- United States

- /

- Office REITs

- /

- NYSE:ESRT

Will Empire State Realty Trust’s (ESRT) New Leadership Sustain Its ESG Momentum and Strategic Consistency?

Reviewed by Sasha Jovanovic

- On September 19, 2025, Empire State Realty Trust announced the transition of longtime Executive Vice President Thomas P. Durels’ responsibilities to new Co-Heads of Real Estate, Ryan Kass and Jackie Renton, while Durels remains with the company in an advisory capacity until mid-2027.

- This leadership transition closely followed Empire State Realty Trust being awarded the highest possible GRESB 5 Star Rating for the sixth year in a row, reflecting continued recognition of its sustainability leadership.

- We’ll examine how the company’s top GRESB rating highlights its sustainability strengths and influences the overall investment narrative.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Empire State Realty Trust Investment Narrative Recap

To be a shareholder in Empire State Realty Trust, you need to believe in the long-term power of iconic New York City real estate, the ability to maintain high occupancy rates in major office properties, and the company's strength in sustainability leadership. The recent transition of executive responsibilities appears orderly and does not have a material impact on the biggest catalyst, the company’s ability to leverage sustainability for tenant demand, or the key short-term risk, which remains pressure on discretionary revenues from the Observatory segment amid volatile tourism trends.

The company’s continued recognition with a sixth consecutive GRESB 5 Star Rating, scoring 93 out of 100 with top marks in management and disclosure, stands out as an announcement most relevant to investor confidence right now. This achievement reinforces the ESG catalyst supporting ESRT's value proposition to tenants and investors, especially as demands for sustainable office environments rise amid ongoing competition and shifting workplace trends.

However, investors should be aware that, despite the ongoing sustainability recognition, the Observatory segment’s earnings remain exposed to...

Read the full narrative on Empire State Realty Trust (it's free!)

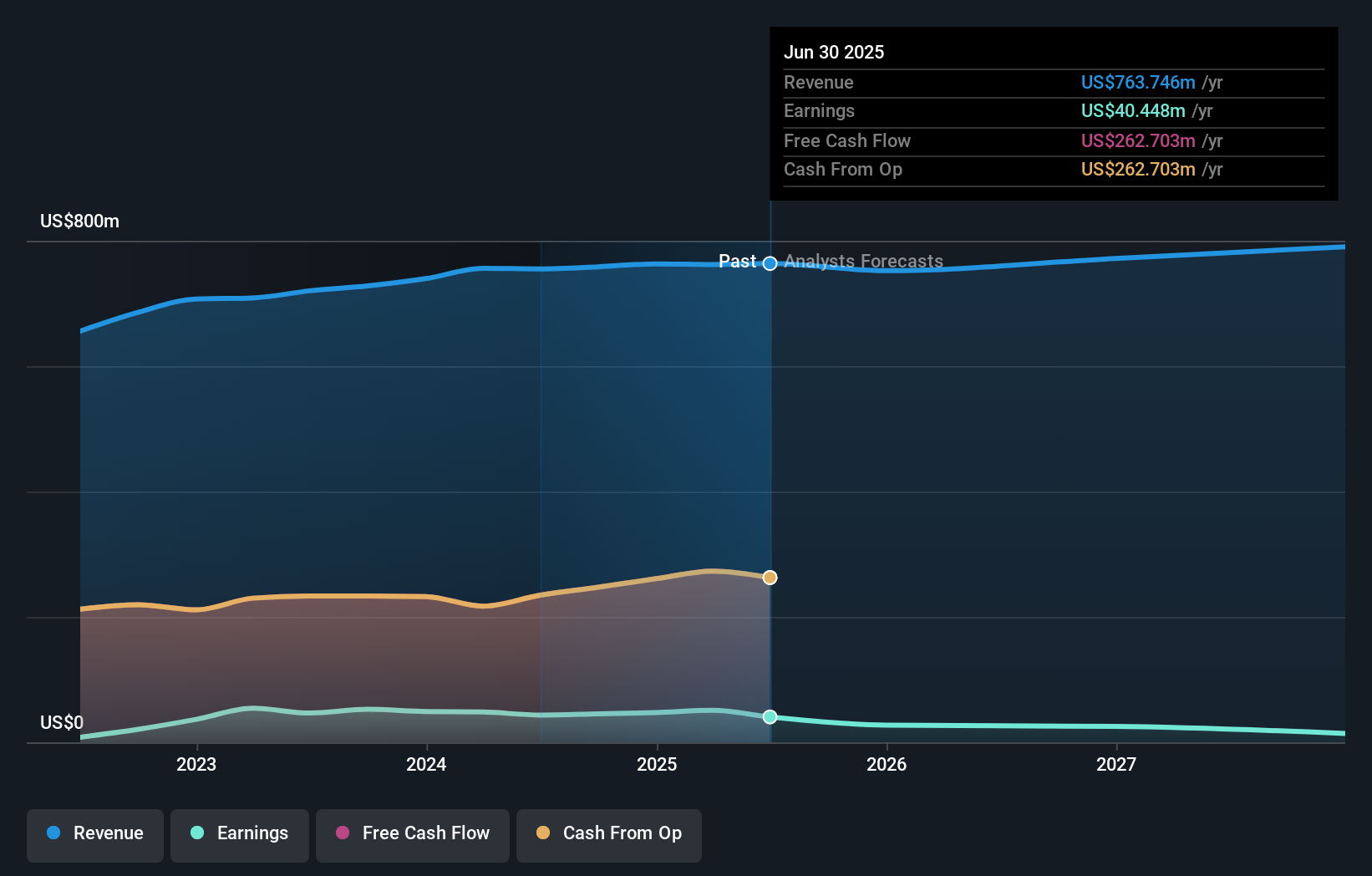

Empire State Realty Trust is projected to reach $797.6 million in revenue and $13.7 million in earnings by 2028. This outlook is based on analysts’ assumptions of 1.5% annual revenue growth and a decrease in earnings of $26.7 million from current earnings of $40.4 million.

Uncover how Empire State Realty Trust's forecasts yield a $8.97 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Only one member of the Simply Wall St Community has set a fair value for ESRT at US$8.97. With earnings from the Observatory segment under pressure, your own estimate could easily differ, explore more viewpoints for a fuller picture.

Explore another fair value estimate on Empire State Realty Trust - why the stock might be worth just $8.97!

Build Your Own Empire State Realty Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Empire State Realty Trust research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Empire State Realty Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Empire State Realty Trust's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Empire State Realty Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESRT

Empire State Realty Trust

Empire State Realty Trust, Inc. (NYSE: ESRT) is a NYC-focused REIT that owns and operates a portfolio of well-leased, top of tier, modernized, amenitized, and well-located office, retail, and multifamily assets.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives