- United States

- /

- Residential REITs

- /

- NYSE:ESS

Essex Property Trust (ESS): Evaluating Valuation as U.S. Apartment Rents Decline for First Time Since 2009

Reviewed by Kshitija Bhandaru

Essex Property Trust (ESS) is in the spotlight after the U.S. apartment market posted its first negative rent growth since 2009. With demand softening and supply increasing, investors are watching Essex’s upcoming earnings closely.

See our latest analysis for Essex Property Trust.

The past year has seen Essex Property Trust's share price drift lower, with a total shareholder return of -8.4%. The broader apartment REIT market continues to wrestle with weaker fundamentals and earnings uncertainty. Momentum has faded over recent months. However, the longer-term five-year total return of 54.1% is a reminder that cyclical downturns have not erased the stock’s track record for patient investors.

If you’re interested in broadening your search during this market reset, it could be the perfect time to discover fast growing stocks with high insider ownership

With shares trading at a notable discount to analyst targets amid sectorwide challenges, the question now is whether Essex Property Trust is undervalued given its long-term performance or if the market has already taken into account next year's risks and rewards.

Most Popular Narrative: 12.8% Undervalued

Essex Property Trust’s widely followed narrative places its fair value at $295.44, which is noticeably higher than the recent closing price of $257.58. The popular outlook suggests an opportunity, but the assumptions behind the number warrant a closer look.

Limited new multifamily supply in the company's core markets, especially on the West Coast, is expected to sharply decline by 35% in the second half of 2025. This reduction should ease competitive pressure and drive higher occupancy and rent growth, positively impacting revenues and net operating income. Ongoing demographic trends, such as Millennials and Gen Z delaying homeownership, are sustaining strong demand for high-quality apartments in coastal urban and suburban regions like Northern California and Seattle. This trend supports stable occupancy, pricing power, and long-term revenue growth.

Curious what assumptions fuel this bullish outlook? The narrative’s bold fair value hinges on projections for future growth, profit margins, and an ambitious profit multiple. Which key factors tip the scales, and could they really justify that price? Unlock all the reasoning and see how the narrative reaches its call.

Result: Fair Value of $295.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory pressures and the company's concentrated exposure to California markets could pose significant risks to the upbeat growth narrative for Essex Property Trust.

Find out about the key risks to this Essex Property Trust narrative.

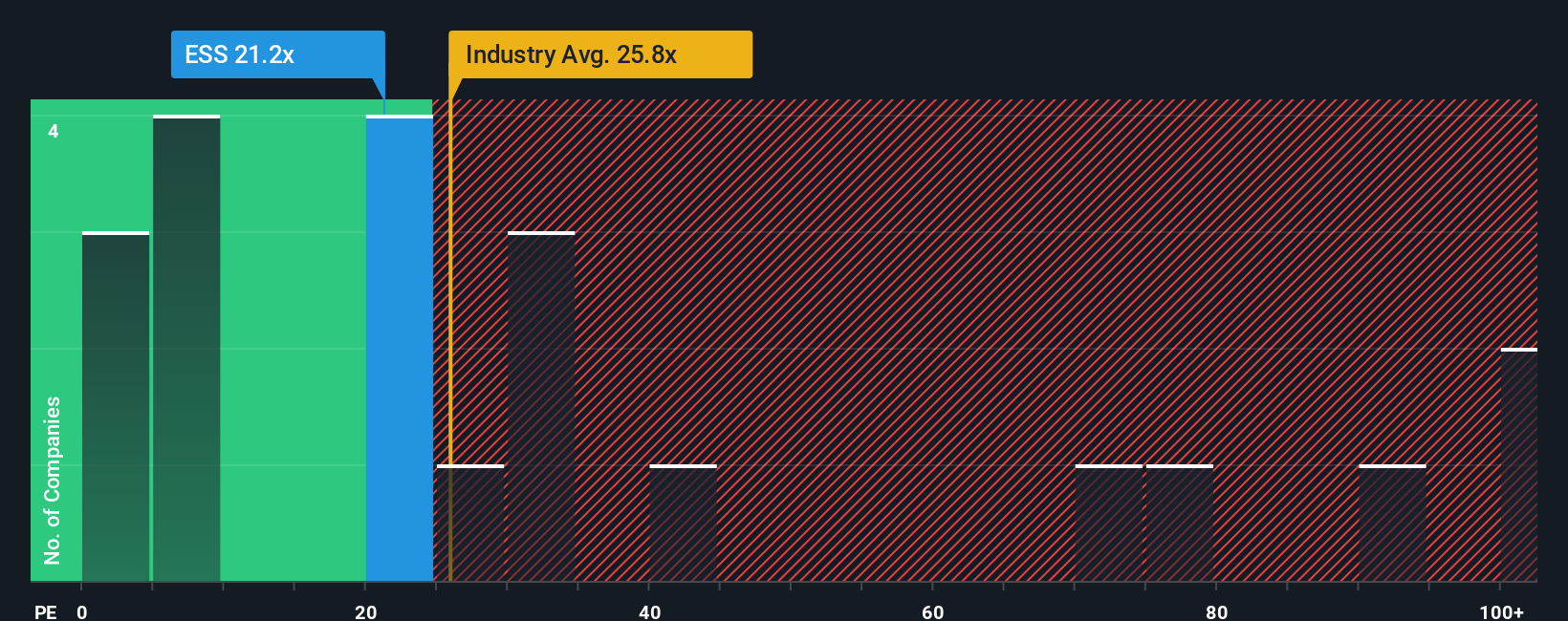

Another View: What Do Earnings Multiples Say?

A different perspective comes from comparing Essex Property Trust's price-to-earnings ratio of 20.7x with both the global industry average of 19.7x and its peers averaging 53.8x. While Essex looks more expensive than the industry, it appears considerably cheaper than its direct peers. The fair ratio stands at 24.4x, which suggests the market could shift closer to that level. Does this gap signal a real opportunity or more risk for investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Essex Property Trust Narrative

If you want to challenge these conclusions or analyze the numbers for yourself, you can craft your own perspective in just a few minutes with Do it your way

A great starting point for your Essex Property Trust research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let fresh opportunities pass you by. Take charge of your next move and discover stocks tailored to your investment strategy with these powerful tools:

- Tap into steady income streams and browse these 18 dividend stocks with yields > 3% with robust yields above 3% to build a portfolio that works harder for you.

- Catch the momentum in healthcare’s tech revolution by exploring these 33 healthcare AI stocks, where game-changing advances in AI and medicine meet profitable growth.

- Unlock strong growth at a value with these 894 undervalued stocks based on cash flows based on future cash flows. This approach can provide a smart edge in today’s dynamic markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Essex Property Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESS

Essex Property Trust

An S&P 500 company, is a fully integrated real estate investment trust (REIT) that acquires, develops, redevelops, and manages multifamily residential properties in selected West Coast markets.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives