Narrative?

Reviewed by Simply Wall St

- In the past week, Essex Property Trust reported second-quarter 2025 results that topped expectations and raised its full-year outlook, aided by growth in same-property revenues and net operating income alongside recent acquisitions and a significant property sale in California.

- An interesting aspect is that, while operational performance and guidance improved, analyst sentiment turned cautious citing sector-wide headwinds and a softer future earnings environment for apartment REITs.

- We'll examine how Essex's improved full-year guidance and second-quarter beat may affect its investment narrative in the face of sector challenges.

Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

Essex Property Trust Investment Narrative Recap

Essex Property Trust appeals to investors who believe in resilient apartment demand across West Coast tech hubs and the long-term stability of high-quality multifamily assets. The company's second-quarter beat and raised 2025 guidance help reinforce the near-term earnings catalyst, but these results have not materially changed the biggest risk: ongoing rent growth and revenue volatility tied to Southern California's slow recovery and persistent concessions. Operationally stronger results are encouraging, yet sector-wide caution remains a live concern for the months ahead.

Of Essex's recent moves, the updated full-year earnings outlook following strong Q2 growth stands out as particularly relevant. This not only reflects the positive impact of new acquisitions and a major property sale but also affirms that management remains committed to capital discipline despite increased market scrutiny and softening fundamentals in some markets.

However, against the backdrop of improved financial guidance, investors should be aware that ongoing supply pressures and demand softness in key metros could still...

Read the full narrative on Essex Property Trust (it's free!)

Essex Property Trust's outlook anticipates $2.1 billion in revenue and $437.7 million in earnings by 2028. This implies 3.4% annual revenue growth, but earnings are forecast to decrease by $362.6 million from current earnings of $800.3 million.

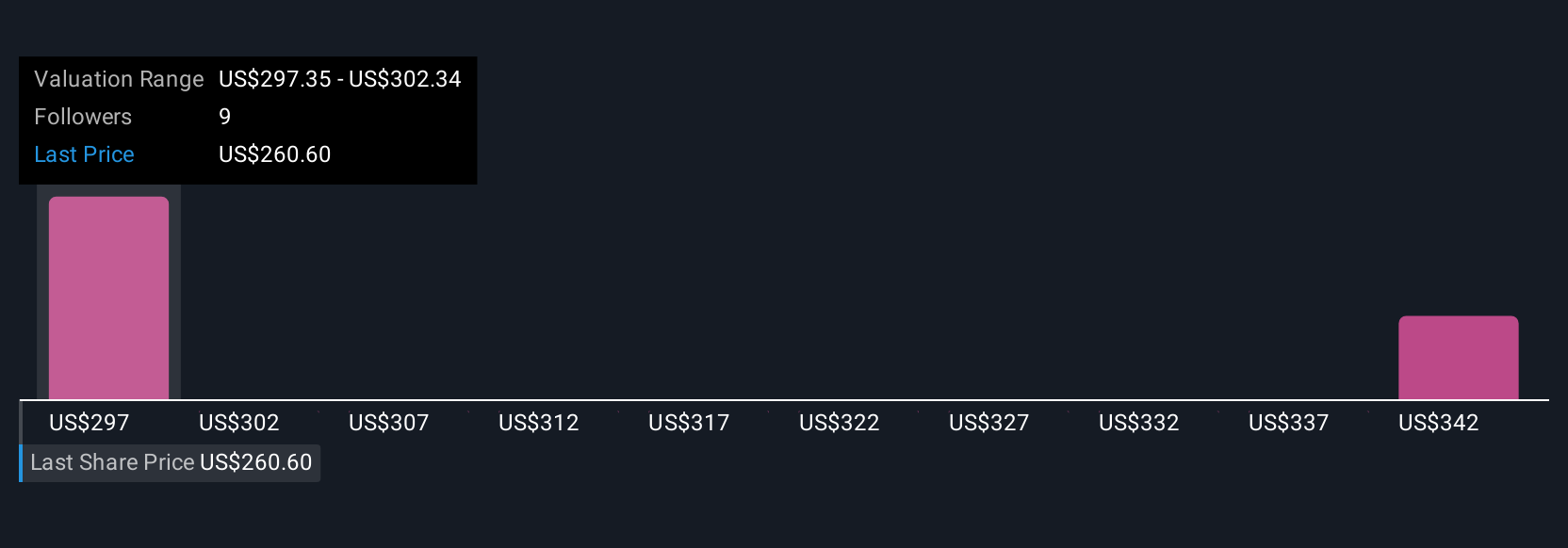

Uncover how Essex Property Trust's forecasts yield a $297.35 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Two private members of the Simply Wall St Community provided fair value estimates for Essex, ranging from US$297.35 to US$347.21 per share. While some see clear opportunity, remember ongoing concessions and persistent softness in Southern California may matter more than headline numbers as you weigh different outlooks.

Explore 2 other fair value estimates on Essex Property Trust - why the stock might be worth just $297.35!

Build Your Own Essex Property Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Essex Property Trust research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Essex Property Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Essex Property Trust's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Essex Property Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESS

Essex Property Trust

An S&P 500 company, is a fully integrated real estate investment trust (REIT) that acquires, develops, redevelops, and manages multifamily residential properties in selected West Coast markets.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives