- United States

- /

- REITS

- /

- NYSE:EPRT

Should Essential Properties Realty Trust's Earnings Momentum Prompt a Fresh Look from EPRT Investors?

Reviewed by Sasha Jovanovic

- Essential Properties Realty Trust, Inc. announced its third quarter 2025 results, reporting revenue of US$144.93 million and net income of US$65.62 million, both higher than the same period last year.

- This performance included substantial year-over-year increases in both earnings per share and total sales, reflecting ongoing growth in the company’s real estate portfolio.

- Given the company’s robust increase in quarterly revenue, we’ll examine how this earnings momentum may shape Essential Properties Realty Trust’s broader investment narrative.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Essential Properties Realty Trust Investment Narrative Recap

To be a shareholder in Essential Properties Realty Trust, you generally need confidence in the company’s ability to deliver steady growth by expanding its portfolio of service-based retail properties under long, inflation-protected leases. The robust third quarter results support this thesis and reinforce confidence in near-term portfolio expansion, but the most important short-term catalyst, continued access to accretive acquisition opportunities, remains unchanged, while rising competition in the net lease sector continues to be the primary risk that could impact future growth.

Among the recent announcements, the Q3 earnings report is most relevant. The company achieved year-over-year growth in revenue and earnings per share, signaling that recent investments and portfolio maneuvers are translating into tangible financial results, this aligns closely with the catalyst of expanding the acquisition pipeline, yet does not materially alter the principal risk stemming from cap rate compression due to sector competition.

However, investors should take note: as strong as recent results appear, the potential for lower investment yields due to rival capital inflows remains a factor that …

Read the full narrative on Essential Properties Realty Trust (it's free!)

Essential Properties Realty Trust's narrative projects $791.7 million in revenue and $320.5 million in earnings by 2028. This requires 16.3% annual revenue growth and a $97.4 million increase in earnings from the current $223.1 million.

Uncover how Essential Properties Realty Trust's forecasts yield a $35.89 fair value, a 14% upside to its current price.

Exploring Other Perspectives

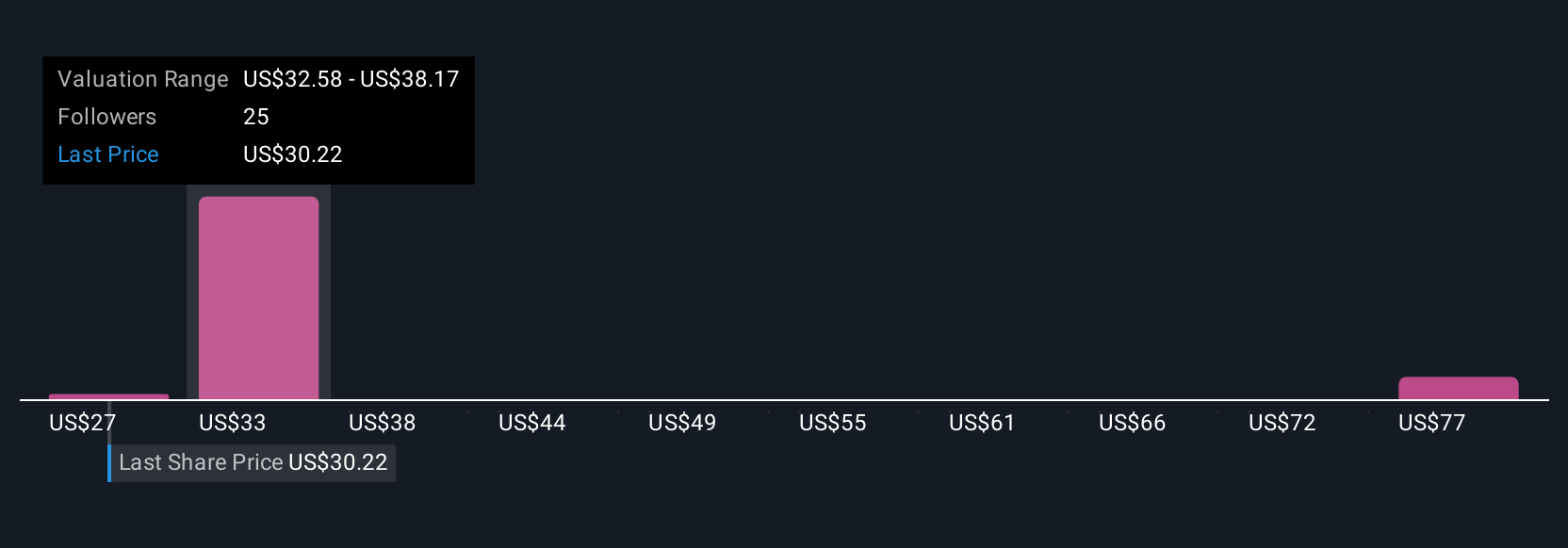

Simply Wall St Community members place fair value for Essential Properties Realty Trust from US$27 to US$76, based on five independent forecasts. Views differ significantly, reflecting the ongoing risk from increased sector competition and its potential to shape longer term profits and acquisition returns.

Explore 5 other fair value estimates on Essential Properties Realty Trust - why the stock might be worth 14% less than the current price!

Build Your Own Essential Properties Realty Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Essential Properties Realty Trust research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Essential Properties Realty Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Essential Properties Realty Trust's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Essential Properties Realty Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EPRT

Essential Properties Realty Trust

A real estate company, acquires, owns, and manages single-tenant properties in the United States.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives