- United States

- /

- REITS

- /

- NYSE:EPRT

Should Essential Properties Realty Trust’s New US$400 Million ATM Equity Program Prompt Action From EPRT Investors?

Reviewed by Sasha Jovanovic

- In early December 2025, Essential Properties Realty Trust, Inc. completed a filing for a US$400 million at-the-market follow-on equity offering of its common stock.

- This move signals management’s intent to access gradual equity funding, a choice that can influence both dilution expectations and future growth capacity.

- Next, we’ll explore how this at-the-market equity program may reshape Essential Properties’ investment narrative around funding growth and dilution.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Essential Properties Realty Trust Investment Narrative Recap

To own Essential Properties Realty Trust, you need to believe in the resilience of net lease, service-focused retail real estate and the REIT’s ability to grow accretively while managing tenant credit risk. The new US$400 million at-the-market program increases funding flexibility but also raises near term dilution questions, making execution on external growth and safeguarding AFFO per share the key short term catalyst, and heightened competition and cap rate pressure the most immediate risk.

The recent US$256.2 million common stock offering in November 2025 sits alongside this fresh at-the-market capacity, underlining how actively Essential Properties is using equity to support its acquisition pipeline. For investors tracking catalysts, the link between stepped up equity issuance, ongoing portfolio expansion in e commerce resistant sectors, and the impact on per share earnings and dividends is becoming more important to monitor.

Yet while growth capital is plentiful, rising competition for net lease deals and the risk of cap rate compression are factors investors should be aware of as...

Read the full narrative on Essential Properties Realty Trust (it's free!)

Essential Properties Realty Trust's narrative projects $791.7 million revenue and $320.5 million earnings by 2028.

Uncover how Essential Properties Realty Trust's forecasts yield a $35.89 fair value, a 17% upside to its current price.

Exploring Other Perspectives

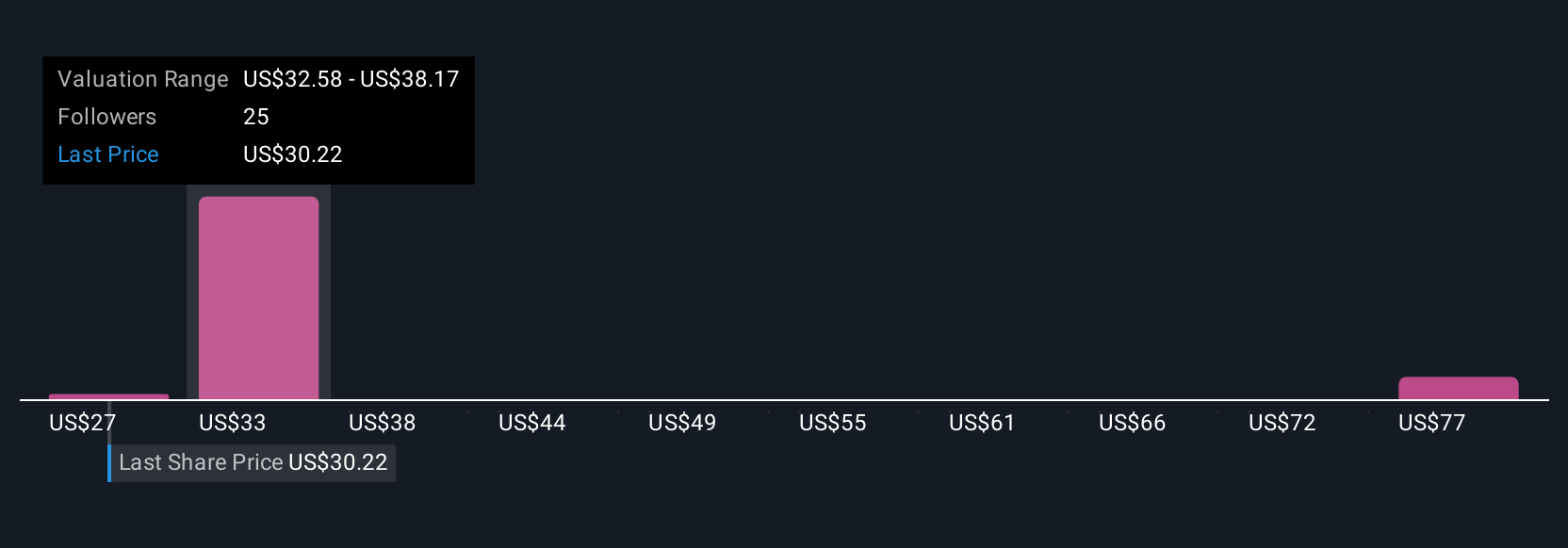

Four members of the Simply Wall St Community currently see fair value for Essential Properties in a wide US$31.35 to US$82.60 range, showing how far apart individual views can be. When you set those opinions against the growing use of equity funding for acquisitions, it underlines why many market participants are weighing dilution risks alongside the company’s external growth ambitions and you may want to compare several of these perspectives yourself.

Explore 4 other fair value estimates on Essential Properties Realty Trust - why the stock might be worth just $31.35!

Build Your Own Essential Properties Realty Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Essential Properties Realty Trust research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Essential Properties Realty Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Essential Properties Realty Trust's overall financial health at a glance.

No Opportunity In Essential Properties Realty Trust?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Essential Properties Realty Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EPRT

Essential Properties Realty Trust

A real estate company, acquires, owns, and manages single-tenant properties in the United States.

Good value with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026