- United States

- /

- Office REITs

- /

- NYSE:ESRT

How Investors May Respond To Empire State Realty Trust (ESRT) Adding $175 Million in Private Debt with New Leverage Limits

Reviewed by Sasha Jovanovic

- On October 15, 2025, Empire State Realty Trust, Inc. and its operating partnership entered into a Note Purchase Agreement for a private placement of US$175,000,000 in 5.47% Series L Senior Notes due January 2031, with the sale scheduled to fund on December 18, 2025, subject to closing conditions.

- This debt financing introduces new covenants on leverage and financial ratios, signaling a meaningful shift in the company’s capital structure and balance sheet flexibility.

- We’ll examine how this private placement, with its added leverage limitations, could influence Empire State Realty Trust’s investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Empire State Realty Trust Investment Narrative Recap

To be a shareholder in Empire State Realty Trust, one must believe in the ongoing value of premier Manhattan office and mixed-use assets, the appeal of high-profile landmarks, and the potential for recurring revenue from both leasing and tourism segments. The recent US$175,000,000 Series L note issuance, with new covenants and leverage limits, modestly increases financial flexibility but does not materially shift the most important near-term catalyst, a rebound in Observatory revenues, or the biggest risk, which remains cost inflation outpacing revenue growth.

Among recent announcements, the Q3 2025 earnings release scheduled for October 29 is directly relevant, offering critical insights into how Empire State Realty Trust is balancing additional debt against operating income trends. The interplay between earnings growth and new balance sheet covenants is especially important given recent pressure on net income and margins.

By contrast, investors should also be aware that persistent increases in operating expenses present underlying risks that could...

Read the full narrative on Empire State Realty Trust (it's free!)

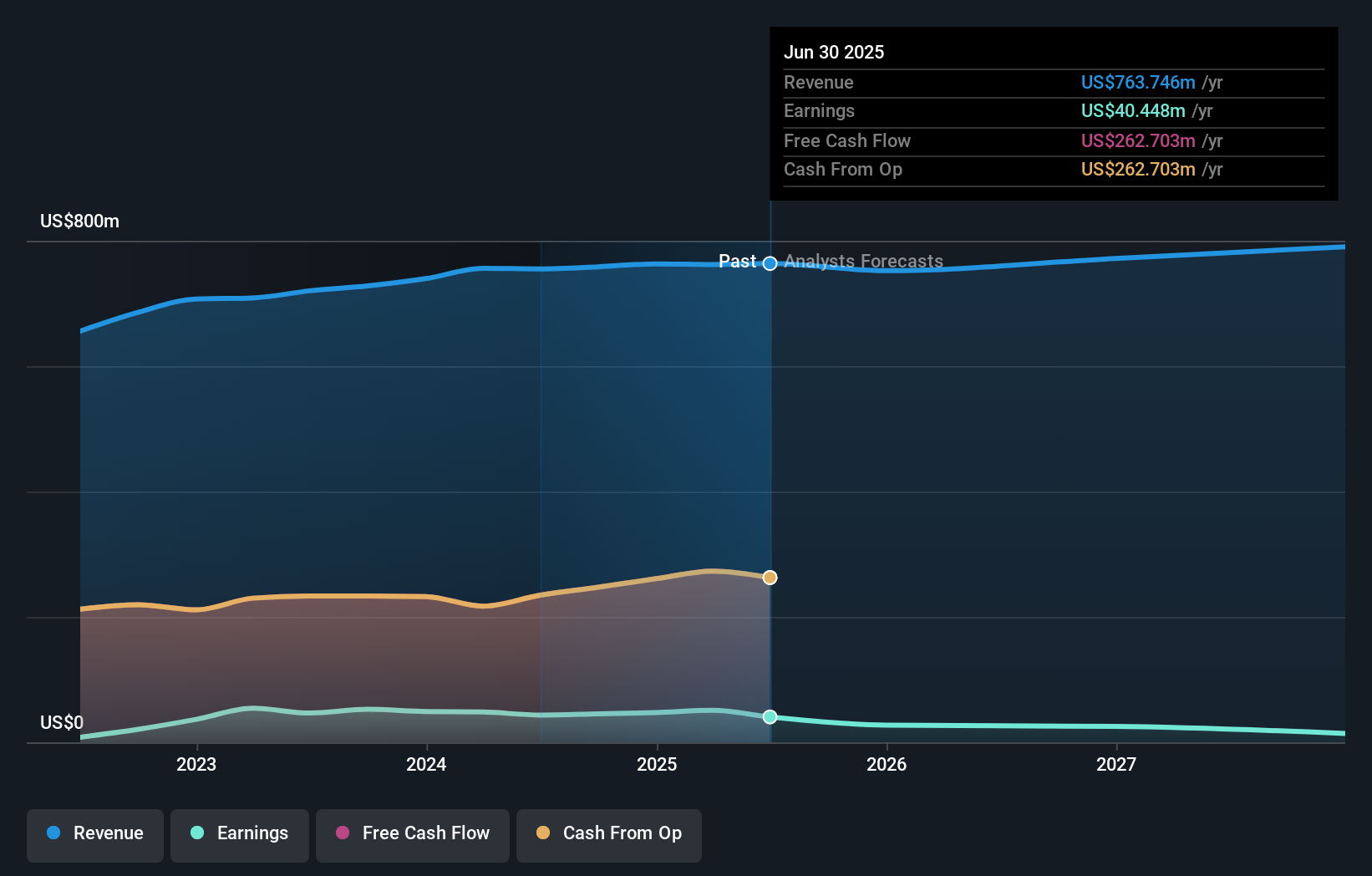

Empire State Realty Trust is forecast to reach $797.6 million in revenue and $13.7 million in earnings by 2028. This assumes annual revenue growth of 1.5% and a decrease in earnings of $26.7 million from the current $40.4 million.

Uncover how Empire State Realty Trust's forecasts yield a $8.97 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members submitted a single fair value estimate at US$8.97 for Empire State Realty Trust. With mixed outlooks on expense pressures and earnings growth, opinions can vary widely so explore alternative viewpoints for a fuller picture.

Explore another fair value estimate on Empire State Realty Trust - why the stock might be worth just $8.97!

Build Your Own Empire State Realty Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Empire State Realty Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Empire State Realty Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Empire State Realty Trust's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Empire State Realty Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESRT

Empire State Realty Trust

Empire State Realty Trust, Inc. (NYSE: ESRT) is a NYC-focused real estate investment trust ("REIT") that owns and operates a portfolio of well-leased, top of tier, modernized, amenitized, and well-located office, retail, and multifamily assets.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives