- United States

- /

- Specialized REITs

- /

- NYSE:EPR

EPR Properties Valuation in Focus After Major Price Surge in 2025

Reviewed by Bailey Pemberton

Thinking about what to do with your EPR Properties stock? You’re not alone. Plenty of investors are sizing up this unique real estate investment trust, especially after a year like this. The numbers are hard to ignore: EPR’s stock has surged 30.7% year-to-date and an eye-popping 215.5% over the last five years. Even with a quieter week (down just -0.1%), the company’s long-term momentum is building a serious case for optimism.

So, what’s fueling these gains? While broader economic optimism has definitely played a part, EPR is also benefiting from renewed interest in experiential real estate and market developments that suggest leisure and entertainment properties are back in demand. Recent months have seen a 7.6% climb in just 30 days, reflecting shifting risk appetites as investors look for reliable yields beyond tech and growth names.

Now, the big question: Is EPR Properties undervalued after all this growth, or has the stock become too expensive? Here’s where things get interesting. According to a comprehensive value score (where EPR shines in 5 of 6 key checks), the company looks attractively priced, scoring an impressive 5. That’s remarkable, especially after such an extended rally.

Let’s break down the valuation approaches behind this score and see where EPR stands today. And just when you think you know the answer, stick around. The most insightful way to value this stock is still to come.

Approach 1: EPR Properties Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular method for estimating a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. In the case of EPR Properties, the analysis uses adjusted funds from operations, specifically looking at Free Cash Flow (FCF) as a measure of how much actual cash the business generates for shareholders.

EPR’s latest twelve months saw Free Cash Flow of $371.4 Million. Analysts provide detailed FCF forecasts for the next few years, with expectations that by the end of 2029, annual FCF could reach $444.6 Million. In addition to these direct estimates, Simply Wall St extrapolates further growth based on observed trends and analyst consensus.

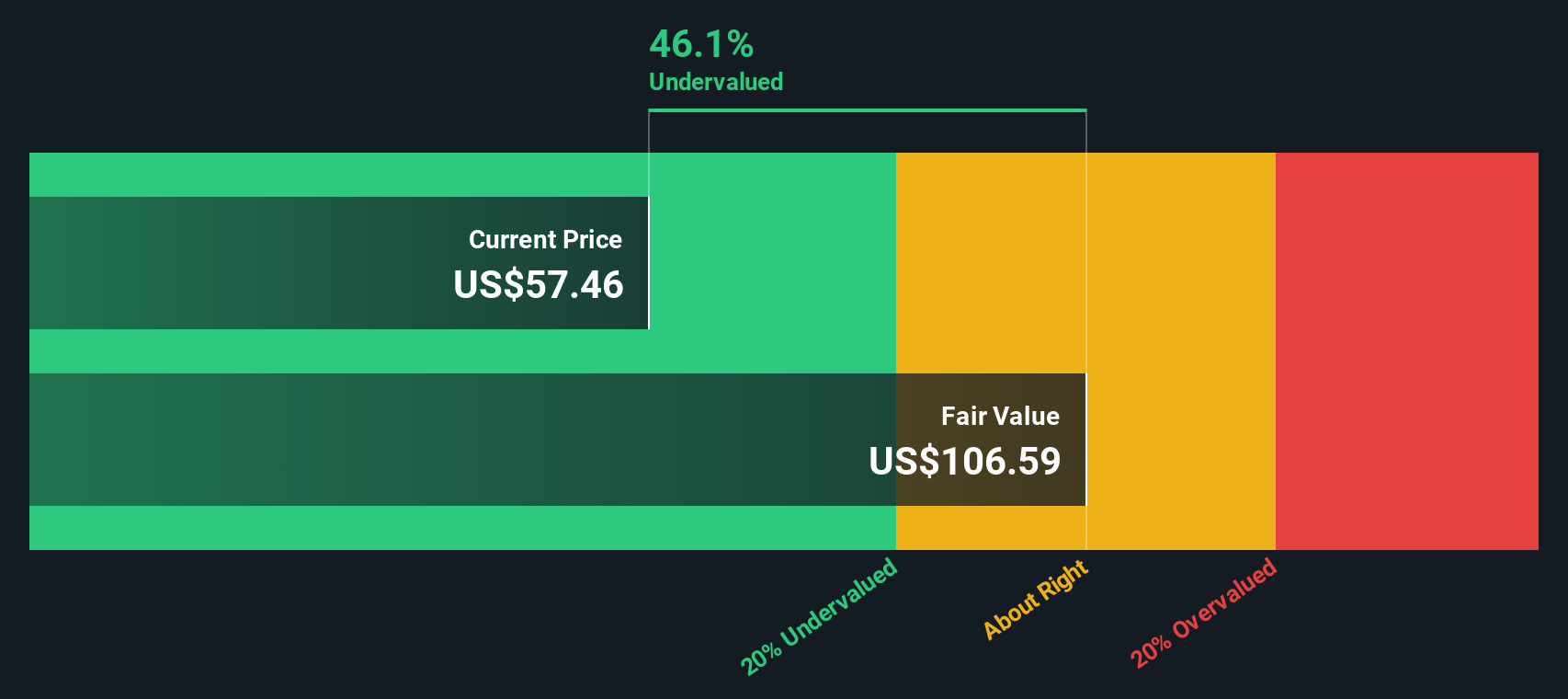

Each year’s cash flow is discounted back to present-day dollars, providing an estimate of what the business is worth today if its future unfolds as projected. The resulting intrinsic value, according to this DCF model, is $107.05 per share. Based on the current share price, this implies a 46.3% discount to that intrinsic value. The analysis suggests EPR Properties is significantly undervalued by the market.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests EPR Properties is undervalued by 46.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: EPR Properties Price vs Earnings

The Price-to-Earnings (PE) ratio is widely used to assess the value of profitable companies like EPR Properties, as it puts a company’s share price in context with its earnings. This makes it especially useful for income-generating businesses, since strong or stable earnings often warrant a higher multiple.

However, what constitutes a “fair” PE ratio depends not just on earnings growth, but also on how much risk investors see in those earnings. Companies with higher growth prospects or less risk typically command higher PE ratios, while riskier or slower-growing firms tend to trade at a discount.

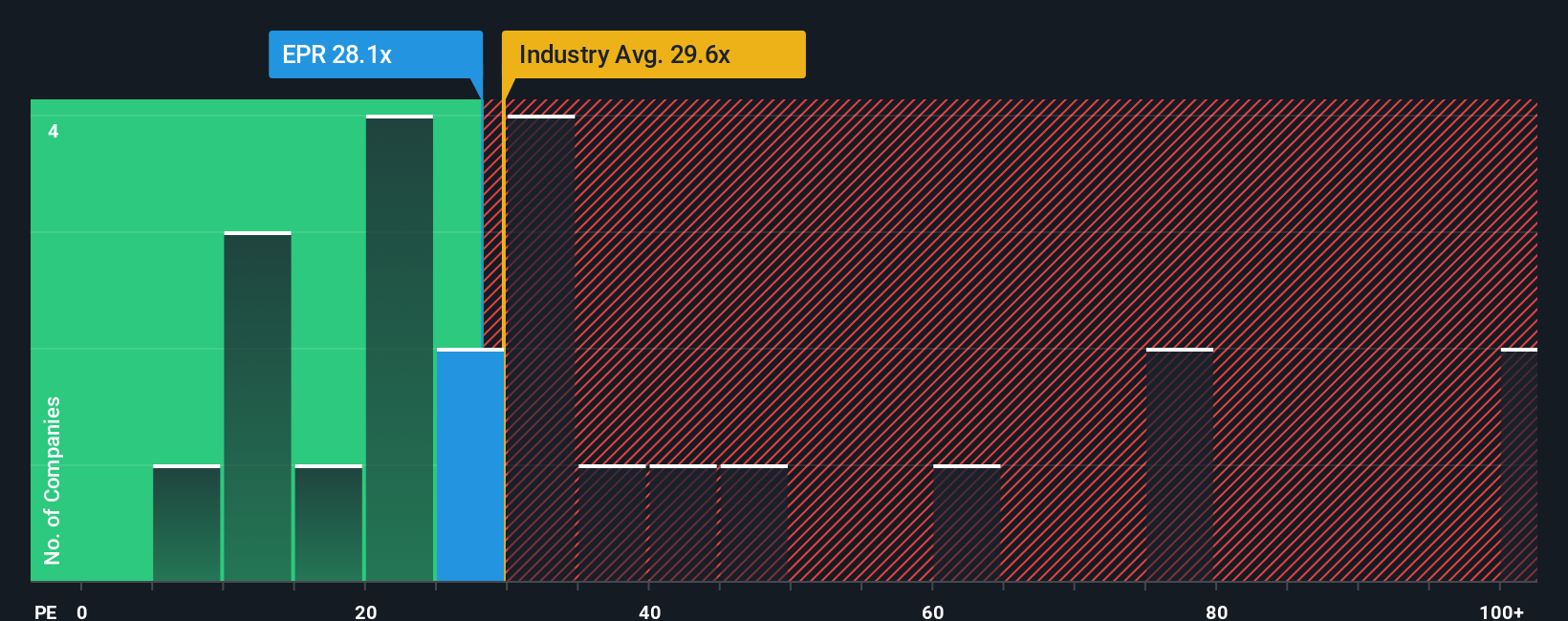

Currently, EPR Properties has a PE ratio of 28.1x. This stands above the broader Specialized REITs industry average of 17.8x, but noticeably lower than its peer average of 48.6x. However, these simple comparisons miss important nuances behind the numbers.

Simply Wall St’s proprietary “Fair Ratio” accounts for EPR’s specific earnings growth, profit margin, market cap, and risk profile. The Fair Ratio for EPR Properties is calculated at 34.7x, reflecting how the market should price the stock given all of these characteristics. Unlike a straight comparison with industry averages or peers, the Fair Ratio provides a smarter benchmark that is custom-fit for EPR’s unique traits.

Comparing EPR’s actual PE of 28.1x with the Fair Ratio of 34.7x, the stock appears undervalued, suggesting the market may be underestimating its earnings quality and outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your EPR Properties Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is your own story about a company’s future, combining your assumptions about things like revenue or profit growth with a financial forecast and fair value estimate, all in one place.

Narratives create a bridge between the numbers and the underlying business story, helping you turn what you believe about EPR Properties into clear, actionable insights. They are easy to build and update using Simply Wall St’s Community page, where millions of investors share and compare Narratives for every major stock, including EPR.

With Narratives, you can immediately see whether your fair value is higher or lower than the current price, making it simple to decide if you want to buy, hold, or sell. As news and earnings are released, Narratives update dynamically so your outlook remains current without extra work.

For example, some investors believe EPR’s shift into experiential properties will drive sustained earnings growth, justifying a price target as high as $65.5. Others see lingering risks from theater exposure and project fair value closer to $52. This means you can quickly see the full spectrum of perspectives and choose the Narrative that fits your outlook best.

Do you think there's more to the story for EPR Properties? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EPR Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EPR

EPR Properties

EPR Properties (NYSE: EPR) is the leading diversified experiential net lease real estate investment trust (REIT), specializing in select enduring experiential properties in the real estate industry.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives