- United States

- /

- Residential REITs

- /

- NYSE:EQR

Equity Residential (NYSE:EQR) Declares US$1 Dividend Amid 10% Price Drop Last Quarter

Reviewed by Simply Wall St

Equity Residential (NYSE:EQR) has declared a cash dividend of $0.6925, with an ex-dividend date set for March 20, 2025, while their share price declined 10% over the last quarter. Despite reporting an increase in earnings and confirming guidance, the overall market turmoil due to the recent tariff announcements contributed to the decline in share price. The broader market saw significant drops, notably the S&P 500 and Nasdaq plunging 9% and 10%, respectively. The global stock sell-off and economic uncertainties, particularly surrounding trade policies, have been influential in Equity Residential's recent share performance.

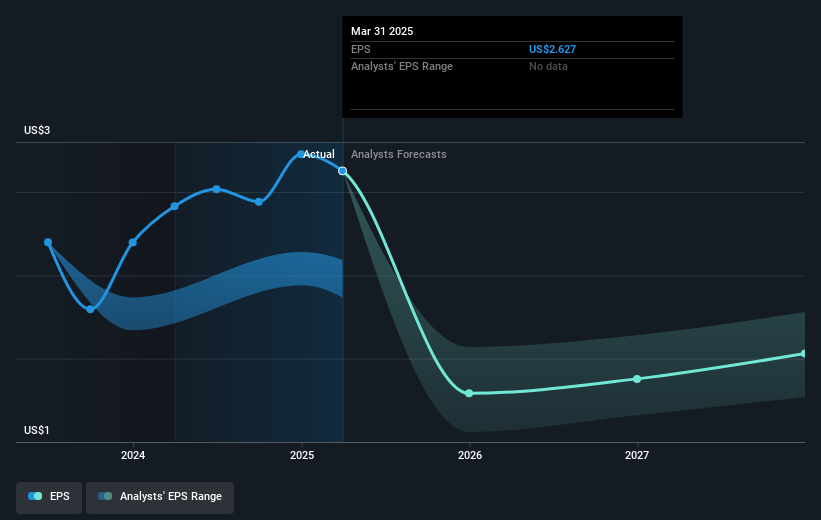

Over the last five years, Equity Residential achieved a total shareholder return of 11.11%, reflecting a mix of share price performance and dividends. During this period, the company faced several market-sensitive challenges that influenced its long-term performance. Notably, regulatory challenges in key markets like Los Angeles created unpredictability in net margins due to increased expenses. Furthermore, supply absorption issues in cities like Atlanta and Denver pressured earnings, impacting overall revenue growth. Despite these hurdles, high physical occupancy rates of 96.2% in 2024 demonstrated strong demand for the company's properties.

In addition to external market challenges, Equity Residential underwent significant corporate activities that influenced its shareholder returns. The expansion into new markets, such as the opening of luxury apartment communities in Texas, reflected an effort to capitalize on growth opportunities despite initial revenue pressures. Furthermore, the company’s commitment to its dividend policy, including regular cash dividends, played a crucial role in providing returns to shareholders over this period.

Evaluate Equity Residential's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Equity Residential, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Equity Residential might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EQR

Equity Residential

Equity Residential is committed to creating communities where people thrive.

Moderate, good value and pays a dividend.

Market Insights

Community Narratives