- United States

- /

- Office REITs

- /

- NYSE:ESRT

Empire State Realty Trust (ESRT): Evaluating Valuation Following $175 Million Series L Senior Notes Financing

Reviewed by Kshitija Bhandaru

Empire State Realty Trust (ESRT) just signed a Note Purchase Agreement for a sizeable $175 million private placement of Series L Senior Notes at 5.47%. The funding is set to occur in December. This financing has real implications for the company’s balance sheet and long-term strategy.

See our latest analysis for Empire State Realty Trust.

After a tough stretch for Empire State Realty Trust, with the year-to-date share price return down around 29%, investors are watching this new financing as a possible turning point. While short-term price momentum remains muted, it is worth noting that the company has delivered a positive total shareholder return of about 26% over the past five years. This suggests value has been created for long-term holders even through volatility.

If you’re exploring what other opportunities the market is offering right now, this is a great chance to discover fast growing stocks with high insider ownership.

The share price is trading well below analyst targets and at a sizeable discount to estimated intrinsic value. However, with earnings under pressure, is there a genuine buying opportunity here, or is the market already factoring in the path ahead?

Most Popular Narrative: 18.9% Undervalued

The most widely followed narrative calculates Empire State Realty Trust’s fair value as $8.97, placing it well above the latest closing price of $7.27. This perspective points to a possible mismatch between market sentiment and the company’s projected fundamentals, setting the scene for a closer look at the key drivers behind this valuation.

Ongoing portfolio modernization and demonstrated leadership in sustainability and energy efficiency strengthen ESRT's competitive position. This enables premium rents, attracts high-quality tenants, and supports net margin expansion as tenants increasingly seek sustainable space and as operating costs are optimized.

Want to know what powers this valuation? The full narrative describes a bold mix of modernization, resilience, and a surprising future profit profile rarely seen among sector peers. What specific assumptions create such a gap between price and value? Unlock the details behind the story driving this fair value.

Result: Fair Value of $8.97 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost pressures or a further slowdown in tourism could challenge the outlook and limit upside for Empire State Realty Trust's valuation narrative.

Find out about the key risks to this Empire State Realty Trust narrative.

Another View: Multiples Tell a Different Story

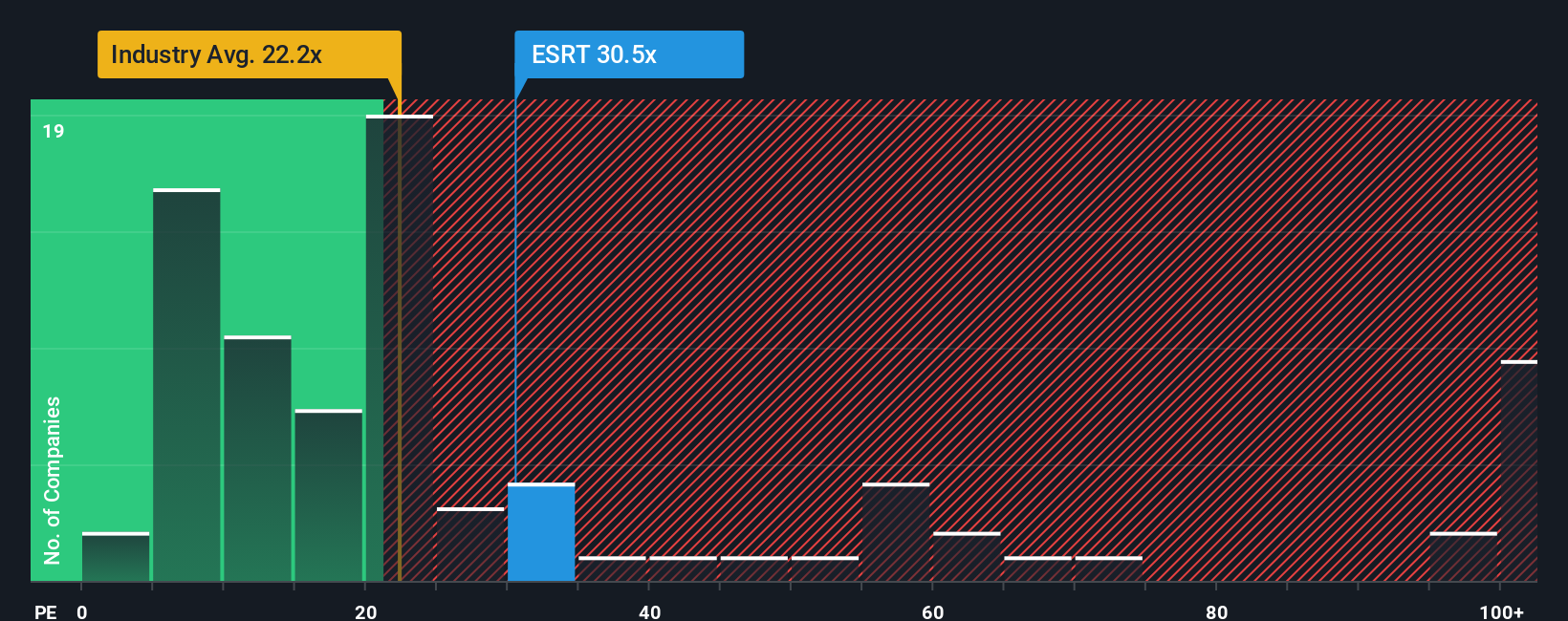

Looking at common ratios, Empire State Realty Trust currently trades at a price-to-earnings of 30.5x. This is higher than both the global industry average of 22.2x and the company’s own fair ratio of 23.6x. For investors, this means the market is pricing in more optimism than fundamentals suggest. Could there be downside risk if expectations shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Empire State Realty Trust Narrative

If you see things differently or want to dig into the numbers on your own terms, it takes under three minutes to craft your perspective and shape your own narrative. Do it your way

A great starting point for your Empire State Realty Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop searching for their next opportunity. Open up new possibilities by checking out carefully curated stock ideas that could match your goals right now.

- Tap into high yields by starting with these 18 dividend stocks with yields > 3%, which offers robust income potential and strong performance histories.

- Seize early-mover advantage and find breakthrough innovators among these 26 quantum computing stocks, a group shaping tomorrow’s tech landscape.

- Catch the next upward trend by reviewing these 878 undervalued stocks based on cash flows, a selection of stocks currently trading below their calculated fair value and positioned for potential growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Empire State Realty Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESRT

Empire State Realty Trust

Empire State Realty Trust, Inc. (NYSE: ESRT) is a NYC-focused real estate investment trust ("REIT") that owns and operates a portfolio of well-leased, top of tier, modernized, amenitized, and well-located office, retail, and multifamily assets.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives