- United States

- /

- Residential REITs

- /

- NYSE:EQR

Equity Residential (EQR): Evaluating Valuation After Strong Earnings Surprise and Upbeat Guidance

Reviewed by Kshitija Bhandaru

Equity Residential (EQR) delivered a sharp earnings surprise in its second-quarter 2025 results, beating expectations by 52% and reaffirming its revenue growth guidance for the year. Occupancy remained high at 96.4%, reflecting stable demand.

See our latest analysis for Equity Residential.

Despite the strong quarterly results and steady operations, Equity Residential’s share price has lost ground this year, reflecting shifts in investor sentiment across the broader real estate sector. However, its 3-year total shareholder return of 11.5% shows that the longer-term picture remains resilient even as near-term momentum has faded.

If you’re weighing your next opportunity, consider broadening your investing horizons and explore fast growing stocks with high insider ownership.

With shares still trading below analyst targets and a healthy discount to intrinsic value, is Equity Residential undervalued or does its solid outlook mean the market is already pricing in future growth?

Most Popular Narrative: 14.9% Undervalued

At $63.48, the latest close sits well below the most widely followed narrative’s fair value target of $74.58. This significant margin implies considerable optimism on future prospects. The market’s doubts stand in stark contrast to expectations embedded by those following the consensus data.

A significant reduction in new multifamily supply, especially in high-barrier coastal markets like New York, San Francisco, and Washington, D.C., is expected to increase pricing power for Equity Residential over the next 12-24 months, supporting stronger revenue and net operating income growth. High housing costs and limited single-family home availability are driving a shift toward long-term renting among well-compensated Millennials and Gen Z, sustaining robust occupancy rates and minimizing rent concessions, which underpins stable or growing cash flow.

Curious about what drives this bullish stance? One key assumption behind this valuation involves future earnings multiples usually reserved for growth stocks. Want to discover which ambitious forecasts underpin a target so far above today’s price? Dive in and see what makes this outlook different.

Result: Fair Value of $74.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in key job markets or rising regulatory pressure in coastal cities could curb rental demand and create challenges for earnings growth in the future.

Find out about the key risks to this Equity Residential narrative.

Another View: What Do Market Ratios Say?

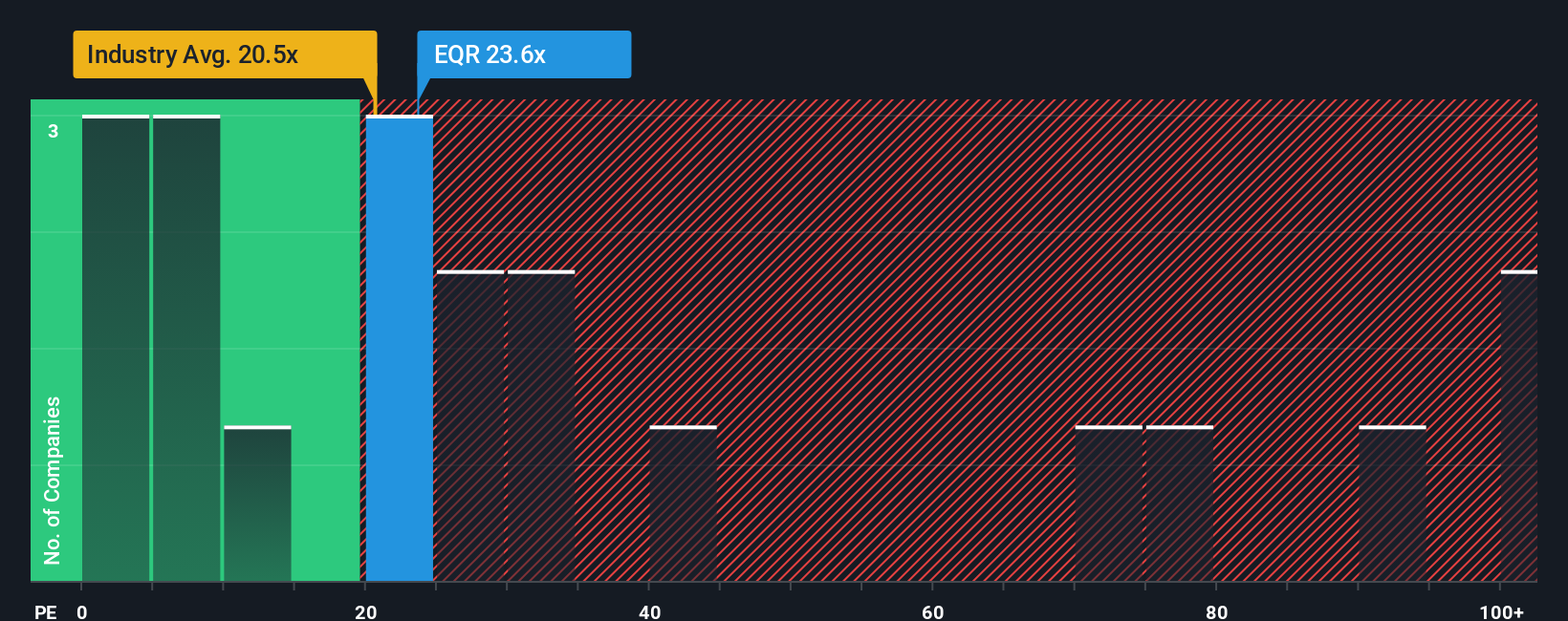

When we look at Equity Residential’s price-to-earnings ratio of 24x, it appears expensive next to the global Residential REITs average of 19.9x. At the same time, it offers better value compared to its peer group at 41.9x. Notably, it also trades below its fair ratio of 27.6x, suggesting the market may be overly cautious or pricing in uncertainty. With ratios sending mixed signals, is there more risk here than meets the eye?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Equity Residential Narrative

If you want to challenge these views or dig deeper into the numbers on your own, you can easily create your personal outlook in just a few minutes with Do it your way.

A great starting point for your Equity Residential research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your investments to one opportunity. Seize your edge and uncover fresh opportunities the market might be missing with these hand-picked stock ideas on Simply Wall Street:

- Tap into the rise of artificial intelligence with these 24 AI penny stocks, featuring companies at the forefront of automation, machine learning, and next-level data analytics.

- Earn more from your portfolio by uncovering these 19 dividend stocks with yields > 3% that offer reliable income potential and yields above 3%.

- Access tomorrow’s growth stories today with these 3569 penny stocks with strong financials, providing a shortcut to stocks displaying both strong financials and breakout potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equity Residential might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EQR

Equity Residential

Equity Residential is committed to creating communities where people thrive.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives