- United States

- /

- REITS

- /

- NYSE:EPRT

Essential Properties Realty Trust (EPRT): Valuation Insights as Investor Optimism Builds Before Next Earnings Release

Reviewed by Simply Wall St

Essential Properties Realty Trust (EPRT) is preparing to announce its latest quarterly earnings, attracting attention due to forecasts of strong growth in both revenue and earnings. Investors are watching closely as positive analyst sentiment has followed recent outperformance.

See our latest analysis for Essential Properties Realty Trust.

Momentum has been building for Essential Properties Realty Trust in recent months, as optimism surrounding the company's consistent earnings beats and forecasted growth has helped lift sentiment. While the share price has climbed 4.9% over the past month and 6.3% in the last week alone, the total shareholder return over the past year remains slightly negative. This highlights the contrast between short-term momentum and recent longer-term results.

If this pickup in momentum has you curious about new opportunities, it could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership.

With the shares trading at a notable discount to analyst targets and expectations for strong growth on the horizon, investors must consider whether Essential Properties Realty Trust is an undervalued opportunity or if the market has already priced in these gains.

Most Popular Narrative: 11.9% Undervalued

The most widely followed narrative sets a fair value above the current share price, suggesting room for upside if assumptions hold. The story rests on structural strengths and evolving sector trends.

Ongoing urban expansion and population growth in secondary and tertiary markets are fueling the company's strong investment pipeline and portfolio expansion. With over $1 billion in investments guided for 2025 and broad tenant diversity, this is expected to drive sustainable FFO per share and asset base growth over the long term.

Want to know why analysts are betting on this steady climb? The forecast hinges on a bold mix of cash flow expansion, relentless portfolio growth, and future margins that exceed industry averages. Curious what numbers are powering that premium? Peel back the layers to see the full financial play beneath this valuation.

Result: Fair Value of $35.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, increased competition and sector-specific risks, such as tenant concentration in car washes and restaurants, could challenge Essential Properties Realty Trust's growth story moving forward.

Find out about the key risks to this Essential Properties Realty Trust narrative.

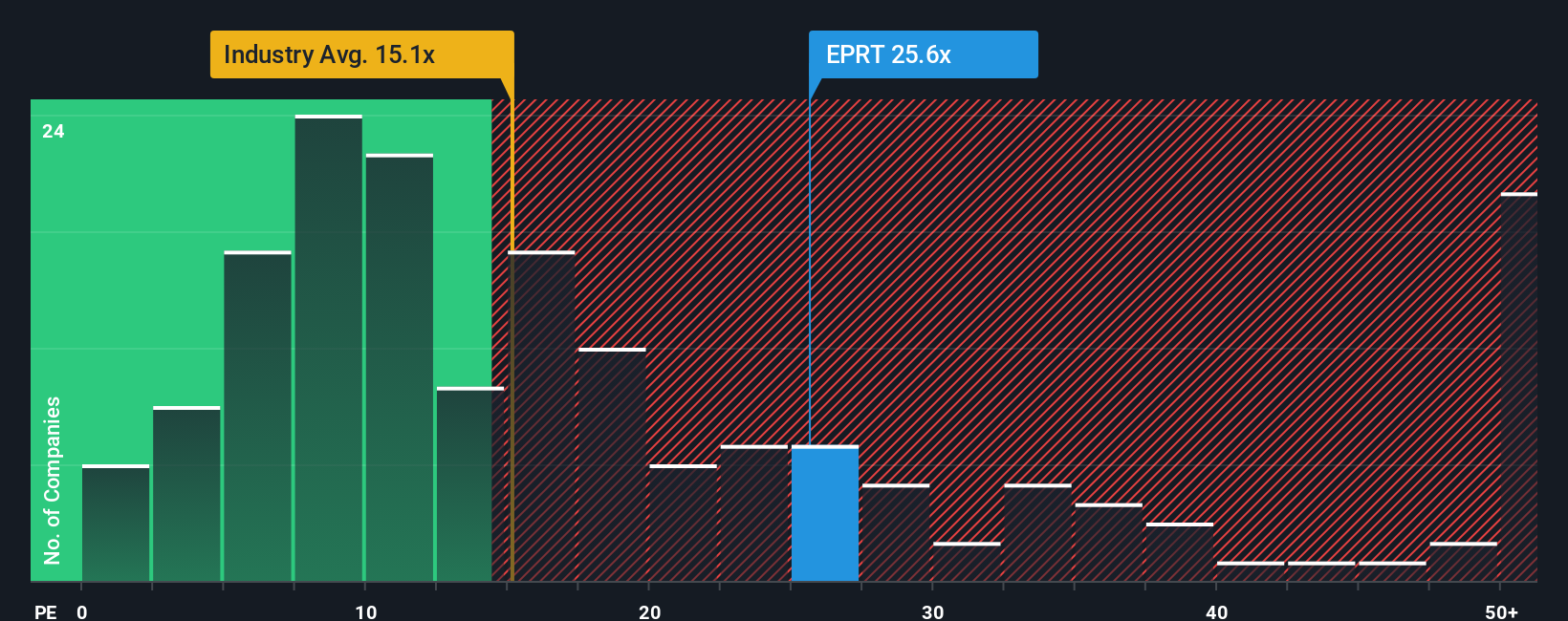

Another View: Market Multiples Raise Red Flags

Switching perspective, valuation using the price-to-earnings ratio suggests Essential Properties Realty Trust is trading at 28.1x, which is high compared to global industry averages (15.7x) but below peers (32.3x). While the fair ratio suggests the market could support up to 35.9x, that gap signals both opportunity and risk depending on which direction sentiment heads next. Are these numbers a red flag or early signal?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Essential Properties Realty Trust Narrative

If you see things differently or want to investigate the details for yourself, you can dive in and build your own story in just a few minutes, Do it your way.

A great starting point for your Essential Properties Realty Trust research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Expand your strategy with hand-picked investment opportunities you might not have considered. Smart investors act now, not later, so get ahead and check these out today.

- Tap into high-yield potential by reviewing these 17 dividend stocks with yields > 3% poised to deliver reliable income streams with impressive yields above 3%.

- Accelerate your portfolio’s growth with these 879 undervalued stocks based on cash flows that stand out based on strong underlying cash flows, often before the rest of the market catches on.

- Unlock future market movers in technology by scanning these 24 AI penny stocks and see which innovative companies are making waves in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Essential Properties Realty Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EPRT

Essential Properties Realty Trust

A real estate company, acquires, owns, and manages single-tenant properties in the United States.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives